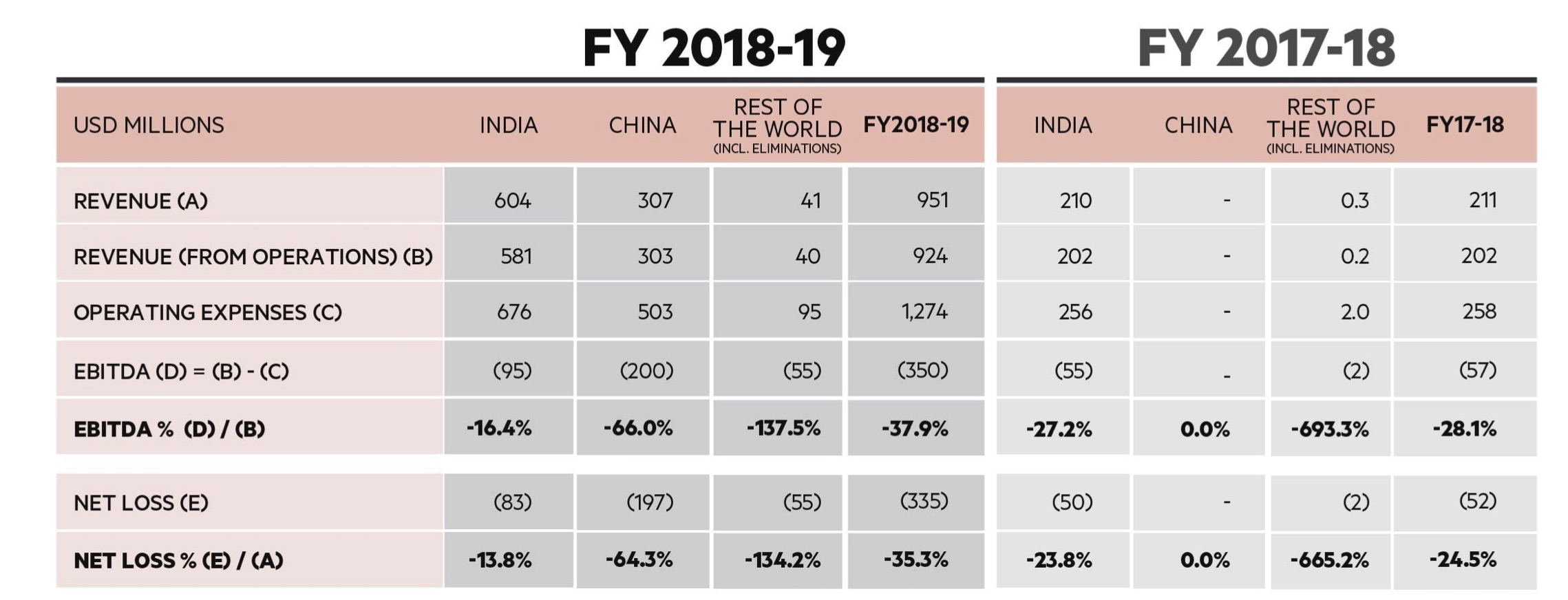

On Monday, budget-lodging startup Oyo reported a loss of $335 million on $951 million revenue globally for the financial year ending March 31, 2019, and pledged to cut down on its spending as the India-headquartered firm grows cautious about its aggressive expansion.

The six-year-old startup’s growing revenue, up from $211 million in financial year ending March 31, 2018 (FY18), is in line with the company’s ambitions to be in a clear path to profitability this year, said Abhishek Gupta, Global CFO of OYO Hotels & Homes, in a statement.

But the startup’s loss has widened, too. Its consolidated loss at $335 million in FY19 rose over sixfold from $52 million in FY18. In India, where Oyo clocked $604 million in revenue in FY19 (up 2.9X since FY18), it was able to reduce its loss to 14 percent (from 24 percent) of revenue in FY19 to $83 million.

Indian laws require every local startup — and international businesses — to disclose their annual financials. Most of them filed their financials in early October.

The startup, which today operates more than 43,000 hotels with over a million rooms in 800 cities in 80 nations, said its expansion in China and other international markets contributed to the loss. Oyo entered China in 2018, and says the world’s most populated nation has already become its second largest market.

“These markets constituted 36.5 percent of the global revenues. While consistently improving operating economics in mature markets like India where it’s already seeing an improvement in gross margins, the company is determined to bring in the same fiscal discipline in emerging markets in the coming financial year,” the startup said in a statement.

Aditya Ghosh, who served as a chief executive of the startup and is now a board member, said in a call with reporters that since Oyo entered a number of markets last year it was in the growth phase and that needed some investments. Speaking especially of China, Ghosh said the company, like many others, is watching the outbreak of coronavirus that has resulted in shutting down some hotels.

He also said that Oyo has pared back from some markets, including India, where it pulled out of about 200 cities. The startup is currently not looking to expand to any new markets, he added.

It is now working on improving its gross margin. In India, its gross margin increased to 14.7% from 10.6% as of FY18.

Oyo’s growth in international markets

Oyo has come under scrutiny in recent months for its aggressive expansion in a manner that some analysts have said is not sustainable. The startup, which rebrands and renovates independent budget hotels, has also engaged in sketchy ways to sign up new hotels, as documented by the New York Times earlier this year. Several hoteliers have claimed that Oyo did not honor its agreements and owed them money.

In 2019, Oyo, which counts Airbnb among its investors, expanded in Europe and the U.S. among other markets. It bought Leisure Group from Axel Springer for $415 million to target Europe’s vacation rental market. It also announced plans to invest another $335 million for this effort. In the same month, it announced it had acquired the Hooters Casino Hotel Las Vegas for about $135 million in its first U.S. property purchase.

It also entered Japan in a partnership with SoftBank. Bloomberg reported on Sunday that Oyo currently has about 12,000 rooms in the country, far fewer than its ambitious 1 million target.

In recent months, Oyo executives have acknowledged that the startup grew too fast and is confronting a number of “teething issues.” Oyo has laid off at least 3,000 employees, mostly in India, in last three months. Ghosh said the startup is still hiring for new roles, but only in key areas such as data science.

“The company’s increased focus on corporate governance and building a high-performing and employee-first work culture will also drive this next phase of sustainable growth for us,” said Gupta.