Pagos, a payment intelligence infrastructure startup founded by former Braintree and PayPal execs, has raised $10 million in seed funding.

Started earlier this year, the remote-first Pagos is building a data “platform” and API-driven micro-services that it says can integrate with any payment stack. The end goal is to drive better performance and “optimization” of a business’ existing payments infrastructure.

The concept was born out of the founding team’s experience at their previous companies. CEO Klas Bäck and CPO Albert Drouart held senior leadership positions at Braintree/Venmo and PayPal over the last eight to nine years (Braintree/Venmo was acquired by PayPal). The pair also worked together at payment processor Netgiro (later sold to Digital River). Daniel Blomberg, the company’s CTO, has launched seven startups (and sold five) over the last two decades.

“The challenge we saw pretty much for every one of our customers was that they didn’t have enough knowledge, not enough data and not enough tools to be able to execute a strategy around payment processing or know how to optimize it,” said Bäck, who led Braintree’s international operations from inception and worked for PayPal after its acquisition of the startup. “This means they are a lot slower and they have a much harder time doing all the things they need to do and producing the results they want.”

In real terms, this can lead to higher operating costs, lost revenue and “unnecessary friction, making execution of business strategy a lot harder than it should be,” added Bäck.

So the remote-first Pagos set out to build a SaaS platform with what it describes as API-driven micro-services to help companies optimize their payment processing and execution of it.

“We want to give them the insight and the data they need to answer — ‘what does it mean? How can I do better? How can I execute faster?”, Bäck said. “We want to give them those tools in an easy to consume way.”

It was enough to win over Underscore VC and Point72 Ventures — who co-led Pagos’ seed round — as well as angels including former Venmo GM and current Accel investor Amit Jhawar; Bill Ready, Google’s president of commerce & payments; Billy Chen, VP of financial partnerships at Finix and former director of payments at Uber; and Rich LaBarca, GM of Dynamics 365 Customer Insights at Microsoft.

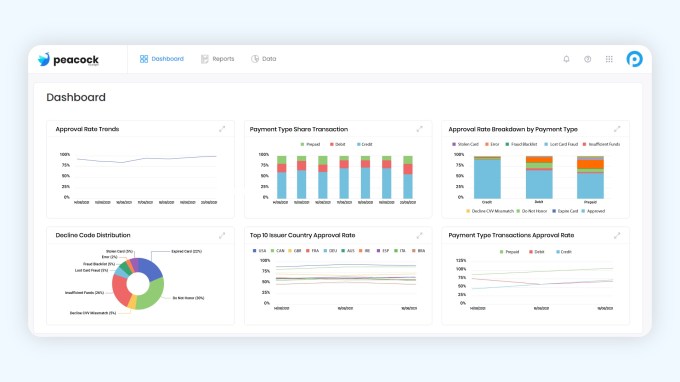

In the short term, Pagos is offering services such as “immediate” payment data visualizations, automatic notifications on payment trends or problems and up-to-date bank identification number (BIN) details to manage customers and track costs. Looking ahead, the company is planning to offer network tokenization and account updater services.

“Midsize to large companies are getting reasonable traction on sales online or via their mobile app. Once they start hitting meaningful numbers, their payment infrastructure is holding them back,” Bäck told TechCrunch. “We want to help them scale, and execute more with less resources.”

Since day one, the company has been working with customers on a global scale, from 50-person companies to others that are selling billions of dollars of products and services online.

The company plans to use its new capital mostly to scale its 20-person team, particularly engineers, noted Bäck.

Image Credits: Pagos

Its investors are, naturally, bullish.

Chris Gardner, partner at Boston-based Underscore VC, told TechCrunch that he was drawn to Pagos because its team spent decades working with its target customers, “making them uniquely qualified to serve them.”

“But their potential market is every e-commerce merchant in the world — and there are millions of them,” he wrote via e-mail. “Those are two potent ingredients in a winning recipe.”

In his view, the Pagos offering is unique in both the capabilities of their services and the delivery model to customers. Over time, the team plans on delivering more than a dozen individual micro services that solve specific payment optimization challenges — all accessible via APIs.

“And since there is no such thing as ‘one size fits all,’” he said, “they are available completely unbundled, free to try and individually priced when used at scale.”

Dave Matter, operating partner of Point72 Ventures, believes that as commerce becomes increasingly digitized, merchants’ payment stacks have become more complex and difficult to manage.

“Pagos is led by two of the most accomplished payments product experts in the business, and their relationships, domain expertise and firsthand experience with these pain points is incredibly valuable,” he said in a written statement.

via https://www.aiupnow.com

Mary Ann Azevedo, Khareem Sudlow