Confluent is a leader in the Commercial Open Source Market, with the founders of Apache Kafka reimagining it as a managed service. It worked. It’s growing a stunning 71% at a $500m run-rate … and acclerating.

Confluent has been one of the top Cloud IPOs of the past year or two, crossing a $10B market cap at a $500m run-rate and importantly, holding up well during the multiple compression we’ve seen in 2022.

Put differently, Confluent is just the type of Cloud IPO the markets want right now.

5 Interesting Learnings:

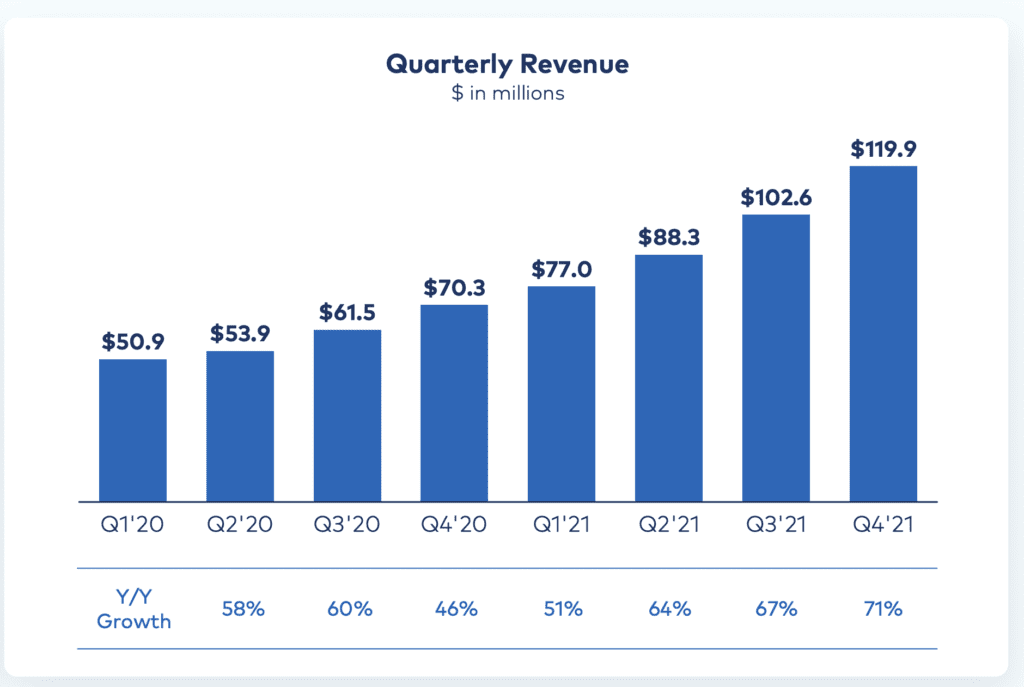

#1. Growth Accelerating on the Way to $1B ARR. While Confluent isn’t the only Cloud leader accelerating post-IPO (something we never used to see), the chart below shows just how incredible their acceleration really is. From 58% growth at $200m ARR to 71% at almost $500m in ARR.

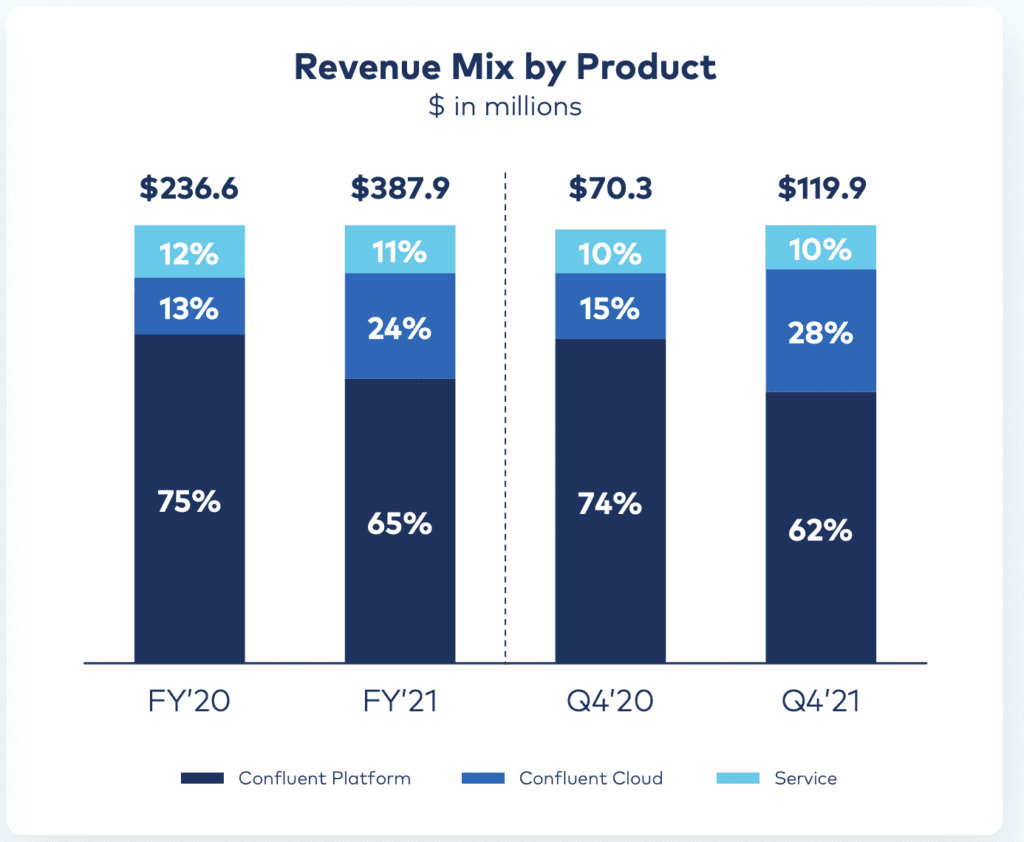

#2. Most customers still run Confluent on their own compute, but Cloud rapidly growing. Like GitLab and other enterprise leaders for developing software, a lot still runs on private clouds, servers, and more. But that’s changing, and Confluent is a visceral example of that. From 13% Cloud revenue in 2020 to 28% today, just 2 years later.

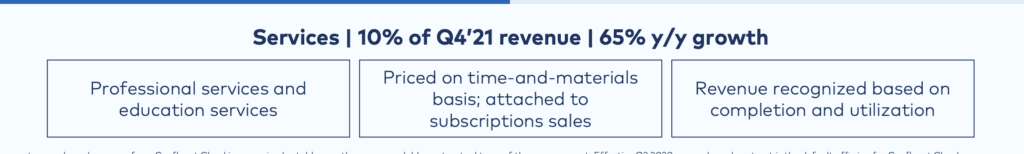

#3. Professional Services are About 10% of Revenues — And They Almost Break Even on Them. We’ve seen a variety of approaches here to Cloud companies at scale, and most (although not all) try to keep services under 10% of their revenues or so, including Confluent. Some like Qualtrics price services to still make money. But Confluent’s approach is perhaps the most common. They are running a -5% to 0% gross margins the past few years, i.e., pricing their services to just about break even.

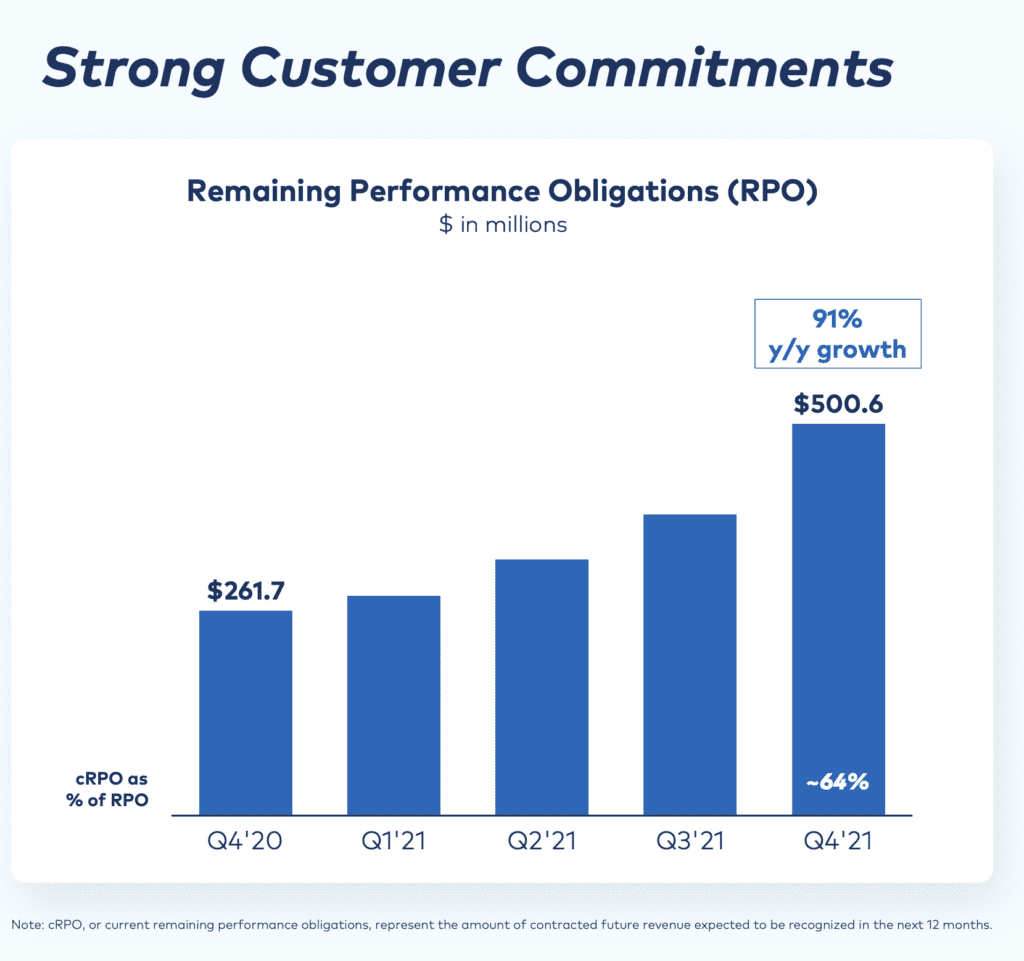

#4. RPO up 91% year-over-year. RPO is all future revenue commits. This is becoming a more and more important KPI for all public and later stage SaaS companies. Investors want to see your RPO higher than your annual growth rate. If it is — everyone gets excited.

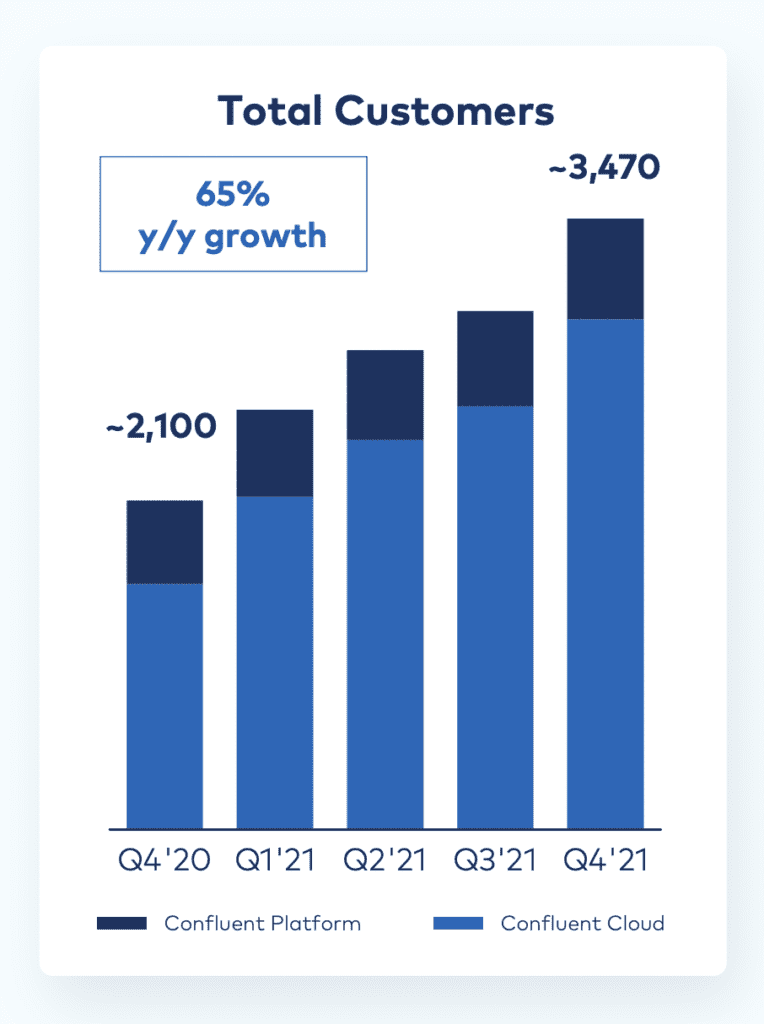

#5. 65% growth in customers paired with 71% revenue growth. This truly is the golden ratio. If your NRR is > 120% or so and your customer count growth is almost as high as your revenue growth, that’s when the true magic of compounding sets in. As your customer count growth falls below half your revenue growth — that’s a sign of rely more on your existing customer base than new ones to scale. And a sign in a few years, growth may stall.

And a few other interesting learnings:

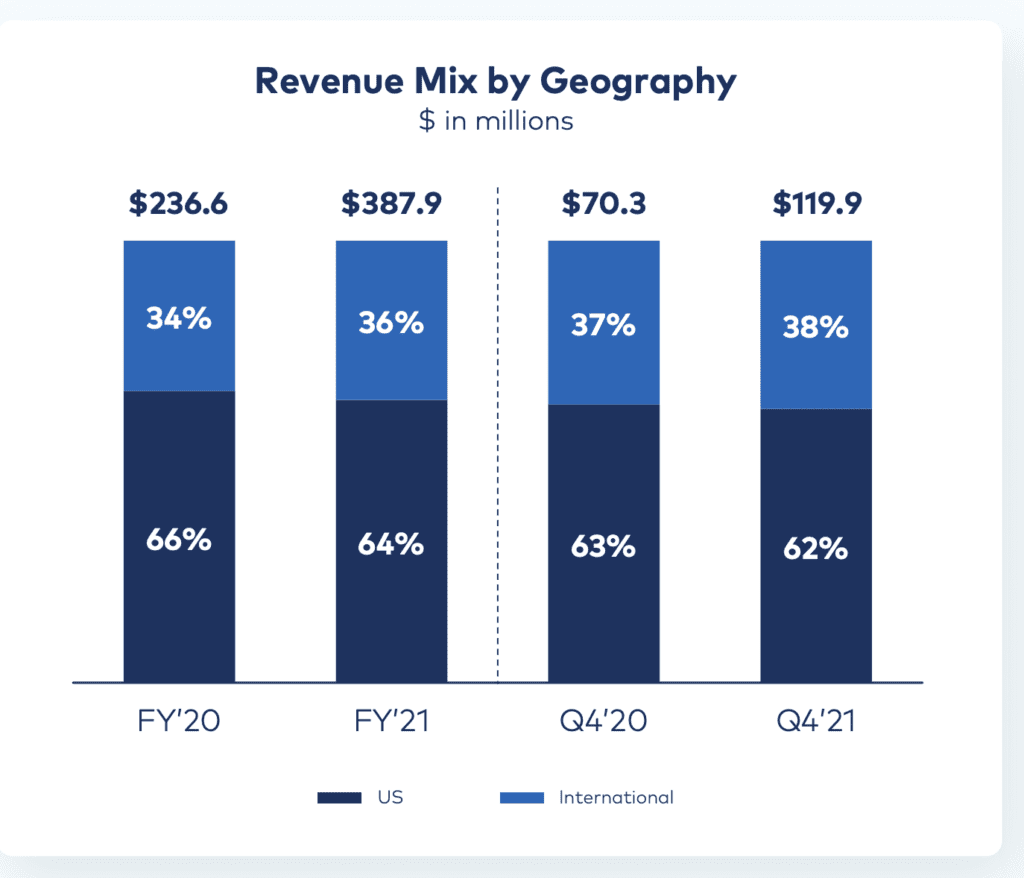

#6. International slowly growing from 33% to 40% of revenue. This is fairly consistent with what we see with other SaaS and Cloud leaders that started in the U.S., but whose products can easily be used by businesses everywhere. Invest here if that’s you.

#7. ~2,000 employees or about $250,000 in revenue per employee. This is pretty standard for high-growth Cloud companies, although not terribly efficient. But they need the headcount to grow this quickly with a sales-driven model.

#8.

Wow, what a story!

The post 5 Interesting Learnings from Confluent at $500,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow