Even in the face of the coronavirus pandemic, ecommerce merchants should optimize advertising campaigns. That includes performance marketing, which is online promotions that cost the advertiser only when a potential customer takes some action, such as clicking a pay-per-click ad or starting a chat on Facebook Messenger.

Given the store closures and social distancing stemming from the pandemic, there are at least four steps an ecommerce marketer could take to improve near-term performance-marketing results.

Review Messaging

Take an inventory of all current marketing messages. Remove ads that are potentially offensive, insensitive, or out of touch given the coronavirus.

Joe Yakuel, founder and CEO of WITHIN, a New York-based performance branding company, put it this way, “You need to review every single piece of collateral in marketing because no matter what it is if it is something that might come across as tone-deaf” you need to update it.

“You might have an ad with people at a wedding and you’re selling a suit, and like right now that’s tone-deaf. No one is at a wedding, right? You might have an ad [showing] a family sitting in a restaurant. Normally, not tone-deaf. Now, tone-deaf. Who’s sitting at a restaurant?

“So, I think, now before you do anything, you need to just look at everything and say, ‘Wait a minute…is this still appropriate or not?’ and pull everything that isn’t.”

Replace “tone-deaf” ad copy, landing page copy, and visuals with new content that communicates an authentic sentiment. Your messaging should make sense in the context of your business, its brand, and the pandemic.

Confirm You’re Open

Brick-and-mortar stores are not the only businesses shutting down as folks try to slow the coronavirus. Many online stores have also temporarily shuttered.

As an example, L Brand’s Victoria’s Secret temporarily closed all of its physical stores and stopped ecommerce shipments. Victoria’s Secret posted a notice on its website letting visitors know it was not accepting orders. Not every online seller has been as courteous. Sometimes a shopper will get to the checkout before she realizes the store is not operating.

The Victoria’s Secret website explains that its physical and ecommerce operations are temporarily shuttered because of the coronavirus.

If your business is still selling online and still promoting itself via performance marketing, you need to let shoppers know.

An example is Michael’s, the omnichannel craft retailer. The company is promoting on Michaels.com its buy-online, pick-up-curbside services. Visitors clearly understand that Michael’s wants to do business.

A visitor to the Michael’s website will know that the company is operating.

Your company’s ecommerce site and performance marketing landing pages should, similarly, make it obvious you’re open.

Reduce Sales Friction

Merchants selling essential products such as food and beverage items, pharmaceuticals, household goods, and similar have enjoyed a leap in sales revenue during the pandemic.

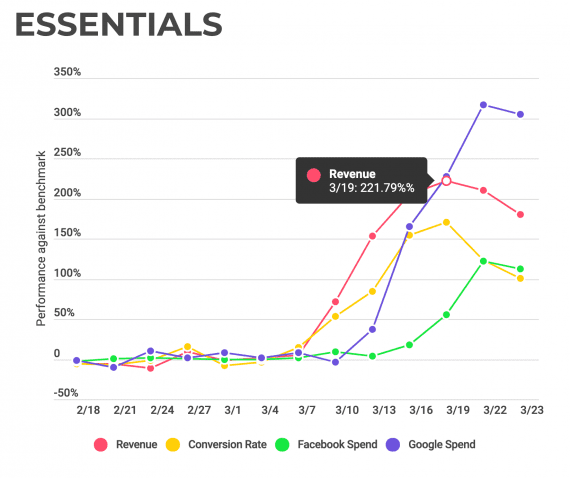

According to data from WITHIN’s customers — which represents about $500 million in performance ad spending and roughly $5 billion in revenue — retailers selling “essential” products have seen revenue rise as much as 221 percent as of March 19.

WITHIN’s data does include year-over-year performance, meaning, “If the sector was up 10 percent YoY before COVID-19, and the sector is now down 15 percent YoY, we would report that as down 25 percent versus the benchmark period.”

Thus, if revenue for a retailer in the essentials segment had already been up, all of the growth may not be due to the virus. Nonetheless, the pandemic has spurred demand for these products.

All of the revenue growth of an “essentials” retailer may not be due to the virus. Nonetheless, the pandemic has spurred demand for those products. Source: WITHIN.

Not all sectors have increased, however, according to WITHIN. Omnichannel retailers and pure-play ecommerce merchants in the fashion segment saw revenue drop as much as 63 percent from the benchmark.

Fashion retailers were among the hardest hit in WITHIN’s client base.

If your business is in the essential category, you won’t need to do much to encourage sales. If, however, your company is in the fashion or “nonessential” segment, remove as much sales “friction” as possible.

WITHIN’s Yakuel suggested that this might be the time to make new or additional free shipping offers. Or, if your business has physical stores, make it easy to click and collect items curbside.

In short, before you invest in performance advertising, try to reduce conversion friction.

Aim for Profit

Having prepared your ad and landing page, made it obvious your store is open, and developed a low-friction offer or two, optimize your performance marketing.

Depending on the business, this could include preserving cash during the crisis or maintaining or increasing the investment.

First-order break-even point. “There is kind of a threshold [in performance marketing spending] where it makes sense for everyone to reach,” said Yakuel. “Then beyond that threshold, it really depends upon your capital structure.”

That threshold is the “first-order, break-even point,” meaning “if you can spend incremental dollars [on performance marketing] and do that in a way that is profitable on the first order…there is no reason why you shouldn’t spend that dollar,” Yakuel said.

Think of it this way. If you can increase your daily performance marketing budget and still make a profit on the first order from each shopper, do it. You should max out your PPC investment to that first-order, break-even point.

“Spend as much as humanly possible until that last and least efficient incremental dollar is at first-order break-even,” Yakuel said.

Thus, as you optimize your ads, don’t necessarily focus on metrics such as clicks or impressions. Rather, focus on profit per sale.

Done correctly, this approach will increase cashflow.

Beyond first-order break-even. After the point of first-order break-even, make a decision. Should your company invest in performance marketing with little immediate return to build long-term customer relationships?

If your business “has a lot of access to cash, and you believe that you can weather this storm, then you might want to spend money in a way that acquires customers beyond first-order break-even…” Yakuel said.

“So, maybe you can’t break even on the first order anymore, but if you expect people to place three orders a year, and you spend deeper than first-order profitability, maybe into second-order profitability, or third-order profitability, you’re still going to make your money back within 12 months.”

Here again, the key is to focus on profits.

March 25, 2020 at 10:35AM

via https//www.brucedayne.com/

Armando Roggio, Khareem Sudlow