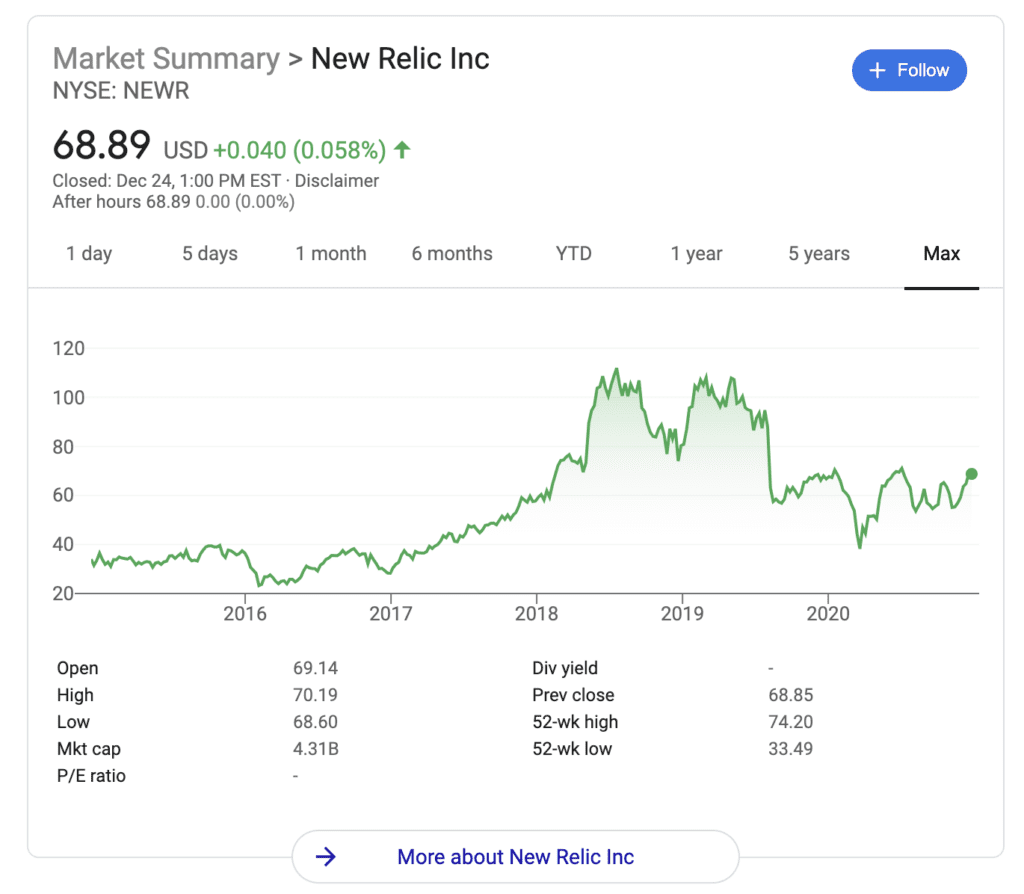

New Relic is one of my favorite Cloud stories. CEO Lew Cirne, after regretting selling his first startup in the space to CA for $375m, tries again with New Relic. Today New Relic is worth more than 10x that, at $4.3B. And more than previous rivals such as AppDynamics, acquired by Cisco for $3.2B.

Yet New Relic doesn’t get the same attention from everyone it did a few years back when it was everyone’s favorite devops app. Times have changed, the Cloud has gotten a lot bigger, and there are many more vendors, including the red-hot DataDog, to grab mindshare.

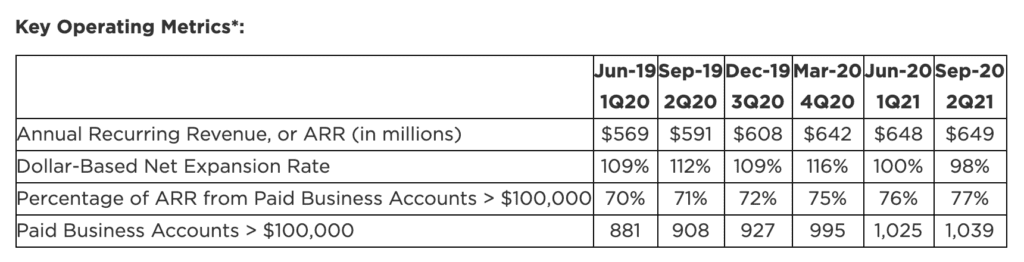

But New Relic has continued to scale, crossing $650,000,000 in ARR (or so) and a $4B market cap. An incredible streak. Let’s take a look at 5 interesting learnings:

1. Slow growth means a low multiple. New Relic is an icon but growth has slowed to 14% annually. This means New Relic trades at just 6.6x ARR. It’s a reminder why there is such a premium paid from VCs and others for growth today. And why VCs don’t really want to fund folks with good-but-not-great growth anymore. The multiples just don’t support it.

2. Devops has gone very enterprise quickly, and so has New Relic. Those of us who’ve been around a while think of New Relic as a freemium and almost SMB tool, but today 77% of their revenue comes from accounts greater than $100k. That’s up from 70% 5 quarters ago — a big change.

3. Low NRR is the difference — and the drag on growth. This is a big take-away. New Relic’s net negative churn / net dollar retention has dropped to 98% in the last quarter, despite a record 77% of revenue being from the enterprise. While New Relic cited Covid, perhaps competition is likely as a big a culprit, as we also saw with Slack. If New Relic had even 120% NRR, it’s growth rate with the exact same rate of new customer acquisition would be 137% instead. And it would probably be worth $15B-$30B instead of $5B.

Do whatever you can to drive up NRR / net negative churn. It’s the secret to scaling effectively. And in staying in the “high growth” category.

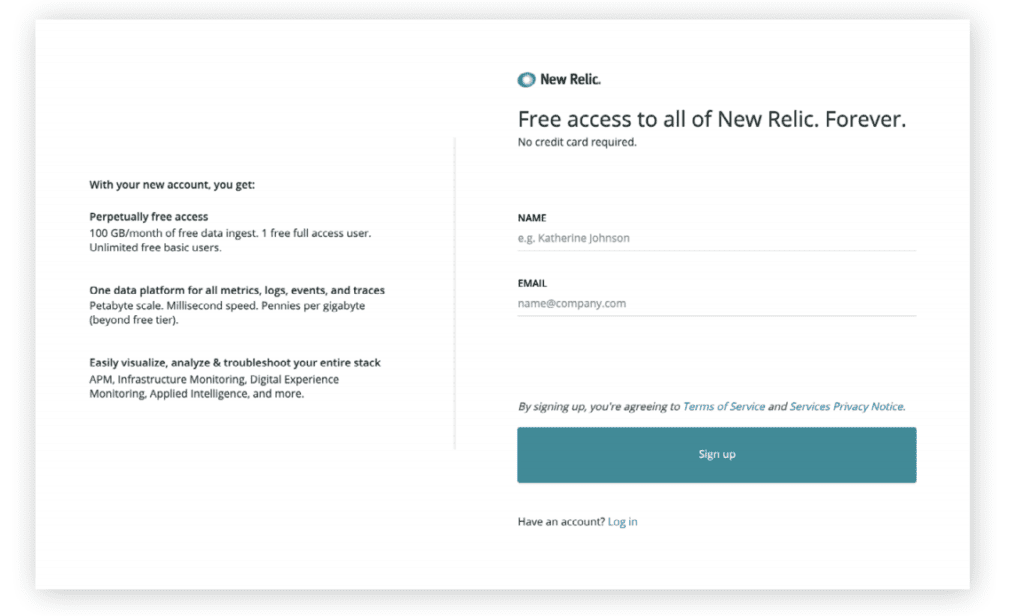

4. 10x the sign-ups with new Free tier. New Relic started off as a very freemium app, but put more gates in place as ARR grew and deal sizes went up. This is fairly common as companies go more enterprise, and the sales team especially wants to limit the use of free accounts and pilots. New Relic has aggressively re-entered the long tail segment of the market with up to 100G/month of usage for free, which has led to 10x the sign-ups of before, when the cost was $2k. Will conversions make up for it? Who knows, but it will be an interesting experiment to watch. It is tough to “go back” to the bottom of the market once you’ve moved away from it, and your DNA has. If New Relic makes this work, it will be a great case study.

https://s2.q4cdn.com/967921702/files/doc_financials/2021/q2/2Q_FY21_Investor_Letter_V7.0.pdf

https://s2.q4cdn.com/967921702/files/doc_financials/2021/q2/2Q_FY21_Investor_Letter_V7.0.pdf

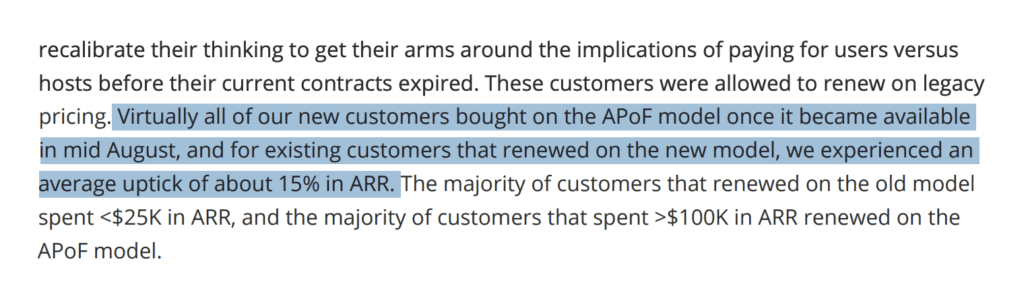

5. New consumption pricing model has increased revenue 15% where rolled out. This is a big deal in B2D/API companies. For years, many developer-focused companies have migrated customers to fixed-price contracts once API usage hit certain levels, to better look like their B2B SaaS companies and have “repeatable revenue”. But in many cases, this just isn’t how folks want to pay for an API. They often want to pay a fair rate for actual usage. Done right, this sort of anti-SaaS pricing model can lead to significantly more revenue. In New Relic’s case, moving from subscription to consumption based usage has increased net revenue 15%. That’s a big deal in general, and especially for a company growing 17%.

I’ve seen this across other B2B/API companies I’ve invested in. It can be a bit scary to move from fixed contracts. But if the revenue has recurring-revenue like characteristics (high NRR, predictable, low churn), Wall Street has said it’s just as good as “true” NRR. On a related note, most of Shopify’s revenue in no longer SaaS revenue either, but variable revenue tied to commerce sales.

So if your customers want to pay per usage, per API call, per transaction … maybe let them. Especially if your model says they’ll pay more. SaaS is more than just standard annual contacts in 2021 and beyond.

….

And on New Relic in general, I’m bullish. They’ve gone through a slow patch, but Lew Cirne is one of the best founders in the business. The new pricing model and move upmarket should work, and while I’m not sure more Free will totally move the needle, it should help in mindshare. We’ll check in again at $1B in ARR!

The post 5 Interesting Learnings from New Relic at $650,000,000 in ARR appeared first on SaaStr.

via https://ift.tt/2Jn9P8X by Jason Lemkin, Khareem Sudlow