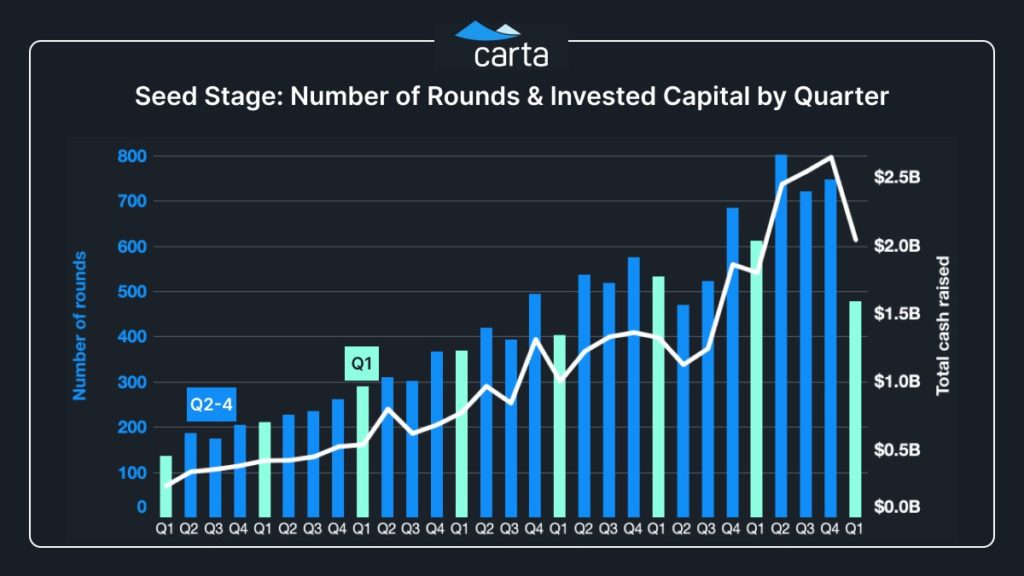

Seed stage VC didn't escape the turmoil in later stages in Q1, according to @cartainc data

Total invested capital fell from Q4 (although remained above Q1 2021), but total rounds down over 20%

And April wasn't great either. 🫤 Full report out soon@alex @jasonlk @dunkhippo33 pic.twitter.com/NjU614rSdj

— Peter Walker (@PeterJ_Walker) May 2, 2022

This is more a note than a post, but I thought it was worth highlighting because there’s so much conflicting advice and commentary in venture today. Especially around seed rounds.

You’ll hear that while investing has slowed down for Series A-D+ rounds, it’s still on pace with similar valuations for seed. Because there are 1000+ more seed funds, and 1000s more seed investors, than just 2 years ago, that are ready to deploy capital.

It is true the number of seed funds has exploded, but what has also happened is FOMO has mostly exited the seed markets. Not totally — it’s always there. The best investors will always be chasing the best deals. And the best deals, even in tougher times, will often have more folks that want to invest than room on the cap table. The best deals often are sometimes even closed in a single email.

But the FOMO to invest in minutes, to skip due diligence, to take more risk that was fueled by the stock market rise for Cloud and SaaS stocks in 2020 and 2021 … well that does appear to be mostly gone.

Even seed investors just taking more time, and being a bit more thoughtful, will feel like a big slowdown to founders. Compared to the crazy, shoot-from-the-hip investing pace of 2020 and 2021.

The preliminary Q1 data from Carta is below. Carta data is helpful because it should lag less than other data sources — since Carta cap tables are updated at closing time, ideally. Versus press releases on TechCrunch and other sources which often reflect rounds closed months ago. In many cases, before the downturn in the markets and venture:

If nothing else, as founders, adjust your expectations. Everything is harder now. Even seed. How much is less clear. Just don’t proceed like the next round will be like the last one. That’s never prudent.

The post Carta: Seed Rounds Down More Than 20% in Q1’22 appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow