So it wasn’t that long ago we checked in with Sprout Social, but when we did in June 2021, the public markets were at their peak for SaaS and Cloud stocks. And Sprout Social seemed like an interesting but small SMB player.

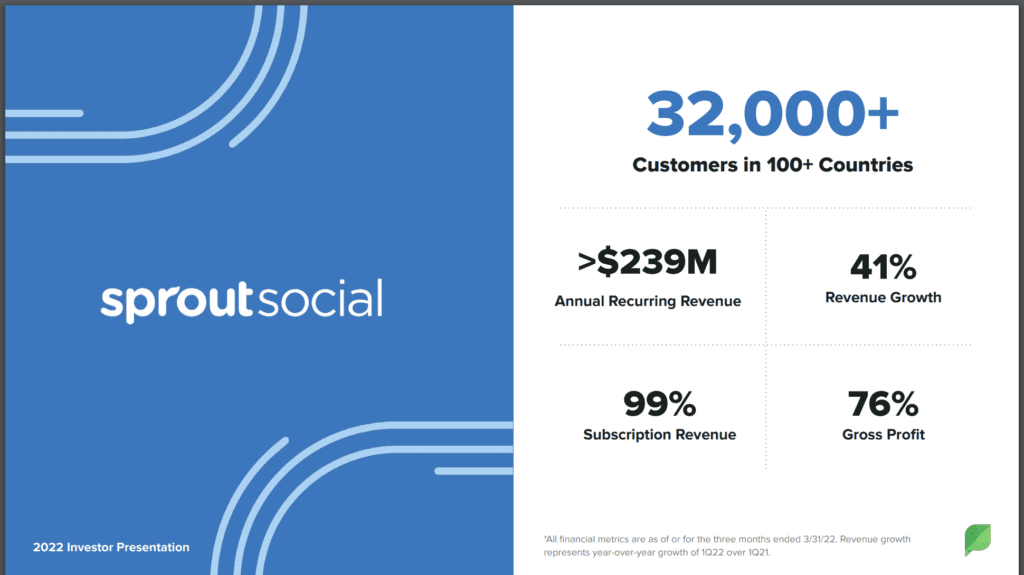

But fast forward to today, and Sprout Social is one of the winners in the current market dynamics. It’s sitting at a $2.6B market cap — up more than 3x from the $800m valuation at its IPO in December 2019, Not too shabby!!

The key? Relatively efficient growth, with a PLG booster. Let’s dig into why Sprout Social stands out in today’s macro environment.

5 Interesting Learnings:

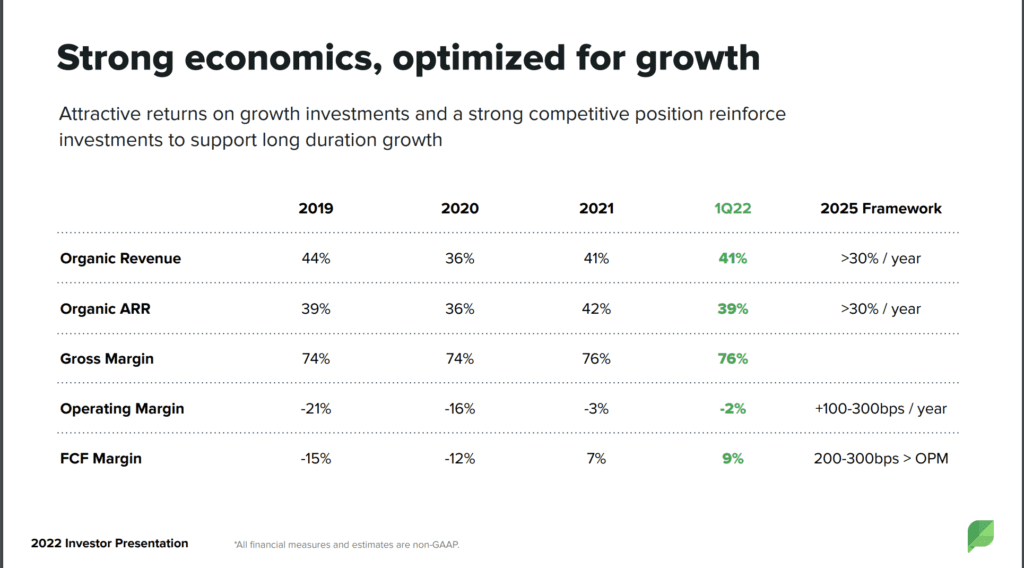

#1. Growth accelerating — efficiently. At $180m ARR, Sprout Social was growing at 34%. Today, it’s growing 41% at $240m in ARR. And at $100m ARR, Sprout Social was growing 30%. That’s pretty solid and impressive acceleration.

#2. Efficient Growth, with 9% Free Cash Flow already at $240m ARR. Many SaaS leaders don’t get to this level of free-cash flow until $500m ARR or even $1B. SproutSocial’s efficiency is growing. That’s what the markets want today. It’s not insanely efficient — but it’s top quartile efficient. It’s generating material cash now at $240m ARR, which suggests a clear path to 20%+ operating margins and free cash flow at scale. Which is what the public markets want today.

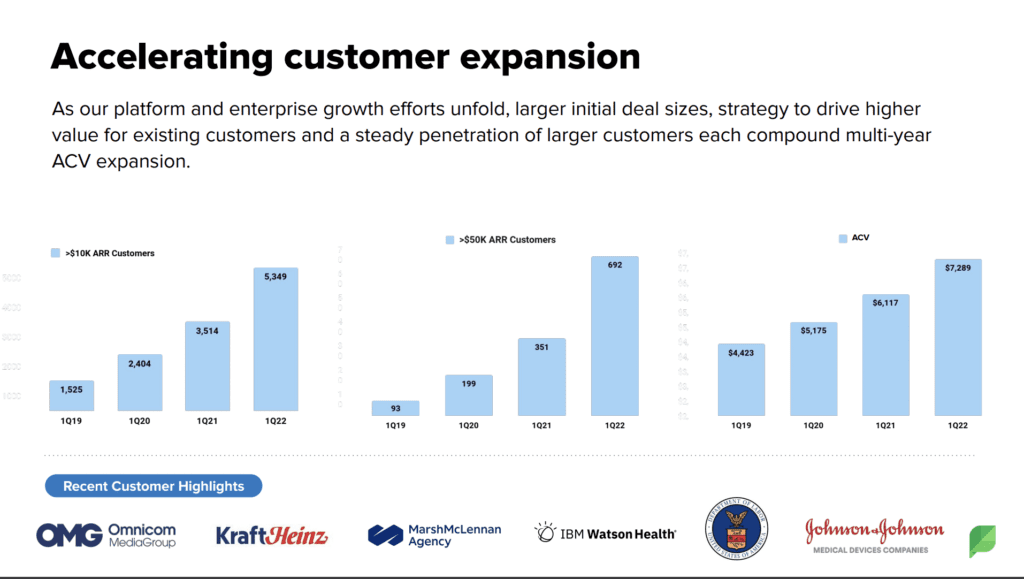

#3. Bigger customers fuel growth. We’ve seen this story a lot. Overall customer count is “only” growing 17%, but $10k+ ACV customers are growing 52% and $50k+ customers are growing 97% to 692 $50k+ total customers. Not going massively enterprise, but enough to move the needle.

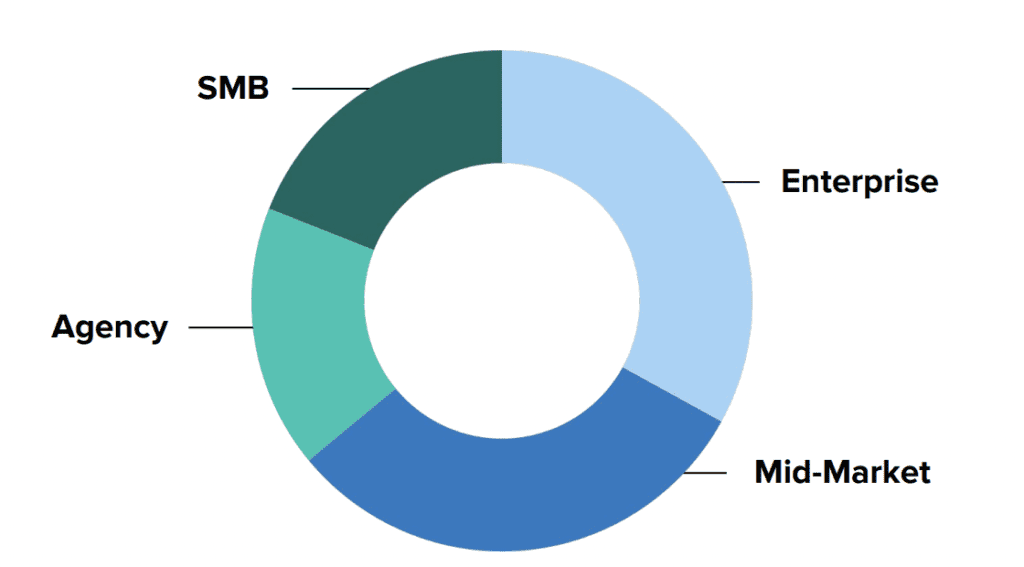

#4. No dominant market segment. While Sprout Social is going more upmarket per the prior point, no one segment dominates it — allowing them to span from $89/month customers to big ones like Salesforce.

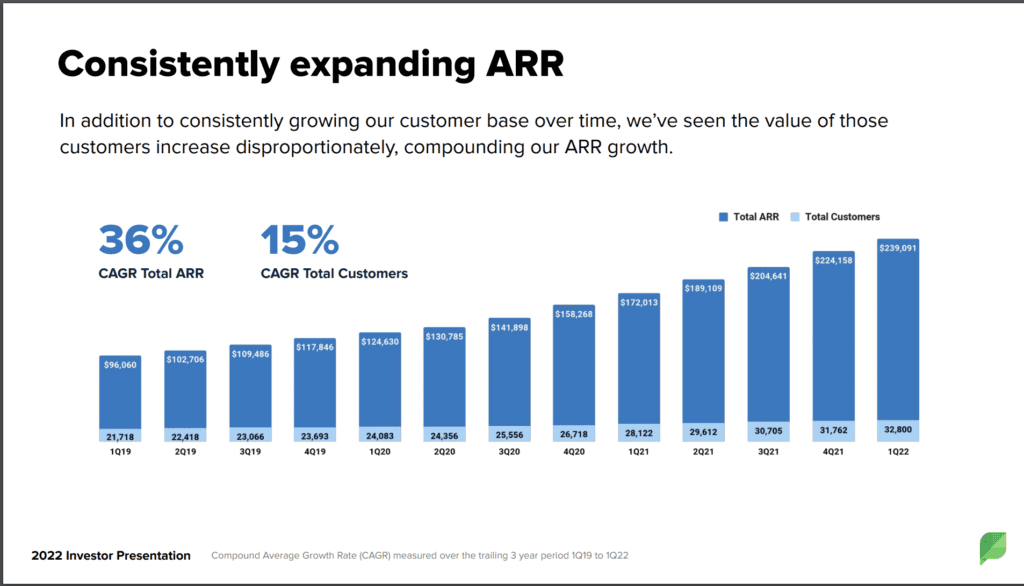

#5. 15% customer growth fuels 36%+ CAGR ARR growth. A helpful way to visualize the intersection between NRR of 110%+ and customer count growth. Sprout Social in essence is growing about 30%-40% from new customers and 60%-70% from its existing customer base. The power of NRR of 110%+ really compounds over time:

A few other interesting learnings:

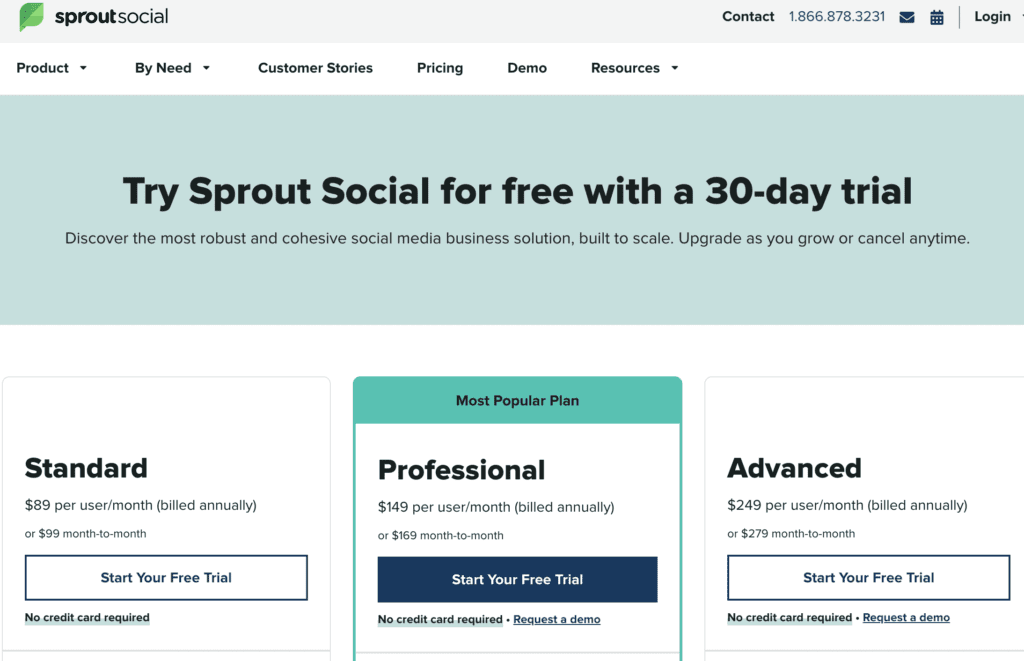

#6. A 30-45 day sales cycle, fueled by a 30-day trial. Most customers pay a relatively modest amount per year, enabling a quick sales process coupled with a free trial.

And to tie it all together:

#7. Sales and Marketing are 39% of revenue. This is efficient for SaaS. Most sales-driven models spend about 50% of their revenue on sales and marketing at scale, which gets them to break-even but makes free cash flow tough. 40% or less of revenue spent on sales and marketing like Sprout Social gets you to material free cash-flow.

Efficiency, efficiency, efficiency. It’s what the public markets today want. And Sprout Social is delivering.

And a look back at Sprout Social at $50m ARR with CEO Justyn Howard:

The post 5 Interesting Learnings from Sprout Social at $240,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow