The late-stage VC first Meritech put together its annual SaaS report here and it slices the data in a few interesting ways.

A few tidbits of particular interest:

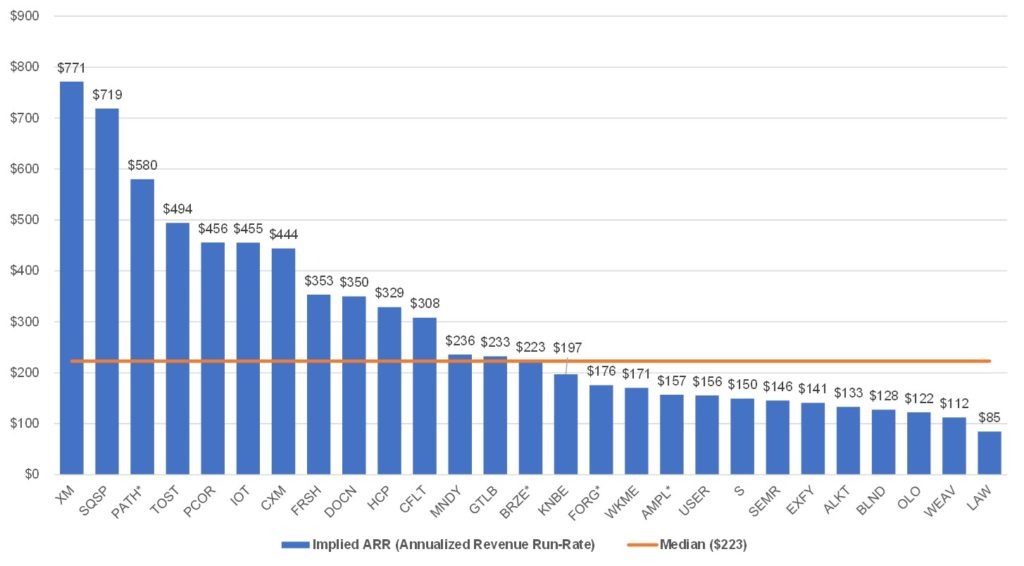

1. The average SaaS company hits $225m ARR at IPO. This was about what I expected, but I hadn’t crunched the numbers myself. So that’s the bar.

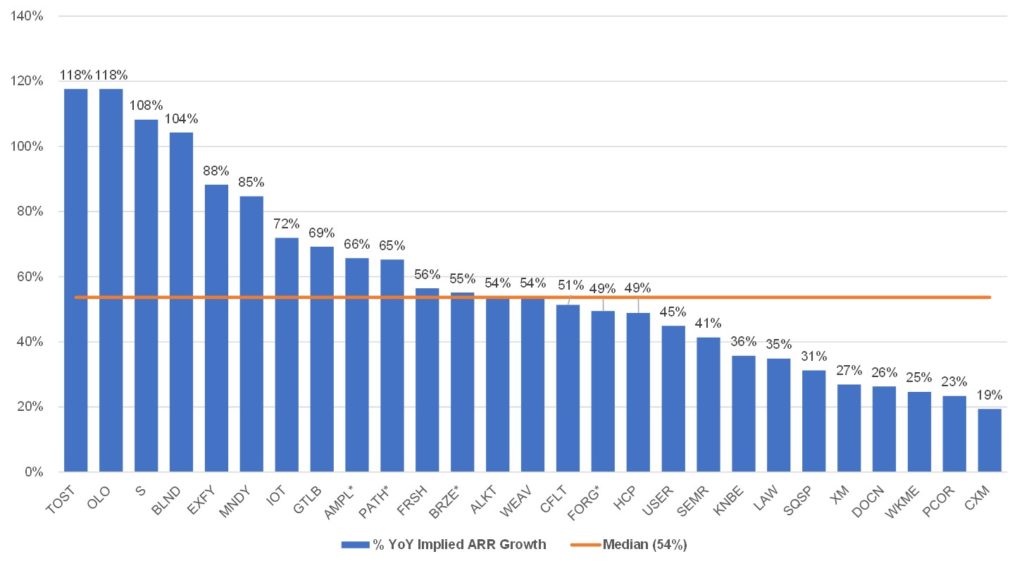

2. The average SaaS company is growing 55% at IPO, at that $225m ARR. Pretty consistent with what we’ve seen on our 5 Interesting Learning series, but helpful to see it distilled to one average number.

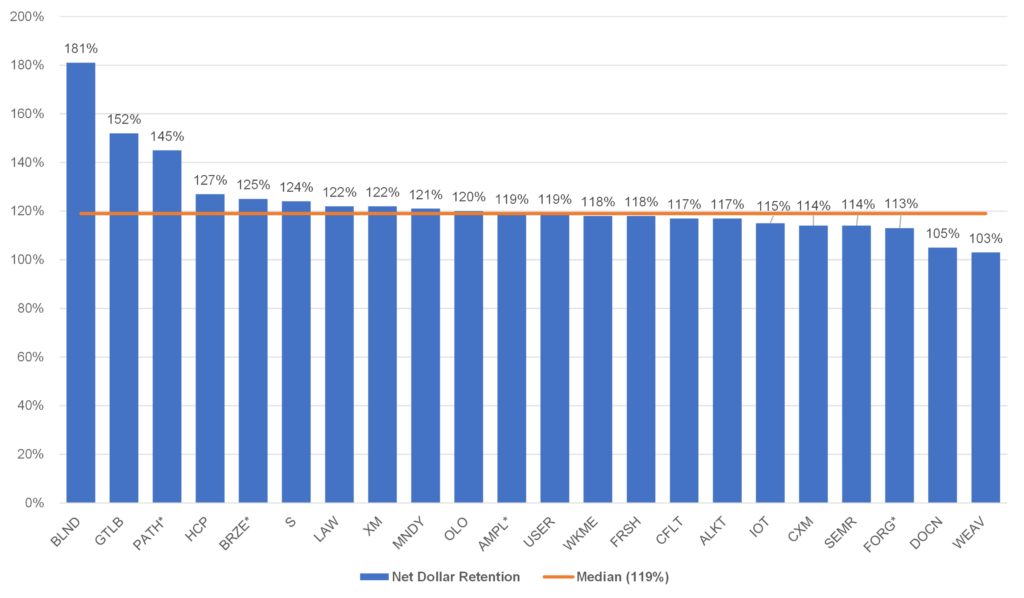

3. Average NRR at IPO is 119% — but this excludes a bunch of SMB folks who did not disclose their NRR. Makes sense, folks that are very SMB with mediocre retention often don’t disclose it. Squarespace’s NRR at IPO was only 85%. Many also exclude customers with say less than 5 seats, so average NRR is really lower than this. But still helpful to see.

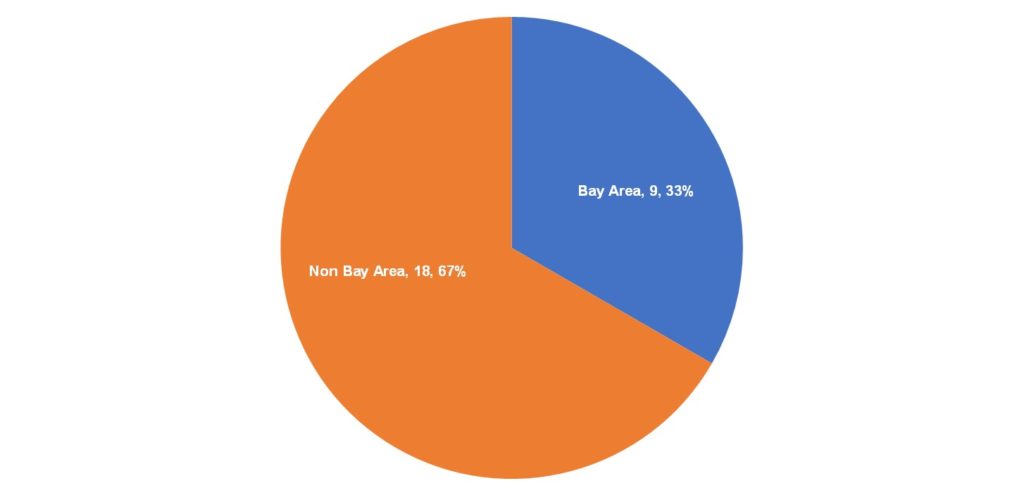

4. Only 33% of IPO’s in Bay Area in 2021. Wow, and down from 40% in 2020.

I exclude some of the metrics at IPO such as Magic Number, sales efficiency etc as they are helpful to see but often very different than what you see at earlier stages.

Much more here:

https://www.meritechcapital.com/blog/2021-review-select-saas-ipos

The post Meritech: The Average SaaS Company IPO’s at $225m in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow