In short

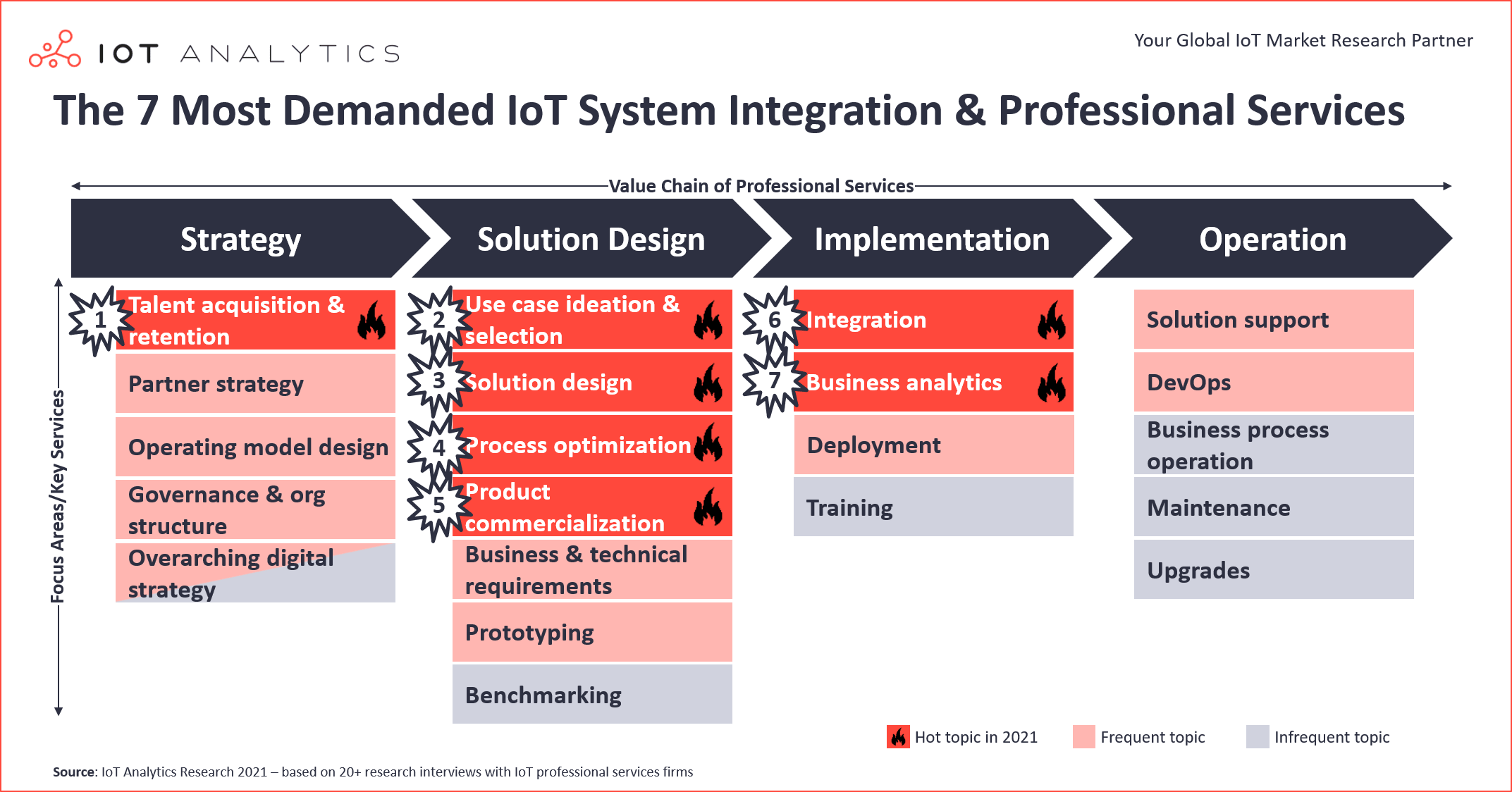

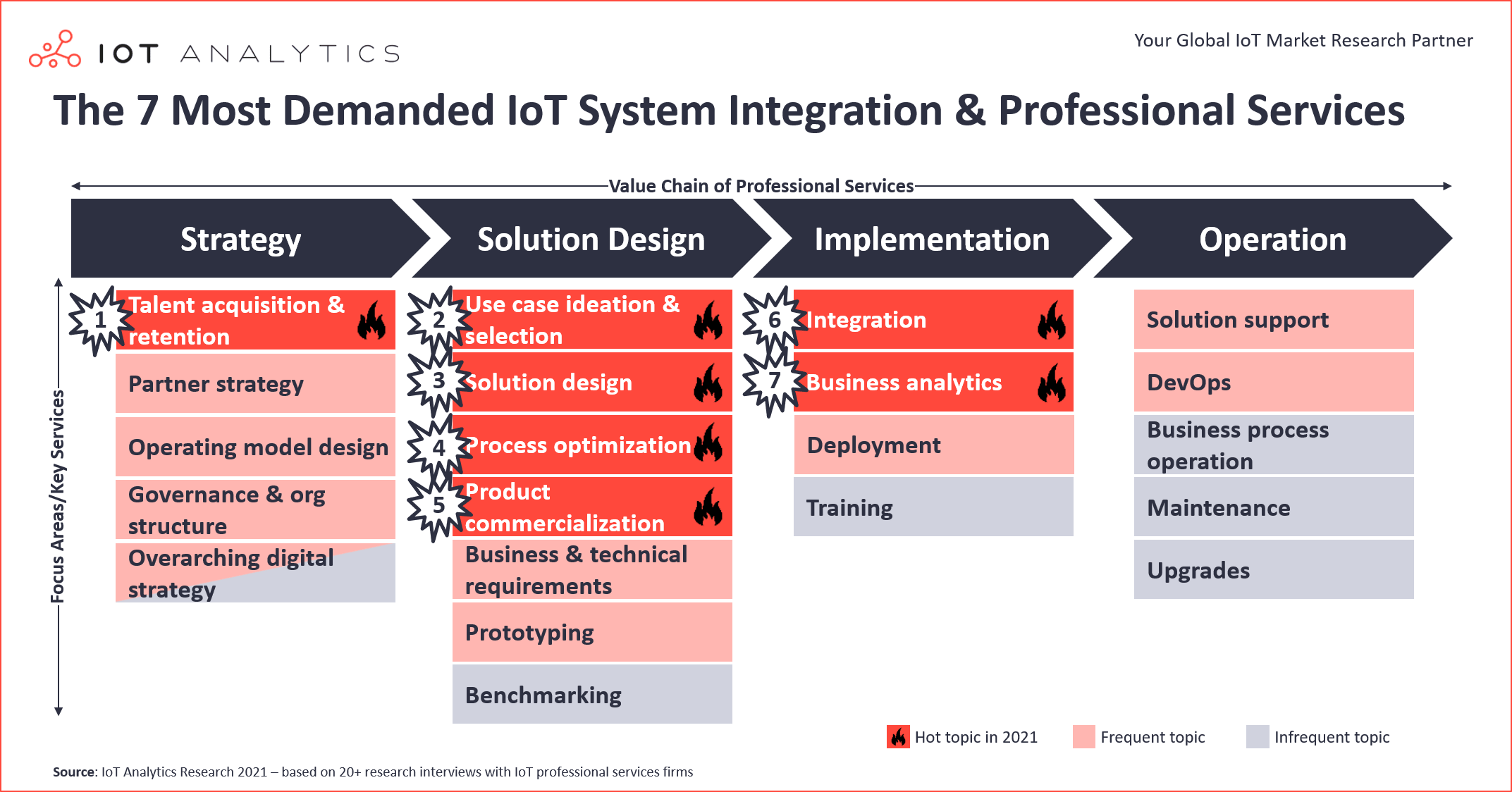

- Seven focus areas are currently in high demand for IoT system integration and professional services.

- The focus areas of today are further downstream in the value chain (mostly in the solution design and implementation stages) than in years past.

- Due to strong demand, many technology vendors are building out their own integration capabilities.

Why it matters?

- Companies offering IoT system integration services need to address these high-demand areas.

- Companies implementing IoT projects may need outside help in some areas to ensure success.

The shifting IoT system integration value chain

Of the companies that hire system integrators, 78% do so because they lack the experience to integrate the systems themselves. This is one of the findings of IoT Analytics’ latest report, IoT System Integration & Professional Services Market Report 2021–2026. This data point highlights why professional services firms, and particularly system integration firms, are in such high demand as technology talent becomes scarcer and integrations more complex.

Compared to other technology areas, the deployment of IoT technology is particularly complex. IoT projects require skills in several areas that have historically been separated, including secure embedded design and engineering, connectivity management, cloud and IT architecture, data science, and application development. The importance of an IoT system integrator to supply these skills and help companies build and scale IoT projects has never been greater.

However, customers’ priorities are shifting with regard to IoT system integration. Based on interviews with numerous professionals in the domain, the IoT Analytics team has created a heatmap of topics that are currently in high demand along the IoT system integration and professional services value chain.

(Please note: The heatmap is based on 20+ discussions with experts in the field and should be treated as an indication only, due to the relatively small sample size. Hot topics are defined as those that are in the greatest demand in 2021.)

The focus areas of IoT professional services are starting to move downstream from strategy towards solution design and solution implementation. While formulating holistic digital and IoT strategies was a key undertaking for many companies a few years ago, consulting firms, in particular, now find that most clients have plans in place and are acting on strategies they formulated in the last three or four years. Accordingly, seven new “hot” areas were identified:

1. Talent acquisition and retention

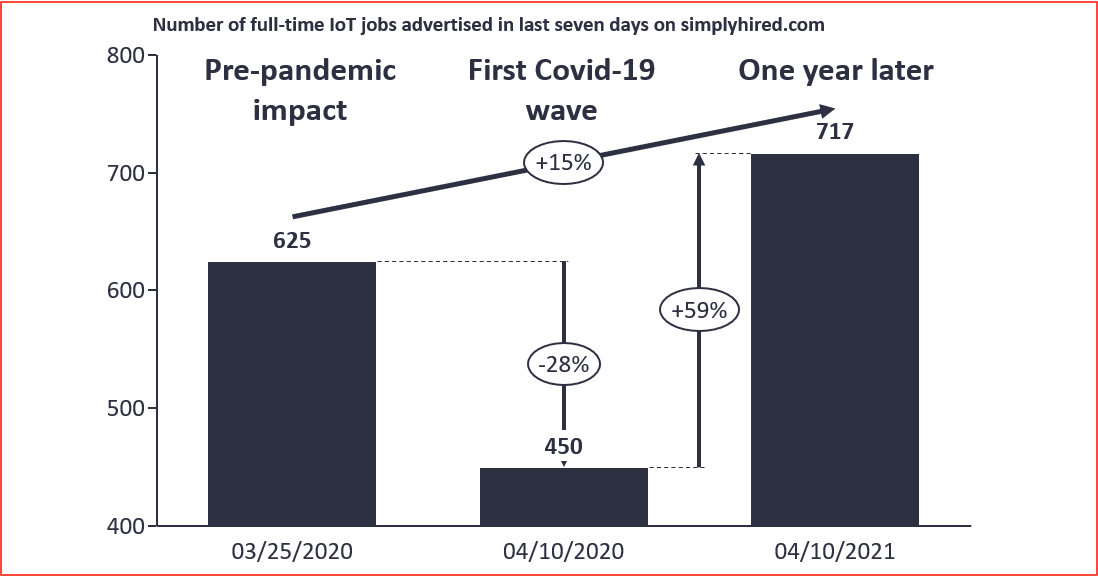

The only hot topic in the strategy stage of the value chain is “talent acquisition and retention.” Although the effects of COVID-19, including mass furloughs and hiring freezes, have temporarily eased the tech skills shortage we discussed previously, there are clear signs that the situation is worsening again for tech employers. The number of full-time jobs labeled as “IoT” on the job portal Simply Hired dropped almost 30% in three weeks when the pandemic hit in April 2020. One year later, in April 2021, the number of IoT jobs advertised is already 15% above pre-pandemic levels. The data shows that both tech suppliers (like AWS, Google, or Lenovo) and organizations adopting IoT (like Mattel, McDonald’s, Bridgestone, or Nike) are currently competing for the same talent.

Enterprises calling on professional services firms for help with talent acquisition and retention strategies ask the following key questions:

- How to manage the new normal of remote work

- How to create a digital work culture

- How to train and reskill the existing workforce

- How to attract and retain Gen Z and younger members of the workforce

2. Use case ideation and selection

Connecting devices and assets through IoT opens up opportunities for hundreds of use cases. But which one is best? Should a firm prioritize a predictive maintenance scenario, IoT-based product quality monitoring, or solutions that help the user or customer handle the equipment? With only limited resources at hand and numerous opportunities in sight, firms in 2021 find themselves overwhelmed with the decision of which IoT use case to prioritize.

“The majority of our clients (right now) are looking to find the right IoT use case for their business and design a solution to meet that need.”

Head of MarCom & Sales Support at Siemens Advanta

Our research shows that most IoT system integration and professional services firms have developed some form of framework (often following the design thinking philosophy) to help their clients navigate the topic of use case ideation and prioritization. Examples include Siemens Advanta’s co-creation framework or Infosys’ use of the (co-developed) acatech Industry 4.0 maturity index for industrial IoT and Industry 4.0 clients.

One of the reasons that choosing an IoT use case is so complicated is simply that there are so many attractive use cases available. Companies that have implemented IoT initiatives report that most IoT use cases have yielded a strong ROI so far. (More data will be presented on this topic in the upcoming IoT Use Case Adoption Report 2021, to be published in the summer of 2021).

3. Solution design

Few companies design their IoT solutions entirely in-house. Therefore, it is not surprising that solution design is a core topic for IoT professional services and system integration firms. Solution design services are in particularly high demand for companies that are transitioning from years of selling an unconnected product or machine to offering a smart connected product with applications often residing in the cloud.

There are hundreds of case studies of companies providing custom IoT solution design.

Example 1: HCL Technologies helped a provider of precision irrigation management systems build a microservices-based architecture to optimize sensor network design and ensure a failure tolerance for low-power data transmission.

Example 2: German integrator Tresmo helped Viessmann, a Germany-based provider of heating and refrigeration solutions, develop a next-generation modular smart home solution by connecting devices to a scalable IoT platform.

4. Process optimization

Companies using IoT solutions in their operations or manufacturing setup often ask IoT system integrators to analyze and improve their processes.

Example 1: Capgemini helped Baker Hughes implement an overarching IoT process optimization tool for its machine tools, furnaces, cranes, and manufacturing execution system.

Example 2: Infosys helped a Tier I aerospace supplier streamline the production processes of composite parts, e.g., by implementing condition monitoring and predictive maintenance and by using augmented and virtual reality headsets to enhance the maintenance process.

5. Product commercialization

In addition to IoT use case selection, one of the biggest business-oriented struggles facing organizations in 2021 is bringing new IoT solutions to market, particularly when these involve smart connected products. Original equipment manufacturers often refer to this as “servitization.”

“In the machinery sector, it is all about servitization right now. Servitization is driving OEMs to add digital software tools to their physical products.”

Partner at consulting company in EU

When asked, “What is the most important factor for driving customer adoption of newly connected IoT solutions?” companies that had rolled out a connected IoT device replied, “relentless focus on the value proposition for the customers” and an extra effort to “align sales and marketing processes to the new connected product” (Data from our 2020 IoT Commercialization & Business Model Adoption Report).

At IoT Analytics, we have talked to several companies during recent years that struggled to establish connected IoT products in the market. All had underestimated the complexity of designing a working business model, aligning the entire organization behind it, and getting customers to adopt the new solution.

6. Integration

Classical system integration continues to play an important role in 2021. Key themes include:

- Integrating and migrating workloads into the cloud (including hybrid and multi-cloud architectures)

- Connecting disparate applications and platforms (e.g., IoT platforms and enterprise resource planning)

- Harmonizing the edge-to-cloud setup

With systems becoming ever more interconnected, offering end-to-end integration capabilities has become crucial for system integrators that seek to satisfy customer needs.

“It is a top priority to […] get a relevant end-to-end business model while customers are rising critical needs in their digital demand.”

Elie Girard, CEO at Atos (August 2020)

However, it is challenging for firms to scale end-to-end digital capabilities organically. Partnerships, collaboration, and strategic acquisitions play an important role. That is why the IoT system integration vendor landscape is currently witnessing unprecedented merger and acquisition activity. Large integrators like Cognizant or Accenture, for example, have spent billions of dollars on acquisitions in the last 24 months.

“Since January 2020, we’ve announced approximately $1.6 billion in acquisitions, all focused on our strategic priorities of digital engineering, data, and AI, cloud and IoT, which together enable clients to compete as modern digital businesses.”

Brian Humphries, CEO at Cognizant (February 2021)

7. Business analytics

In our “IoT 2020 in Review” analysis, we highlighted “AIoT” as a popular buzzword to describe the combination of AI and IoT data. As billions of devices have come online in the last few years, the need to analyze data and perform powerful machine learning algorithms has increased steadily. In response, professional services firms have hired thousands of data scientists and AI experts, a trend that is likely to continue (provided enough people upskill to become data scientists).

“We currently have more than 20,000 people focused on Applied Intelligence, including 6,000 deep in artificial intelligence and data science.”

David Rowland, former CEO at Accenture (March 2019)

Outlook

Integration for the Internet of Things remains essential. Alongside a steady increase in demand for traditional consulting, system integration, and solution development firms, tech suppliers such as Microsoft are also significantly expanding their consulting and integration teams. In fact, our report found that six of the ten most used professional services firms are technology companies that monetize professional services on the side (e.g., Microsoft, SAP, IBM, and Cisco). These companies increasingly compete with the traditional system integration heavyweights such as Accenture, Deloitte, or Tata Consulting.

As long as IoT remains a complex undertaking and the technology presents as many options and intricacies as it does now, IoT system integration will remain in high demand. We forecast that the IoT professional services market will grow 19% per annum for the next five years. The leading IoT professional services firms in that period will be those that manage to establish themselves as knowledgeable and trusted partners along the entire tech stack, the entire project lifecycle, and the entire value chain.

More information and further reading

Are you interested in learning more about IoT system integration and professional services?

The IoT System Integration & Services Report 2021–2026 is a comprehensive 100-page report assessing the IoT professional services space, particularly IoT system integration. It also presents market sizing and an outlook for 2018–2026, with breakdowns, a vendor landscape of ~70 firms, results from a survey of IoT system integration customer perspectives, a heatmap of hot topics in 2021, and a discussion of six current trends and three challenges. The report is part of IoT Analytics’ ongoing coverage of IoT software and related topics (including IoT platforms and software workstreams).

This report provides answers to the following questions (among others):

- What characterizes professional services in the IoT context and along the value chain?

- How big is the IoT professional services market today, and how fast is it growing?

- Which types of services have the highest market volume, and how quickly are they growing?

- Who are the leading vendors, and what type of services does each vendor offer?

- Why do customers choose system integrators, and what are their main decision criteria?

- What trends are characterizing the market currently?

- What challenges are holding the market back?

And more …

Sample:

The sample of the report gives you a holistic overview of the available analysis (including the outline and key slides). The sample also provides additional context for the topic and describes the methodology of the analysis. You can download the sample here:

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.

The post The 7 Most Demanded IoT System Integration Services appeared first on IoT Analytics.

via https://www.aiupnow.com

by Knud Lasse Lueth, Khareem Sudlow