Many small businesses need to change their business models. COVID- 19 is the reason. That’s left owners open to liability. Some don’t have the right insurance.

Bold Penguin, matches SMBs with insurance companies. They’ve seen a four-fold spike in inquiries for business interruption coverage since February.

Pandemic Risk Management for Small Business

Small Business Trends contacted Amber Wuollet, Director of Marketing at Bold Penguin. She explained how this pandemic is moving the goalposts for small business commercial risks.

Stay Creative

She started out on a positive note.

“There is no question small businesses are being hit hard right now with government-mandated quarantine closures,” she writes. “However, we’re also seeing creativity in new business models. The Goat2Meeting initiative is a good example of this.”

It’s a business offering goat and llama zoom cameos during hosted SMB video meetings. Wuollet goes on to say that small businesses and insurance companies are going to need new product developments to keep moving forward. Like the example above.

She highlights several ways the pandemic has shifted the commercial risk for small businesses.

Be Aware of Risks When Using Personal Vehicles

Wuollet talked first about an overlap between personal and commercial coverage. Specifically, when it comes to businesses using their personal vehicles to deliver goods and services. For many it’s a matter of necessity. But it could be costly.

“Most people fail to realize that their personal car insurance fails to cover any situations where they are using the vehicle commercially,” she says. “This leaves them liable for any damage that occurs outside of personal use.”

Be Aware of Equipment Liability with Telecommuters

COVID 19 has forced many small businesses to ramp up or adopt remote work. Therefore, business property is being moved to homes. Wuollet says this creates an issue.

“Millions of employees now have computer equipment and supplies in their homes. This means businesses should adjust their business policies so those items are covered outside of the physical office.”

Wuollet supplies a good tip to sidestep any insurance issues. The example comes from one of the harder hit service industries.

“We’ve seen brick and mortar hair salons now create online product storefronts and offer virtual cut and color consultations,” she says. “Some have even gone as far as shipping custom hair color and scissors to customers.”

These salons walk the customer through the cutting and dying via video call. It’s an innovative approach.

“This example moves the salon work function to consultative and shifts the exposure. The customer handles the product instead of receiving the service.”

She has more advice for SMBs looking to have proper insurance during a pandemic.

Be Aware of Cybercrime

“Cybercriminals will take advantage of any national crisis for their benefit and the COVID-19 pandemic is no exception,” she says. “Some are impersonating health officials and organizations to get business owners to click on malicious links and offer information.”

It’s an unfortunate sign of the times. Even things like phishing emails are becoming more common as the pandemic surges. That makes having the right policy even more critical.

“Cyber liability insurance won’t stop data thieves from trying to penetrate digital security,” Wuollet says. “There are several reasons SMBs should invest including the cost and frequency of breaches and risk management.”

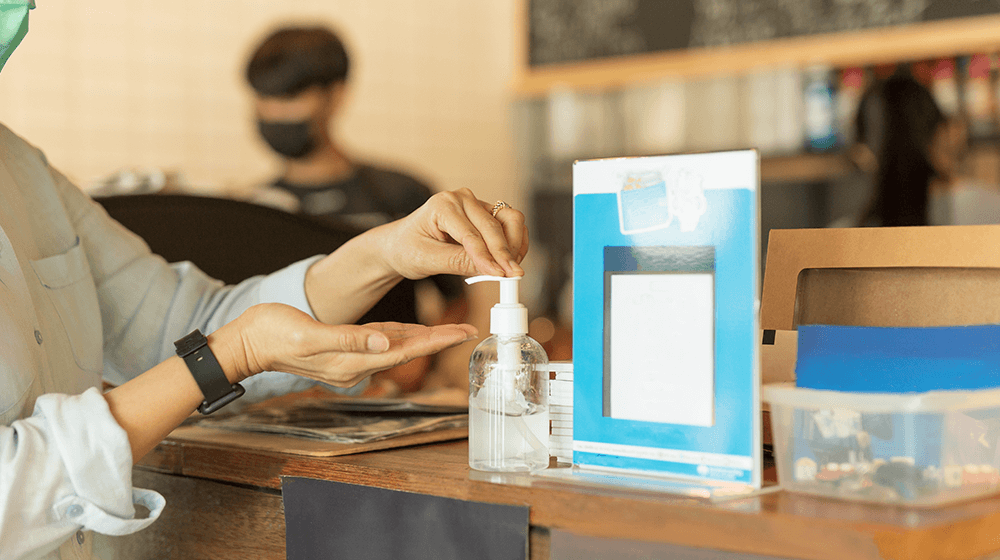

Image: Depositphotos.com

This article, "How the Pandemic Could Impact Your Small Business Insurance Risk" was first published on Small Business Trends

April 20, 2020 at 09:17AM

via https//www.brucedayne.com/

Rob Starr, Khareem Sudlow