Once you decide to finally launch the startup you’ve always dreamed of, you may need to take out a small business loan. However, this process doesn’t simply consist of obtaining a loan and repaying it over a stated period of time.

StartupNation exclusive discounts and savings on Dell products and accessories: Learn more here

After securing a business loan, there are certain steps you should take to facilitate the repayment process and avoid any mistakes:

Consider daily repayment plans

There are several types of business loans, and each of them may have particular repayment terms and conditions depending on the creditor or the lending institution. While some loans are to be repaid weekly, biweekly or monthly, some entrepreneurs may have a daily repayment plan as an option. It may sound really surprising and unusual, but this practice can be beneficial.

Why should you opt for a daily repayment schedule?

- It’s convenient. There’s no need to worry about potential late fees, as the daily payments are made automatically.

- You will be able to boost the cash flow of your company. This can lower the amount you pay in interest, and the repayment schedule will be shorter.

- Daily payments don’t make as much of a dent. For many, it’s really comfortable to make daily payments that won’t even be that noticeable over time, in comparison with larger monthly fees.

More and more entrepreneurs seek options that offer more flexibility, helping to avoid extra costs associated with monthly payments that could incur late fees.

Amortization schedule

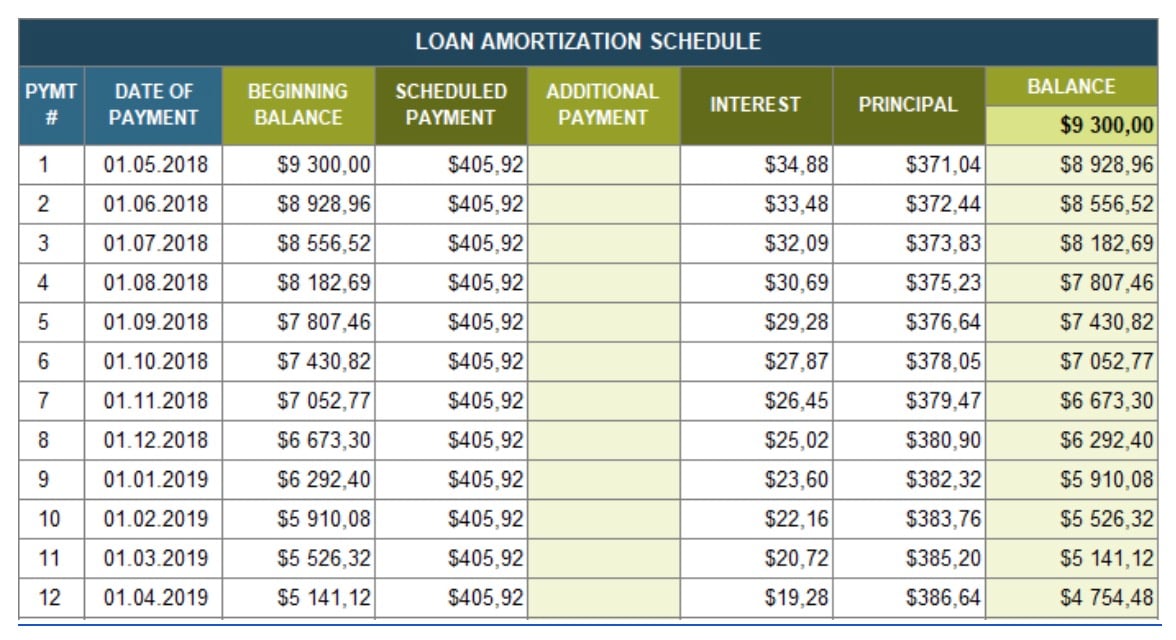

Perhaps you plan to take out an installment loan to start your business. In that case, you pay the loan off in installments, a repayment process known as amortization. Creating your own amortization table is a great way to track the repayment schedule as well as changes in the loan principal and interest over time.

(Image source: Smartsheet)

Many business coaches advise to create such a table in order to see how much money goes toward repaying a certain part of the loan. First, the larger sum goes toward repaying the interest. Several months later, the larger portion of the payment repays the loan principal, while the smaller part repays the interest until it’s fully paid off.

This calendar will be helpful to show you where your money goes, and how much exactly remains to be paid.

Related: Leveraging Credit to Build a Healthy and Thriving Business in 3 Steps

Tax deductible loan

The next step is to learn if your business loan is tax-deductible. Once you understand how the payment splits toward repaying the principal and the interest, it’s time to understand that not every part of that is tax-deductible. In fact, only the interest part may have loan deductions.

For instance, if you need to pay a $1,500 loan installment on a monthly basis, $450 is paid in interest and the remaining $1,050 is paid in principal. Only the $450 interest part can be deducted each month.

Making loan deductions is beneficial as it helps to decrease the amount of taxes you should pay. Be sure to read the fine print of any loan agreement carefully to know all the details and exact terms before signing an agreement.

Generally, here are the basic demands for making tax-deductible payments:

- You are willing to repay the debt on time and in full

- You have signed a legal loan agreement

- You have a real borrower-creditor relationship

It goes without saying that tapping your friends or family members doesn’t qualify here, as they can’t be considered legal lenders.

Loan prepayment

Are you willing to save even more in the long run? Why not opt for a prepayment strategy?

Many loans offer a loan prepayment, but you need to make sure it is possible and stated in the agreement. Otherwise, you may end up paying extra charges for repaying the debt ahead of schedule.

Here are the situations when this solution will work best for entrepreneurs:

- Get rid of debt earlier. In the case that your company’s cash flow is stable, and your startup has become successful even earlier than you projected, it makes sense to prepay.

- If you have an altering sales cycle, such as in retail or restaurant business, you may take advantage of paying the debt off ahead of schedule. This can be made during the high sales season when you are sure you have enough cash flow to cover the expenses and save something for the upcoming low season.

If you are unsure about the near future of your business and haven’t reached your targets under budget, it’s better to skip this method.

Save your credit score

In certain situations, taking out a business loan may affect the personal credit history of the borrower.

For example, if loans require a personal guarantee from the debtor, the creditor will require you to repay the debt in full even in case of bankruptcy. Whether you are just a partner or a sole entrepreneur, you will be fully responsible for paying the debt. Otherwise, your credit score may be affected and lowered in case of non-payment.

The same applies to business credit cards. Your card activity is reported and added to your credit report. While it’s beneficial for improving cash flow and developing your business, it should also be used responsibly to prevent your business credit from being damaged.

In order to keep your personal and business credit history separate, you must select the right business structure and discuss any loan conditions with a creditor.

Sign Up: Receive the StartupNation newsletter!

Refinance a loan

Last but not least, consider loan refinancing, which means obtaining a new loan to repay the previous one. The new loan usually comes with lower interest rates and better conditions. Thus, it’s a good option for those entrepreneurs who have repaid a certain amount of their original loan and want to speed up the process with better terms.

Do your research and find a new loan with better terms and/or lower APR. Examine the terms of the existing debt. In some cases, the debt may not be eligible for refinancing. Generally speaking, equipment loans, term loans, micro loans and working capital loans may be refinanced.

Taking this step is essential if you want to consolidate your company’s debt and boost its organic cash flow.

Overview

Follow these steps to avoid widespread mistakes after taking out a business loan, and you’ll be on your way to turning your startup into a powerful and prosperous enterprise.

The post 6 Steps to Take After Getting a Business Loan appeared first on StartupNation.

via https://www.AiUpNow.com

October 4, 2020 at 05:02AM by Emily Morgan, Khareem Sudlow