When a great SaaS business starts to come together, and crosses Initial Traction ($1-$1.5m), growing nicely (8-10%+ Month-over-Month Growth) … often times, the founders start to see the first bit of real economic returns on the model. It finally starts to make sense, this SaaS stuff.

As you cross $2.5m, $3m in ARR, you can start to see a path to real cash flow and financial independence, even though you aren’t there quite yet. Even if leads are still a bit lumpy, outbound is still stretching itself … you at least learn how to close by this point. It’s repeating, and repeatable … finally.

And often, if you are capital efficient, your marketing cost will be close to $0 at this point (you are barely spending anything to acquire most customers), and your sales costs are pretty predictable. Your Magic Number is often well under 1.0 — you often only need 6-8 months to go “profitable” on a customer from a sales & marketing expense because your sales team is lean, and your marketing spend is small. Add in a bunch of pre-paid annual contracts, and by $3m, $4m ARR or so … you can start to feel pretty confident in your nice, capital-efficient model.

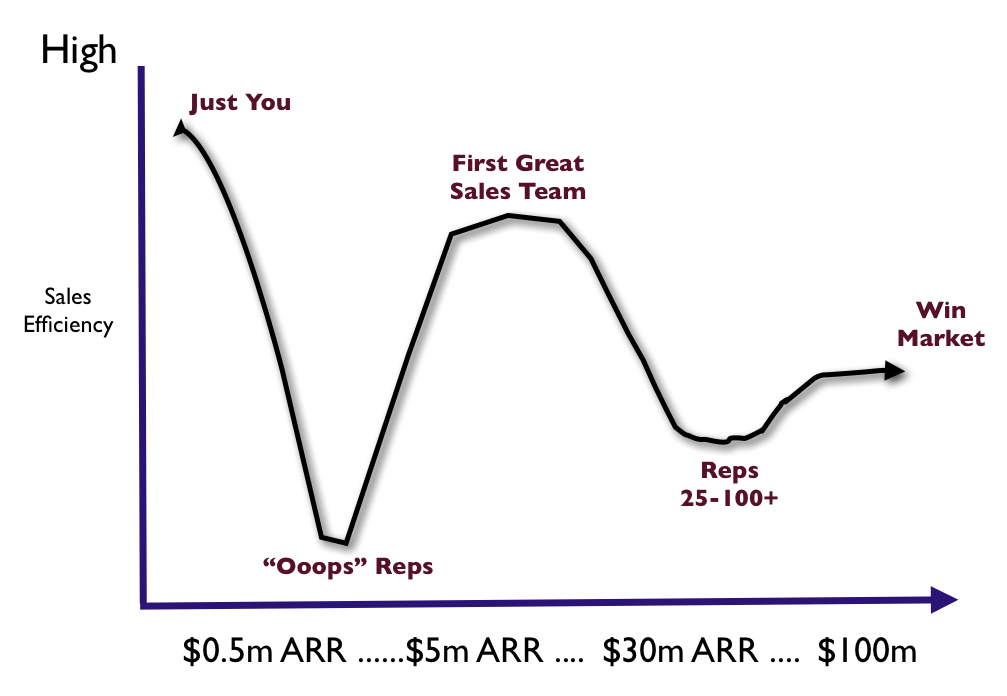

I hope it stays that way, I do. But a top piece of advice I can give you as you round $3-$4m in ARR is … expect your sales efficiency to decline after $8-$10m in ARR or so, almost no matter how great your sales team is.

Why would this be?

Let’s examine several factors:

1. Organizational reasons sales efficiency will decline as you approach $10m in ARR, even as your sales team really starts to dial it in and just kill it:

- You’ll need more managers. Generally speaking, one Director of Sales can manage about 8 closers, account execs, max. Maybe 10 SDRs. But that’s about it. You may be able to get to $10m which just one team of each. But then … you’ll need more managers. And not all of these managers will be equal.

- You’ll need a lot more operations help. You’ll need a couple of folks in sales ops just to keep up with the team and growth. You’ll need more consistent collateral for the sales team. Etc. etc.

- Specialization works — but it’s an up-front investment. As you approach $10m, you are going to need to do more specialization. More SDR: AE pairing. More appointment setting. More account managers and farmers. Whatever it is, you’ll want to move away from a generalist approach. In the end, you can raise AE quotas to pay for this, at least in theory. But specializing across the sales process will take more headcount.

- It will take more of a village. And you may lower the quality bar at least a smidge, even though you say you won’t. You’ll need a more diverse sales team, in every way, to hit your hiring plan. Expanding the box takes time. You’ll need to hire more aggressively to make this work. And ultimately, we tend to lower the rep quality bar just a bit past rep 10 or 12 or so, just to keep the engine moving.

2. Competition in core deals is the root cause of systemic high sales & marketing expenses. And it usually increases once you hit $10m ARR or so. You start to become a break-out leader, and there’s a target on your back:

- Competition leads to price cutting. If not by you, by the competition.

- Competition almost always leads to a lower win rate — at least for a while. Even if you win most deals, as you get into more bake-offs, overall you’ll lose more on an absolute basis. This will drive down your sales productivity. Winning every deal sounds great. But it isn’t. It really means you aren’t in enough deals.

- You’ll get pulled into competitive deals you weren’t pulled into before. And vice-versa with the competition. This is natural and good, but more expensive in the end, at least marginally.

3. Dominant-Dominant Strategy Sales & Marketing is Very, Very Expensive. As you cross $10m, either you, or your competition, or both of you may engage in “Dominant-Dominant Competition.” This is when you compete aggressively not only in the market segments where you have a big competitive advantage, and usually win (which usually has a much cheaper CAC) … but to win big, you also use your $20m, $40m, etc. in venture capital $$$ to compete in spaces where you generally lose. This will confuse you at first, if you haven’t been through it before. But if you have $50m in the bank and your competitor has $4m in capital, you can actually compete everywhere — and they can’t. But this is insanely expensive, until you become Dominant in that sector. Often, you end up paying reps less than $1 for every $1 in ACV they bring in when you staff up a segment of the market where you are weak and the competition is strong.

4. You may be under stress to grow even faster than you “organically” would. In the end, we all sort of end up with an “organic” growth rate after $5-$10m in ARR or so. We have a mini-brand, and then a brand. A good NPS. Referrals and second-order revenue are working. This tends to drive X% growth in leads and Y% growth in revenue. If that’s good enough — you can stay super capital efficient. But often, we want to grow faster. Or we come under pressure to grow faster. Growing faster than the trailing rate of growth and the current rate of lead growth is possible. But again, it’s very, very expensive.

All or none of these factors may affect you. If you stay in a non-competitive segment for a long time, growth will be cheaper. If your brand truly explodes, growth will be cheaper. If you just focus on in-bound, and don’t try to push into segments where you are less dominant, growth will be cheaper.

But ..

It almost never is.

So add some extra costs to that hyper-efficient model you just built. At least as a buffer.

The post Your Sales Efficiency Will Probably Plummet Toward $10m ARR. Plan For It. appeared first on SaaStr.

Small Business

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow