By K C Ma and Bilal Hashmi

By K C Ma and Bilal Hashmi

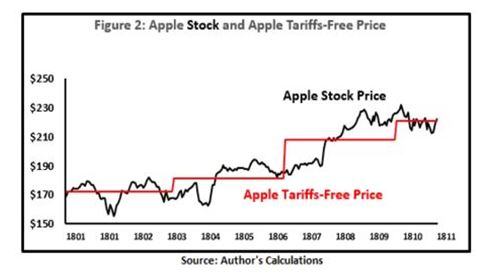

For the longest time, Apple (NASDAQ:AAPL) has been spared from the tariff impact. It has been the only tech firm that received the White House's blessing to be exempted from US tariffs on Chinese imports. Both the Apple Watch and AirPods have been left off the list of products that was originally to be subject to 25% import tariffs. The New York Times noted that they were among 300 product lines removed from an earlier draft. Among the items dropped are smart watches, Bluetooth devices, bike helmets, plastic gloves, high chairs, play pens, and certain chemicals. Not until Tim Cook's infamous downside guidance, Apple's lack of immediate tariffs' risk has been confirmed by the lack of the "tariffs discount" in its stock price, which is clearly demonstrated by the close relationship between Apple actual stock price and its fundamental-only fair value (Figure 2). Though, the above optimism only lasts till the end of 2018. After the breakdown of the trade talks and the tariffs were back on, U.S.'s further ban on Huawei opened the door for China's retaliation ban on a U.S. company of a similar significance. The market finally was forced to entertain the "unthinkable" notion that China may ban Apple's iPhone sale as a response. It was Goldman Sachs' Bala Reddy who first wrote,

After the breakdown of the trade talks and the tariffs were back on, U.S.'s further ban on Huawei opened the door for China's retaliation ban on a U.S. company of a similar significance. The market finally was forced to entertain the "unthinkable" notion that China may ban Apple's iPhone sale as a response. It was Goldman Sachs' Bala Reddy who first wrote,

"If there were a ban or some other restriction on Apple products on mainland China, we estimate that Apple's annual total EPS exposure is about $3.35 per share."

However, Reddy didn't mention the likelihood of such a ban and only trimmed its 12-month price target to $178 from $184 with a forward PE of 14.7x.

Alternatively, in this post, we examined Apple's revenue impact and stock price impact from a potential China iPhone ban because the Apple's slowdown in iPhone sales has started long before the trade dispute. The sheer size of Apple's China iPhone revenue exposure, with or without the threat of a ban, makes the revenue a more critical factor to Apple shareholders.

Apple's China Challenges Before Huawei's Ban

China smartphone shipments declined 11% annually from 121.3 million units in Q4 2017 to 107.9 million units in Q4 2018. The Chinese smartphone is in a recession and has declined for last 5 quarters. It has long suffered from longer replacement cycles and weak consumer spending from the trade war uncertainty. For Apple, due to the patent battles with Qualcomm (NASDAQ:QCOM) and high prices, iPhone shipments dropped 22% annually in 2018, and it has now fallen on a year-over-year basis for 8 of the past 12 quarters. Currently, Apple is at the fourth place of the five major smartphone makers with a 10% market share in China in Q4 2018.

After Huawei's Ban: How Many China iPhones At Risk?

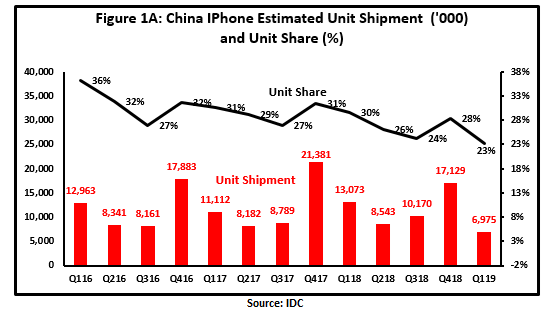

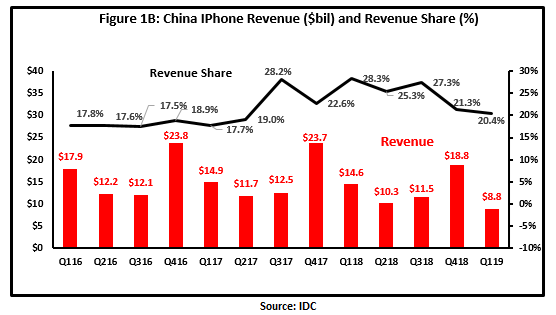

To estimate the impact on Apple from a potential China iPhone ban, I need to first estimate the current iPhone units being sold in China. Apple announced on its fiscal 4Q earnings call that it will stop reporting unit sales for iPhone, iPad, and Mac. Apple's CFO Luca Maestri said that "number of units sold in a quarter is not representative of underlying state of business." In a way, opting not to release iPhone numbers only means slowing unit sales growth in its flagship product. As Apple never reported unit shipments for geographical segments, we have to rely on estimated channel inventory by Canalys and IDC. For fiscal Q2, Apple shipped an estimated 6.975 million iPhones, or 23% of total iPhone shipped, which is 46% lower than 1 year ago or 59% sequentially (Figure 1A). This makes its worst decline in two years. In fact, it sold fewer smartphones in China than Xiaomi (XI), Vivo, Oppo, and Huawei. In terms of revenue, Apple's fiscal Q2 China revenue $8.8 billion was x% lower sequentially and x% a year ago (Figure 1B).

Since the Q2 drop was before the Huawei's ban, the most widely cited reasons include the ramping nationalism and China slowdown, both are a result of the U.S./China trade disputes. It is clear the 2Q China iPhone unit shipment drop was more of a China issue, as shown by the record low 23% China iPhone unit share. Similarly, if China responds with the iPhone ban, the immediate losses will be near $49.4 billion revenue annually (last 4 quarters in Figure 1B) or 18.6% of Apple's total revenue.

From iPhone Ban To Stock Losses

The easy task is to identify the revenue exposure because it is on record. However, the more elusive one is to convert revenue changes to stock price changes. For that, I rely on a stock valuation model that relates company revenue to the stock price since it is Apple's China iPhone revenue at stake. If a stock is valued based on its price to sales multiple, the % change in stock price can be approximated by the % change in revenue and the % change in price to sales:

% change stock price = % change in Sales + % change in P/S

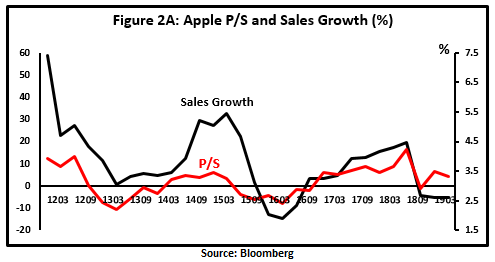

Since the P/S multiple depends on future revenue growth, so the % change in P/S needs to be first estimated with the expected change in revenue growth. For Apple, Figure 2A illustrates a clear positively correlated relationship between P/S and revenue growth rate. Specifically, for every 1% change in Apple revenue growth rate, it will change the P/S ratio by 0.03.

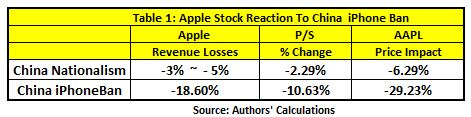

To show how to use the valuation model, for example, if Apple's revenue growth is expected to increase by 10% and P/S will also increase by 9% as a result of the correlation, the stock price will increase by 19% in total. For Apple's case, if China does not ban iPhones, the current nationalism is estimated to cost 3% to 5% Apple revenue for the next 12 months. As a result, Apple's stock looks to lose 6% (Table 1). If China decides to ban iPhone, Apple is likely to lose $50 billion (-18.6%) of its total revenue for the loss of nearly China 43 million iPhone unit sales annually, adding the associated loss on P/S (-10.63%), Apple's stock is expected to decline by 30% (Table 1).

The Chance Of China's iPhone Ban

So, between China's nationalism and the ban on iPhone, Apple stock may look to lose between 6% and 30%. But the stock price and analysts new target price only dropped less than $10, or about 5%, since the wake of Huawei's ban. The fact that the stock prices have not fully reflected the extent of potential revenue losses seems to suggest some glimpse of hope. The market may have seen through the reality that China will not risk the local employment and economic growth that the same Apple they want to ban provides. The market may have seen through the intricacy of the international trade that the announced ban or embargo can be easily "mitigated" by the companies as the tariffs have been. Or, the market may have seen through the intricacy of the trade negotiation that the "surgical" ban on Huawei can be quickly reversed as it was instituted. Less than a week after the ban, Reuters reported,

"The United States has 'temporarily delayed' trade restrictions on China's Huawei to minimize disruption for its customers, a move the founder of the world's largest telecommunications equipment maker said meant little because it was already prepared for U.S. action."

Finally, the sign of sanity may have already surfaced. In late April, before Trump's Huawei ban, Apple reported slightly better iPhone sales in China. CEO Tim Cook told analysts during a conference call:

"There is an improved trade dialog between the U.S. and China, and from our point of view, this has affected consumer confidence on the ground there is a positive way."

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

via https://www.aiupnow.com

, Khareem Sudlow