There are pros and cons to being cash-flow positive. In an ideal world, you’d experience both hyper-growth, and free cash flow from almost Day 1. If you’re Freemium and hit it big, fast, in fact it can work that way. See, e.g., Calendly, Zapier, etc.

The reality is though, in SaaS, especially if you are primarily sales-driven, that’s often gonna be tough. You’ll need some capital to get either off the ground, or to get the engine really humming, or both.

The reality is though, in SaaS, especially if you are primarily sales-driven, that’s often gonna be tough. You’ll need some capital to get either off the ground, or to get the engine really humming, or both.

Then, past a certain point, you’ll probably be able to operate cash-flow positive or at least at a fairly low-stress burn rate. Whether that’s good or bad, let’s talk about later. But at least having the option is a good thing.

And with things a bit tougher in venture overall now, being more capital efficient is suddenly more attractive than. before.

So if you’re building a model for your SaaS start-up, or thinking about cash-flow positive as a goal, let me offer a few learnings about how we got there faster:

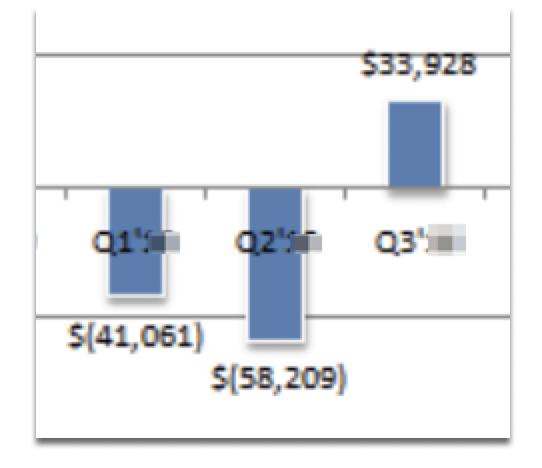

- Land A Few Whales. You don’t want all whales (i.e., Big Customers) in SaaS. Being dependent on just a few large companies is fraught with problems. But … getting a few whales early can really help with cash flow. Large companies are fine prepaying a year of cash up front, and sometimes, multiple years. When our early-ish burn rate was ~$60k a month, we closed one whale that prepaid us $360k. Bamm! That’s 6 extra months of runway. I remember than one well

- Incent Annual & Multiyear Prepayments. Give whatever discount it takes to get customers to prepay for a year, and even bigger discounts for 2 years. 20% usually will do it. But whatever it is, getting that cash in now will make a huge difference. Assuming you are growing 100%+ or more YoY, you’re not really robbing Peter to pay Paul — because there will be plenty more in the future.

- Pay Sales Bonuses When Cash is Received, Not Upon Signed Contract. Sales reps hate, hate, hate this. But you can a strike quid-pro-quo. Pay them a lot on a per deal basis. We did, and we’ll write more on this later. Paying reps a lot, especially in the early days, lets them spend more time with customers and increase the quality of the customer experience. But if you don’t pay until the check comes in, you’ll not only align interests with sales on cash flow … you’ll turn your sales reps into collections helpers. Which will lead to more cash, more quickly, without spending on commissions before cash comes in. A double win.

- Target At Least 120% of MRR Each Month in Collections. This is really just a way to quantify the above steps. Set a goal of > 100% MRR collection each month. The exact % can vary based on types of payments and customer size. We aimed for 120%. Whatever it is, that extra bit is the cheapest financing of your business you’ll ever get.

- Debt. You might think taking on debt decreases net cash flow. After all, you have to pay it back. But what we found, what many SaaS start-ups find, is debt allows you to make a few extra key hires. Those key hires can build features, for example, with an ROI of far more than 1x what you pay them in salary. That makes debt very accretive in SaaS. You can do this with convertible debt, or once you are a bit bigger (say $2m in ARR), you can probably get a bank loan from Silicon Valley Bank, Comerica (who we used), Wells Fargo, etc. These loans are often at about 6% interest these days. Again, that’s obscenely cheap in a start-up.

- Renewals. Renewals. Renewals. This is really the first key to everything. Obviously, in your first 12 months, there are no renewals. Even 18 months out, there won’t be many. But by the time you get to months 20-24 … this is where all the profits are. With no marketing costs, no sales commissions, renewals are almost pure profit. So if you haven’t hired a dedicated Customer Success Manager well ahead of your first renewals — make sure you do.

- Upgrades and Upsell. This is the second key. Every SaaS company selling to all but the smallest of customers generally has “negative” churn. I.e., on average, for year 2, their customer base buys more of your product (by revenue), even counting churn and cancellations. More seats, more licenses, etc. Our number was well over 120% net revenue growth from our existing customer base YoY historically, and more importantly, this number keeps growing over time. Yours will too, if your customers are happy and well managed and aren’t all tiny businesses.

For most SaaS businesses, after month 24 or 30 or so, Renewals + Upgrades/Upsell combined will account for the majority of your cash flow. So the real key, to boil it all down to one factor, is to Take Care of Your Customers. Extremely Well. Cash flows straight from that, as this is your highest margin activity in Years 2+.

Then apply people and processes to that, add in a few whales, prepayments, an upgrade engine, and maybe some debt … and you’ll be in good shape.

A bit more here:

The post 7 Simple Steps to Getting to Cash-Flow Positive Faster (in SaaS) appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow