Revolut, the European banking and money transfer app that now claims over 10 million customers, has partnered with open banking API provider TrueLayer to add bank account aggregation features to its app.

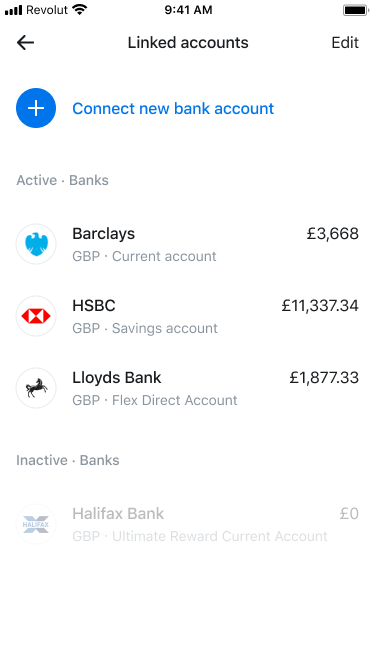

The new functionality means that Revolut’s U.K. customers — both consumer and business — can now connect their external U.K. bank accounts to Revolut, enabling them to see all of their bank balances and transactions, regardless of which of their U.K. bank accounts the data resides in. Known as account aggregation, the feature is designed provide a more complete view of your spending and other transactions, and it was one of the early promises of open banking.

However, despite being adopted by legacy banking apps, such as Barclays, along with a plethora of money management apps, the aggregation use case hasn’t exactly seeped into the consciousness of most consumers. Revolut’s move to roll out aggregation features has the potential to help change that. Or so says TrueLayer co-founder and CEO Francesco Simoneschi.

However, despite being adopted by legacy banking apps, such as Barclays, along with a plethora of money management apps, the aggregation use case hasn’t exactly seeped into the consciousness of most consumers. Revolut’s move to roll out aggregation features has the potential to help change that. Or so says TrueLayer co-founder and CEO Francesco Simoneschi.

“I think this is the moment Open Banking will go mainstream,” he tells me, perhaps a little over optimistically. “Revolut is putting this feature at the very core of their customer journey and will set the standard for the next phase — not just in the U.K. but everywhere.”

“With the launch of our new Open Banking feature, U.K, customers can now view and manage multiple external bank accounts, enabling them to interpret their day to day spending across all of their accounts,” adds Joshua Fernandes, Product Owner for Open Banking at Revolut. “We’re delighted to see that new legislation such as Open Banking is changing our financial landscape for the better, and I’m proud that Revolut and TrueLayer are at the forefront of this experience”.

From a regulatory point of view, Revolut is authorised as an “Account Information Service Provider” (AISP) by the U.K. regulator, the Financial Conduct Authority. This permits it to access official U.K. Open Banking APIs for information purposes on behalf of customers.

What it doesn’t allow is Revolut to transfer funds and make payments via third-party bank accounts, which would require a different Open Banking license. Were this to happen it would make it even more convenient to add and withdraw funds from Revolut and use the app’s budgeting and money transfer features, so I wouldn’t be surprised to see that come next.