So at long last, after 17+ years, secretive Palantir IPO’d. Is it a SaaS company? Sort of. Maybe. It it a service company? In many ways, yes. Is it enterprise software? Oh yeah. With the average customer paying $5,000,000+ a year, it’s definitely enterprise software :). A $23B market cap enterprise software company — with a lot of services.

While most of us sell at a lower ACV, there are still interesting things for us all to learn re: enterprise buyers and selling. Here are the 5 that stood out to me at $1B run-rate and post the IPO:

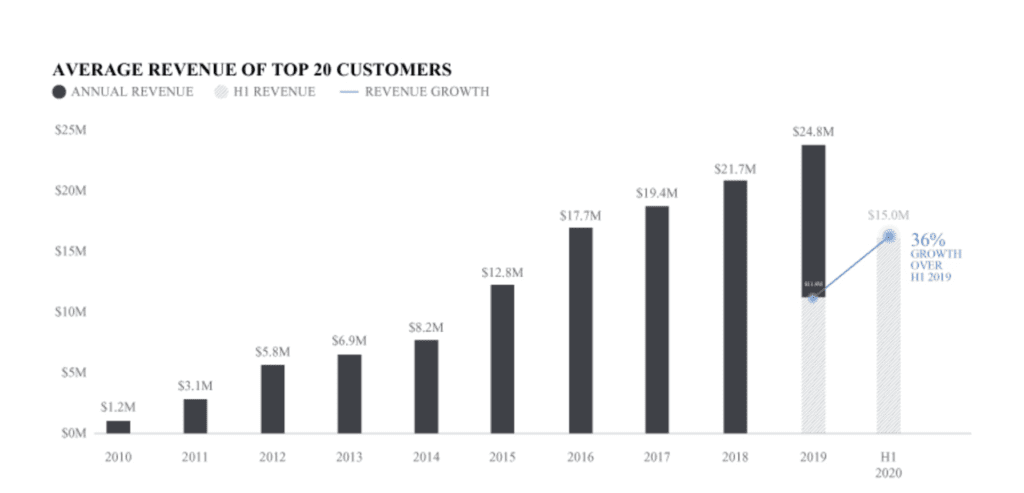

1. Highly concentrated revenue is worrisome, but not the end of the world. 66% of Palantir’s revenue come from its Top 20 Customers. These top 20 customers alone average $15,000,000 a year. Remember when Twilio IPO’d and there was a lot of worry they’d lose Uber, and were too concentrated in top customers? Well, they did lose Uber. And Twilio has done just fine since they, growing more than 10x in market cap

So yes, concentrated revenue is a worry. But Twilio and Palantir have been big success stories despite it.

2. Deal sizes have increased 30% a year on average. This is pretty consistent with the net revenue retention we’ve seen from other SaaS leaders, and good to see it continue there.

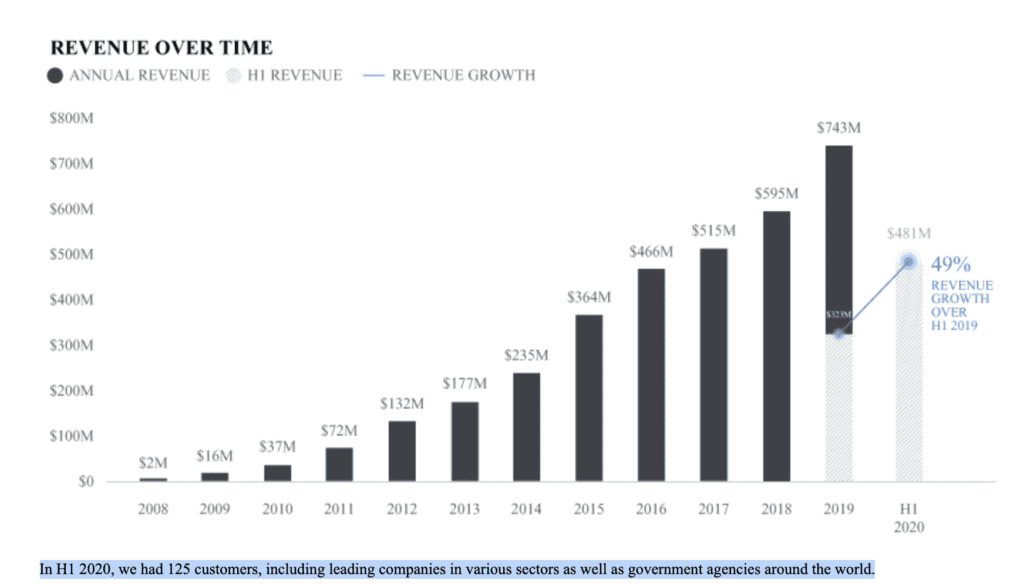

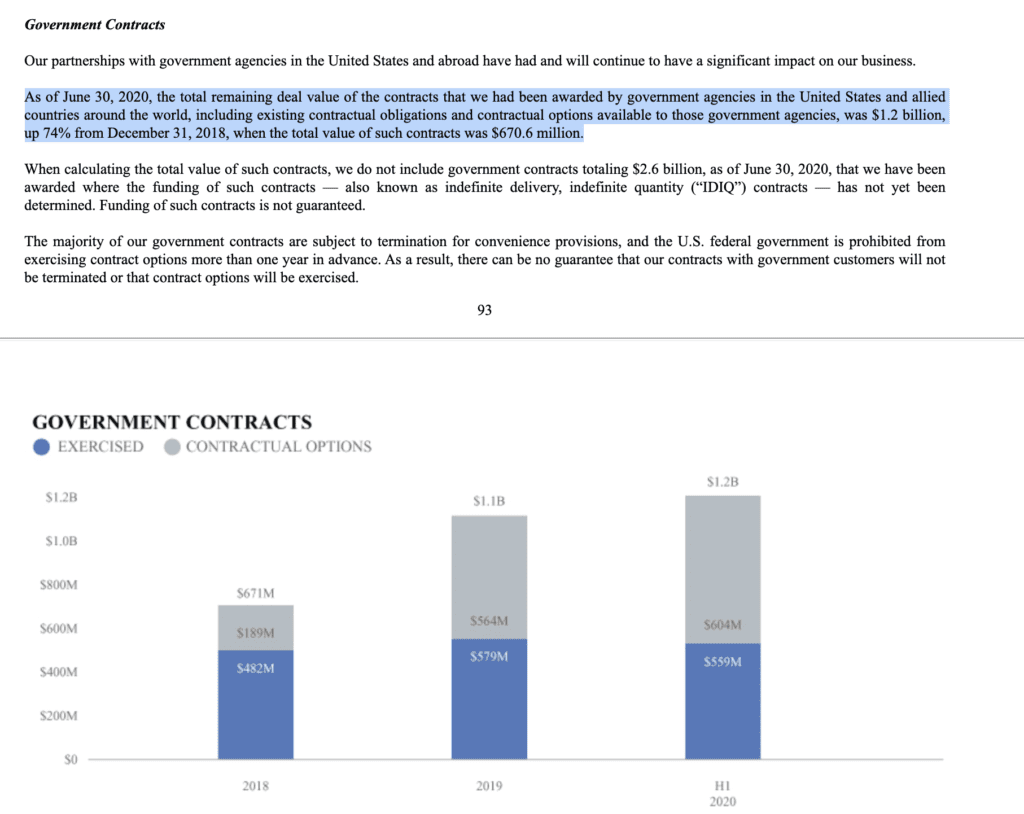

3. You can grow your TAM — even at a $1B run-rate. Palantir is now growing faster than in years, with 49% annual growth rate at a $1B run-rate (!). Yes, they got a Covid boost. But so what? And government contracts in particular were on fire, growing 74% year-over-year. Yes, selling to the government takes time. But once you are in, you can really grow:

4. Existing customers fuel the bulk of growth at scale — even at a $1B run rate. Because they’ve grown 5x in size since 2012. We’re seeing this again. Yes, Palantir grew 49% in 1H of this year. But with 36% growth in existing accounts, likely more than half of its growth came from its existing customers. They can be your fuel in the enterprise almost forever.

And these largest accounts have grown from a stunning $5m in 2012 to $25m+ today, trending to $30m. That’s 5x-6x growth since 2012. A vivid reminder that net retention compounds:

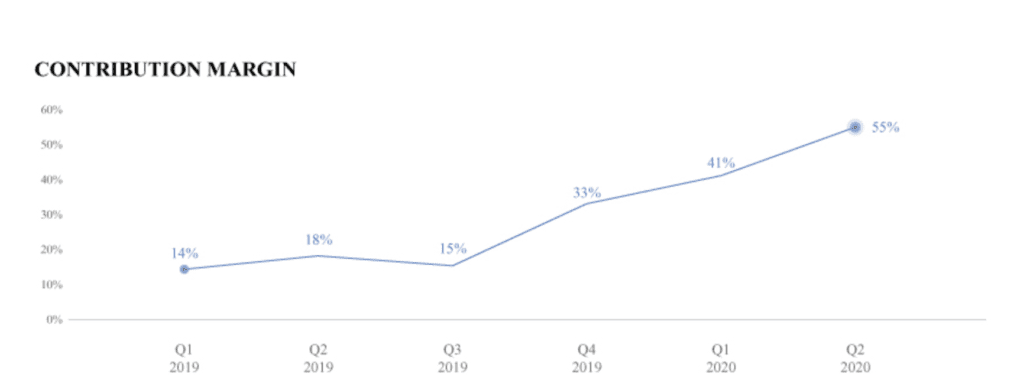

5. Palantir finally became a software company (based on gross margins). But not until 2020, really. With so many services, when did Palantir cross 50% gross margins … sort of the minimum to be a software and not a service company? Not for 17 years. Not until this year.

So the lesson perhaps is Be Who You Are. Palantir really did start off as a services business. But it knew it needed to grow into a software business to command the multiples it asked — it’s market cap is a very healthy 23x ARR today. So it did get there, to the 50%+ margins of a software company.

But it took its time. 17 years.

To $23 Billion.

The post 5 Interesting Learnings from Palantir at $1 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow