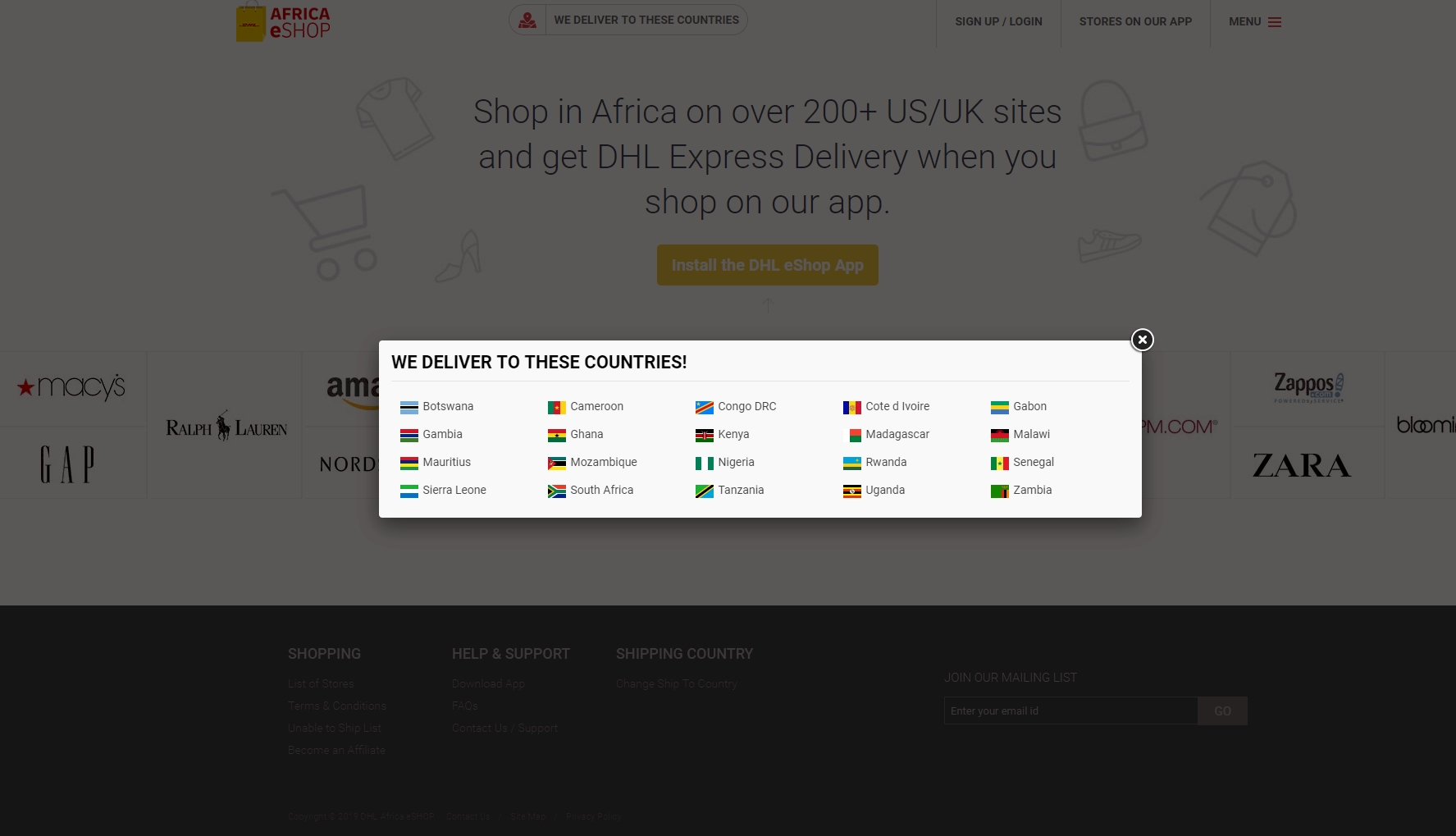

DHL is expanding its DHL Africa eShop business to 9 additional markets, upping the presence of the global shipping company’s e-commerce platform to 20 African countries.

DHL went live with the digital retail app in April, bringing more than 200 U.S. and U.K. sellers — from Neiman Marcus to Carters — online to African consumers.

Africa eShop operates using startup MallforAfrica.com’s white label fulfillment service, Link Commerce. Payment methods include local fintech options, such as Nigeria’s Paga and Kenya’s M-Pesa.

DHL’s move to offer Africa eShop to 20 of the continent’s 54 countries comes a month after Africa’s most visible (and well funded) e-tailer, Jumia, went public. Jumia—which operates consumer retail and online service verticals in 14 African countries—raised over $200 million in an NYSE IPO.

There’s a competitive e-commerce scenario brewing between the two platforms. DHL Africa e-Shop touts itself as “Africa’s Largest Online Shopping Platform.” Jumia said “We believe that our platform is the largest e-commerce marketplace in Africa,” in its SEC S1 filing.

It’ll take a little more time to shake out the stats behind each company’s branding claims.

DHL didn’t respond directly to the question of Africa eShop’s new market moves and competition with Jumia. “DHL’s growth expansion has always been centered around satisfying our customer’s wants…Africa e-Shop will be no different,” DHL spokesperson Megan Roper told TechCrunch.

DHL’s app takes advantage of the shipping giant’s existing delivery structure on the continent, able to get goods to doorsteps through its DHL Express courier service.

DHL’s partner for the new app, MallforAfrica, brings experience collaborating with a number of big-name retailers, including Macy’s and Best Buy. MFA’s payment and delivery system serves as a digital broker and logistics manager for big-name retailers to sell goods in Africa.

E-commerce ventures have captured the attention of VC investors looking to tap Africa’s growing consumer markets. McKinsey & Company projects consumer spending on the continent to reach $2.1 trillion by 2025, with e-commerce accounting for up to 10 percent.

Africa’s e-commerce startup landscape has already seen some ups and downs. Jumia’s recent IPO filing on the NYSE is a first for any startup operating in Africa. Despite continuing losses, Jumia’s post-IPO results earned the confidence of Wall Street analysts.

DHL’s Africa e-Shop expansion also demonstrates momentum for digital sales on the continent.

On the flip side, the distressed acquisition of Nigerian e-commerce hopeful Konga.com, backed by roughly $100 million in VC, created losses for investors. And in late 2018, Nigerian online sales platform DealDey shut down.

As for the big global names, Alibaba has talked about Africa expansion, but for the moment has not entered in full.

Amazon offers limited e-commerce sales on the continent, but more notably, has started offering AWS services in Africa.

To watch is how DHL’s Africa eShop expansion factors into the continent’s online-sales market, particularly vis-a-vis Jumia.

On a B2C level, Africa eShop brings distinct advantages on a transaction cost basis (i.e. the cost of delivery) given it’s connected to one of the world’s logistics masters.

Another component of DHL and MallforAfrica’s partnership is the market for offering e-commerce fulfillment services. MallforAfrica CEO Chris Folayan acknowledged Jumia as a competitor to his company’s logistics offering, but said, “I’m not building Link Commerce to go after Jumia…I’m building Link Commerce to become the powerhouse e-commerce platform to help emerging markets gain access to U.S. and UK products.” On a call with TechCrunch, Folayan also confirmed Link Commerce would open up to vendors from Asia in the next 12 months.

On its recent earnings call, Jumia CEO Sacha Poignonnec flagged carving out the “Jumia logistics services as a standalone entity” as a future company priority.

These developments could put DHL’s Africa eShop, MallforAfrica, and Jumia on a footing to compete with (or work with) big e-commerce names entering Africa. They certainly add another layer of competition to online retail and fulfillment services on the continent.

For the moment, the DHL Africa eShop expansion creates additional choice on overlapping product categories with Jumia, such as phones, tablets, fashion, health, beauty, and gaming.

Africa eShop will also offer African consumers more price competition in the operating countries it shares with Jumia—currently 10: South Africa, Kenya, Nigeria, Tanzania, Cameroon, Uganda, Ivory Coast, Rwanda, Senegal, and Ghana.

Tech

via https://www.aiupnow.com

Jake Bright, Khareem Sudlow