Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

82% of businesses fail because of poor cash flow management and subpar accounting practices. Yikes. It’s no secret that accounting is hard — and there’s a reason people spend their entire lives learning how to do it well.

But there’s good news.

You can avoid becoming a part of this statistic without heading to university to get a Bachelor’s (or Master’s) degree in accounting.

Enter… modern-day accounting software. It exists to help even the smallest businesses improve their bookkeeping processes, save time, and make fewer costly mistakes.

Plus, understanding your numbers can lead to smarter business decisions and improved overall business health/performance as well.

However, choosing the best accounting software isn’t easy, thanks to the thousands of options on the market. Which one offers everything you need without a slew of confusing features you’ll never use?

If you’re not sure how to answer that question, you’re in the right place. This article covers how to choose the right software, the different types of software, and my top five recommendations.

Let’s get started!

The top 5 options for accounting software:

- FreshBooks – Best for freelancers and solopreneurs

- QuickBooks – Best accounting software for small businesses

- Zoho Books – Best for businesses with 50+ customers/vendors

- Sage50 Cloud – Best desktop accounting solution

- Wave – Best free accounting software

How to choose the best accounting software for you

There isn’t a one-size-fits-all accounting solution for every business in every industry. Furthermore, the size and complexity of your business play a role as well.

Because of this, it’s critical to understand your budget and software requirements before making any decisions. To help you out, these are the criteria I considered when creating this list.

Feel free to use them as you go through the process of making your final choice.

Number of clients, vendors, and users

It’s important to consider the number of clients and vendors you manage because certain plans limit the number you’re allowed to have. So be sure to pay close attention to the limitations of each plan before making your final decision.

Furthermore, you need to know how many user accounts you need as well. Some of the basic plans included in this list limit the number of users to one or two.

So, you may need to upgrade to an advanced plan to accommodate your needs if you need more than that.

Mobile accessibility

Make sure the software you choose offers a mobile app so you can manage payments, invoices, and cash flow on the go. It may not seem like an important feature now, but you never know when (and where) you need to access your accounts or send an invoice.

Client management

The best accounting software includes intuitive features that let you follow up on invoices and a portal where your clients can pay you. With internal client management tools, revenue and accounting are centralized in one location to simplify the process.

Plus, it’s easier on your clients.

Billing and invoicing

Most accounting software includes invoicing functionality but in different capacities. Some offer highly customizable invoices while others are easier to use with fewer customization options.

Furthermore, the software you choose should make paying invoices as easy as possible for your clients. Some other billing and invoicing features to consider include:

- Automatic payment reminders

- Payment due dates

- Late fees

- Recurring invoices

- Ability to save client information

- Payment processing options

- One-click payments

Lastly, consider the payment processing fees associated with each software. Most charge a set percentage plus a small fee for credit card transactions and 1% for ACH transfers.

Receipt management

Many modern accounting tools make it easy to categorize and store digital versions of your receipts. All you have to do is snap a photo of your receipt and attach it to the associated expense in your account.

However, not every software includes this. So, if this is something you’re interested in, be sure to choose an accounting software with receipt management capabilities.

Banking

Connecting your bank accounts and credit cards to your accounting software makes account reconciliation a breeze. It also reduces the chances of human errors when making manual entries.

However, not every software offers this capability on basic plans (but all of my top recommendations do).

So make sure you opt for a software that includes this functionality.

Integrations

It’s important to consider the tools you’re already using to run your business. Why? Because the best accounting software for you integrates seamlessly into your tech stack with minimal hassle or headache.

So before you get started, make a list of everything you need and the tools you already use.

Then, make sure the top contenders on your list include your full requirements and the necessary integrations.

You can even schedule a call with a sales rep for each accounting software to walk through your list of requirements to make sure they can handle everything you’re looking for.

The different types of accounting software

When it comes to accounting software, you have several options. Some of them are better than others, but the best choice for you depends on your situation.

So let’s walk through your options before we dive into my top recommendations.

DIY spreadsheets

Spreadsheets are a free, DIY option if you’re on a tight budget. They work okay if you’re just getting started and have a limited number of business transactions.

However, they’re not a long term solution and they leave a lot of room for human error.

If you’re looking for a free option, I highly recommend Wave as an alternative.

Cloud-based accounting software

Most modern-day accounting software is cloud-based, making it easily accessible from anywhere with an internet connection.

And it’s usually billed on a monthly basis, scalable, affordable, easy to use, and built for small to midsize businesses.

Every option on this list falls under this category.

Database accounting software

This is a type of highly secure accounting software specific to enterprises and large businesses.

It’s very expensive and requires an in-house team of engineers and/or financial specialists to install and maintain.

Because of that, I didn’t include this type of software in my research.

Now, let’s dive into my top accounting software recommendations based on the size of your business and your specific needs.

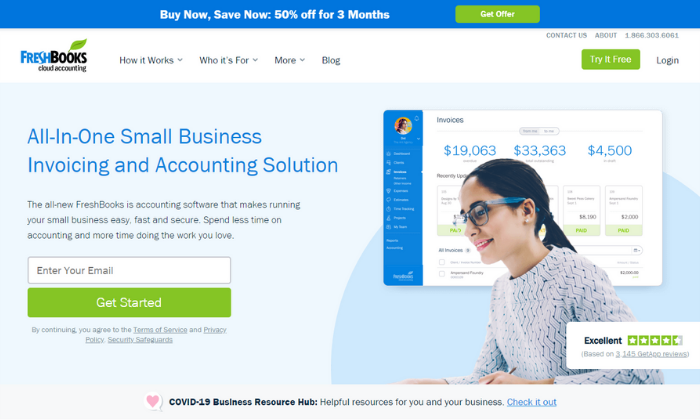

#1 – FreshBooks Review — The best for freelancers and solopreneurs

If you’re a freelancer, solopreneur, or small business, FreshBooks is a great accounting software to consider. To date, they serve more than 10 million businesses around the world.

And the software complies with double-entry accounting standards, providing you with more in-depth insight into your finances and business transactions.

FreshBooks specializes in invoicing, but the tool also includes small business features, like:

- Time and expense tracking

- Recurring invoices

- Automatic payment reminders

- Automatic late fees

- Multiple currencies

- Project management

- Client proposals

- Tax calculations

- Reporting and analytics

Furthermore, your account dashboard includes a birds-eye view of your business’s financial health. It shows outstanding invoices, total profit, revenue by source, expenses, and unbilled time all in one centralized location.

Plus, you can manage your books on the go using their robust mobile app.

And the software integrates with over 200+ business tools like Shopify, G Suite, Stripe, Zoom, Squarespace, and Gusto. So, you don’t have to worry about incompatibility with most of the tools you already use.

But like most accounting software, FreshBooks charges a transaction fee of 2.9% + $0.30 per transaction for credit cards and 1% for ACH transfers. However, these fees are pretty standard across the industry, and you don’t have to worry about any additional hidden costs.

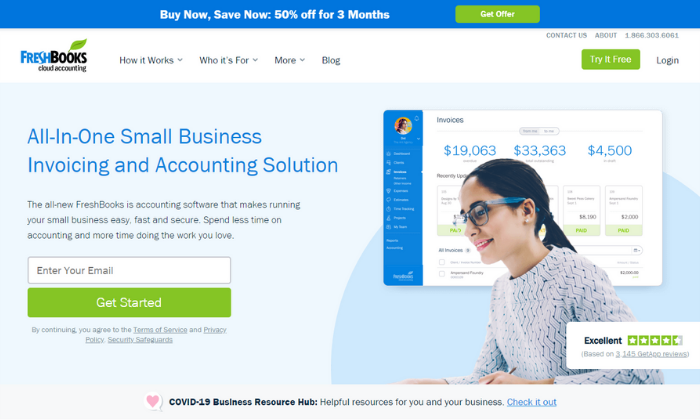

Their paid plans start at $6 per month for up to five clients making it very affordable for freelancers, solopreneurs, and small business owners alike.

However, FreshBooks can scale alongside your business with other plans, including:

- Plus — $10 per month for up to 50 clients

- Premium — $20 per month for up to 500 clients

- Select — custom pricing for more than 500 clients

Sign up for a free trial to take FreshBooks for a test drive today! Alternatively, you can save 50% off your first three months. However, you have to choose one offer or the other.

#2 – QuickBooks Review — The best accounting software for small businesses

If you’re running a small business or starting a new business from scratch, QuickBooks is a popular choice — and for a good reason. In fact, over 5.6 million users around the world trust them for their accounting needs.

From small businesses to self-employed individuals, QuickBooks offers an array of excellent accounting solutions to match your needs.

Furthermore, you can choose from cloud-based, desktop, or POS system deployment, depending on your situation. However, I highly recommend the cloud-based solution for most businesses.

Plus, the online software integrates with apps like PayPal, Square, and Shopify to simplify cash flow management in one centralized location.

With their online solution, you can easily access your account anywhere globally with an internet connection. Plus, you can use the mobile app to take pictures of your bills and receipts rather than filing a heap of paper receipts in your office.

You also get access to features like:

- Customizable invoices

- Income and expense tracking

- GPS mileage tracking

- Automatic sales tax calculations

- Bank and credit card integration

- Expense categories

- Standard reporting

And you can easily upgrade to an advanced plan if you outgrow the basic plan or need more advanced features. Some of their advanced features include 1099 management, inventory management, and time/attendance tracking.

So regardless of what you need, there’s a plan to suit your needs.

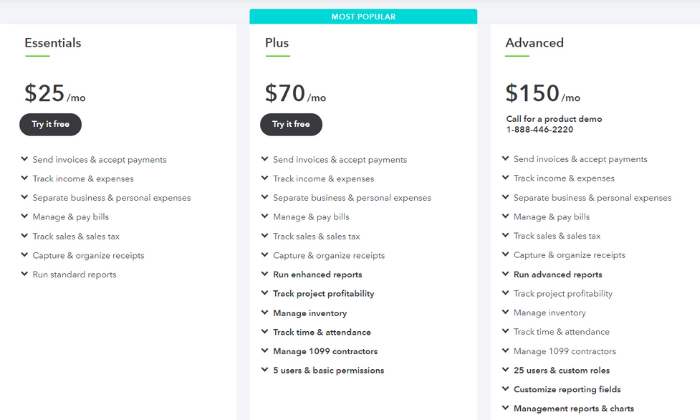

The cheapest plan starts at $25 per month. And you can add payroll services to your plan, starting at an extra $45 per month + $4 per employee per month with more advanced options available.

Furthermore, QuickBooks charges $0.25 + 2.9% for invoices, 2.4% for swipes, and 3.4% for keyed payments per transaction. Alternatively, they charge 1% for ACH transfers. And you can save up to 40% on transaction fees if you charge more than $7,500 per month.

Like FreshBooks, QuickBooks offers a 30-day free trial OR 50% off your first three months.

Get started with QuickBooks today!

#3 – Zoho Books Review — The best for businesses with 50+ customers/vendors

If you manage many clients and vendors, Zoho Books is one of the most affordable accounting software to consider. Their cheapest plan includes up to 50 billable clients, and they also have packages for up to 500 billable clients as well.

So, you don’t have to worry about exceeding your monthly limits.

Furthermore, Zoho Books includes access to powerful features like:

- Tax compliance tools

- Custom quotes and estimates

- Automatic payment reminders

- Vendor and expense tracking

- Inventory management

- Automatic bank feeds

- Time tracking

- Customizable invoices

- Role-based access

- 40+ integrations

Zoho Books also offers an intuitive mobile app for managing your accounts on the go. With the app, you can track your mileage, reach out to customers, track your time, create invoices, and more.

Each plan also includes a private client portal for accepting payments, unlimited phone and email customer support, free SSL encryption, and open rest APIs to connect with third-party applications.

Furthermore, Zoho offers a wide range of other business tools that integrate seamlessly together. Running a subscription-based business? Or need advanced inventory management? Maybe you need extensive expense reporting for your team.

Odds are, Zoho offers what you need. You can bundle tools together to save money and create a custom business management system for your business.

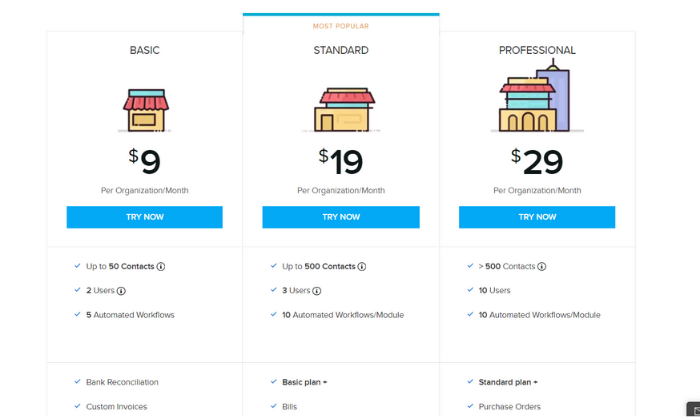

I highly recommend starting with the Basic Plan ($9 per month) and upgrading to an advanced plan when and if you need to. The Basic Plan includes up to 50 contacts, two separate user accounts, and five automated workflows to simplify your accounting processes.

Zoho’s advanced plans include:

- Standard — $19 per month for up to 500 contacts

- Professional — $29 per month for more than 500 contacts

All of which are very affordable for businesses of all sizes. Furthermore, you can add extra users and 50 auto-scans for $2/month and $5/month, respectively.

Sign up for a 14-day free trial to see if Zoho Books is right for you today!

#4 – Sage 50Cloud Review — The best desktop accounting solution

Sage 50Cloud is a desktop accounting application seamlessly connected to the cloud. So, you get the speed and reliability of a desktop software paired with the flexibility and remote accessibility of using the cloud.

Furthermore, Sage offers cloud-based accounting software, so you’re not limited to the desktop application if that’s not your thing. However, their desktop solution is where they really shine.

You can securely access your accounts anywhere, anytime, allowing you to work when you want and how you want. So, you’re not limited to your desktop computer despite the benefits of using desktop software.

Plus, as the #1 rated accounting solution for small businesses, it includes features like:

- Cash flow management

- Flexible invoicing

- Recurring invoices

- Pay Now functionality

- Accounts payable + banking

- Automatic reconciliation

- Advanced inventory management

- Job and project costing

- Payroll processing

As you can see, Sage 50Cloud includes a robust set of features you typically have to pay extra for with the other options on this list (i.e., payroll).

And with those advanced features comes an advanced price tag.

So if you’re looking for basic accounting software, you’re better off going with FreshBooks or QuickBooks. However, if you need these advanced features, pricing starts at $50.58 per user per month.

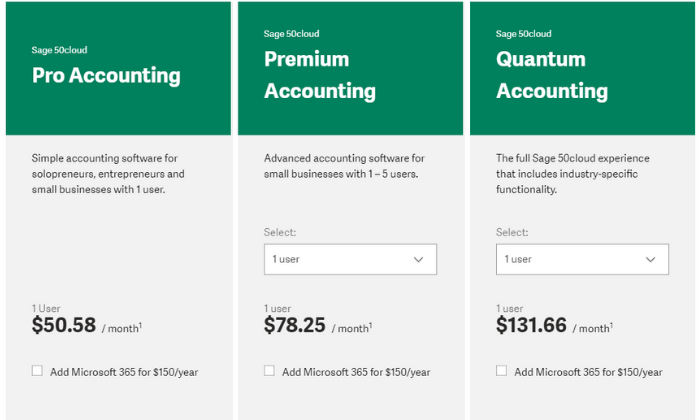

Their paid plans include:

- Pro Accounting — $50.58 per month for simple accounting

- Premium Accounting — $78.25 per month for advanced features

- Quantum Accounting — $131.66 per month for all features

However, you can save a bit more by choosing an annual plan and paying in advance. Additionally, you can subscribe to Microsoft 365 for an extra $150 per year.

You can try Sage’s cloud-based accounting software free for 30 days with no installations and no credit card required. After that, you can purchase Sage 50Cloud if it’s a good fit for your business.

#5 – Wave Review — The best free accounting software

If you have a tight budget or need a simple accounting solution, Wave is an excellent choice. It’s an award-winning finance software for entrepreneurs and businesses of all sizes.

Plus… their accounting features are entirely free with no hidden fees or monthly payments. However, they charge a standard transaction fee of 2.9% (3.4% for American Express) + $0.30 for credit cards and 1% for ACH transfers.

You can also add payroll services starting at $20 per month. But accounting, invoicing, and receipt scanning are all free forever.

This free accounting software includes features like:

- Unlimited income and expense tracking

- Unlimited collaborators and accountants

- Double-entry accounting system

- Powerful reporting and analytics

- Bank + credit card connections

- Tax categories

- Recurring invoices

- Automatic payment reminders

- Unlimited receipt scanning

- 2-business-day payouts

Plus, you get unlimited email support, as well. And if you’re wondering how Wave stays in business, it’s through their transaction fees and payroll services. So, yes. The software really is free forever, with no hidden fees.

Furthermore, you can download Wave’s mobile app to access and manage your accounts on the go from anywhere with an internet connection.

Sign up for a free account to get started today!

Summary

I recommend FreshBooks (for freelancers and individuals) or QuickBooks (for small teams). These two solutions are suitable for most users. They’re incredibly affordable, easy to use, and scalable. Plus, they include all your essential accounting features.

And if you’re on a tight budget, Wave is an excellent free alternative.

However, the best accounting software for you depends on what you need and what you can afford. So, feel free to use the characteristics we talked about as you go through the process of choosing the right software for your business.

What’s your favorite accounting software?

The post Best Accounting Software appeared first on Neil Patel.

via https://AiUpNow.com September 2, 2020 at 08:11PM by Neil Patel, Khareem Sudlow,