So Paycom is a quiet SaaS leader you probably don’t know that much about unless you are in payroll or HR services. I don’t really know as much about them as I should. But they are both a winner in general — and in today’s new world.

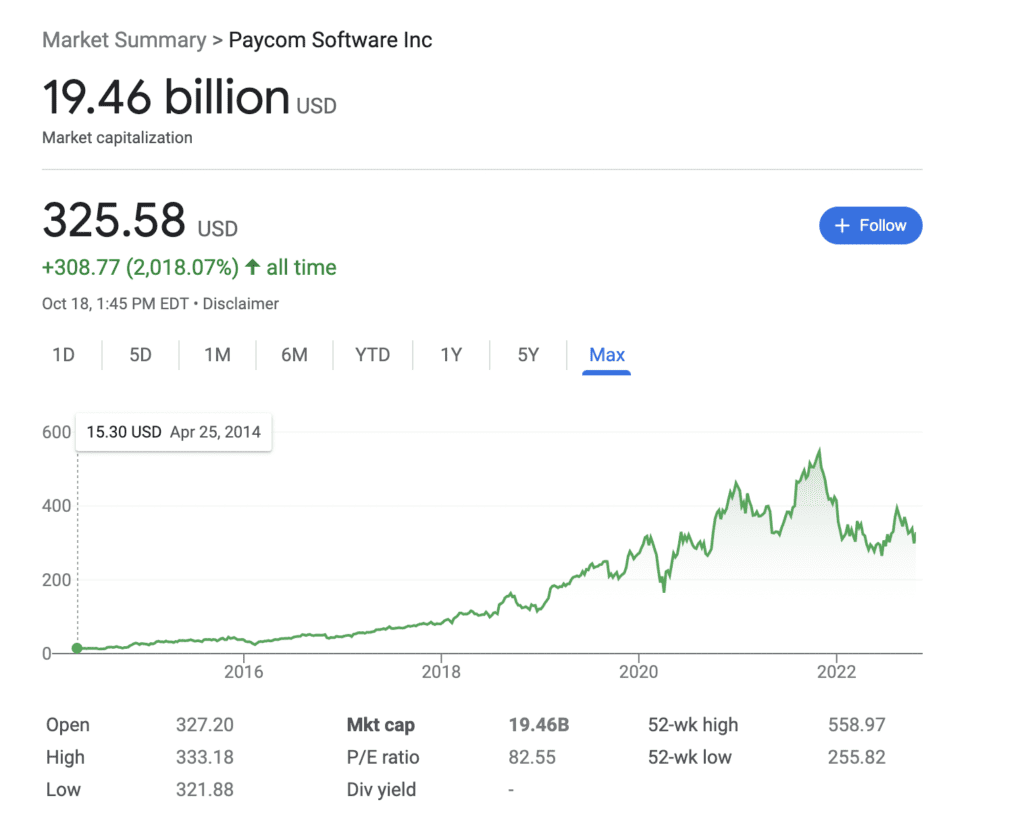

At $1.2B ARR, they’re growing at a health 30%, very profitable — and worth almost $20 Billion. That’s a very impressive revenue multiple in today’s world … for a SaaS company that has the trifecta of growth, profitability, and scale. All based from the Bay Area — HQ’d in Oklahoma City.

In fact, it hasn’t really seen the big impact from the Crash of ’22 that so many other Cloud leaders have:

Who's completely shrugging off any so-called "downturn"?

Paycom

They are at $1.2B ARR, growing 30%, and worth a stunning $20B in today's market

Their stock is even up the past 6 months

The secret? 40% EBDITA

They've got the combo of pretty high growth AND profits pic.twitter.com/OaOEEwN2Yn

— Jason

Be Kind

Lemkin (@jasonlk) October 18, 2022

It was founded way back in 2008, and had a slowish start and a smallish IPO (as did most of us, back in the day). But founder-CEO Chad Richison has kept at it for 14 years, building it into an incredible engine, growing 31% at $1.2 Billion+ in ARR that’s also … highly profitable.

5 Interesting Learnings:

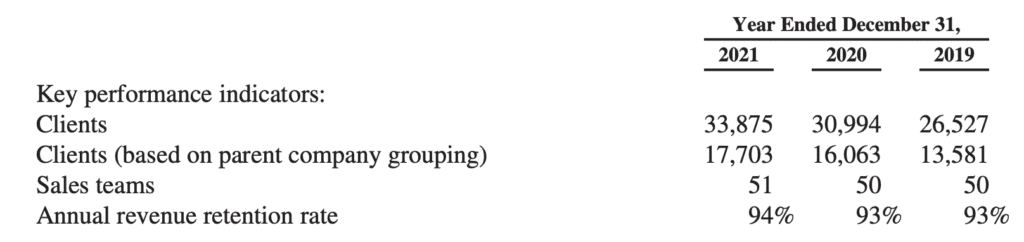

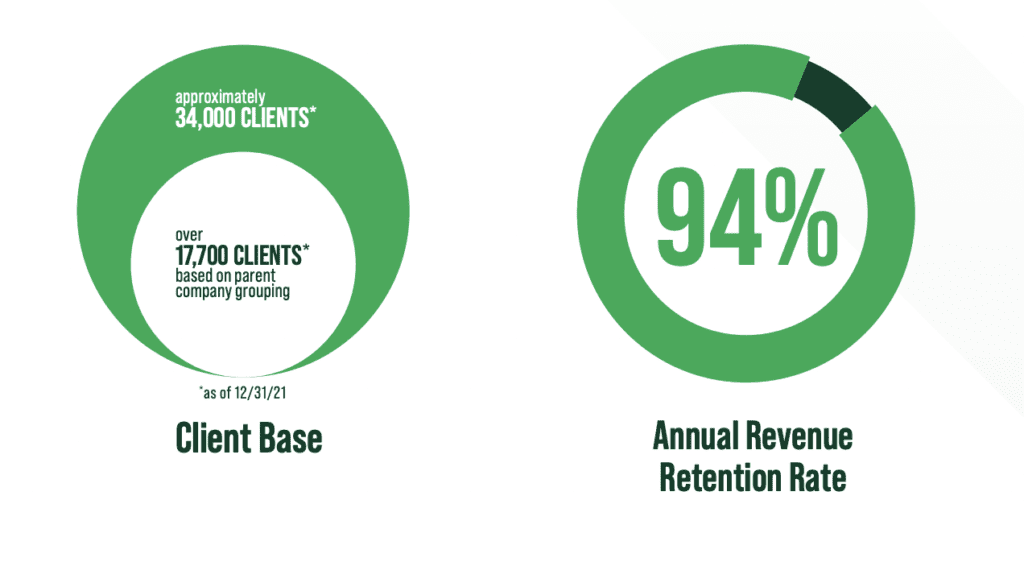

#1. 34,000 customers, so about $35,000 a year per customer. Paycom focuses on smaller businesses, but the bigger of them. Their target has traditionally been companies up to 5,000 employees. They “store data for over 5.7 million persons employed by our clients”, so maybe that’s on average 160 employees per customer.

#2. 94% NRR from smaller and medium-sized businesses, up 3% from prior year. Not the 100% we all look for in theory, but still very solid. A reminder it’s possible to thrive at $1B ARR with less than 100% NRR, even if most SaaS leaders are well above that.

#3. A stunning 40% EBITDA — they hit the “Rule of 65” — and 24% Operating Margins. Paycom really knows how to generate cash, while still growing. This is why the market loves them today. Part of the key is really they don’t spend all that much on R&D (engineering) or even really sales for that matter. With only 11% spent on R&D, this isn’t an engineering-heavy institution.

#4. Slowly going upmarket — after 14 years. Paycom is now attacking the 5,000-10,000 employee segment of payroll and HR. After 14 years of staying “50 employees to 5,000”. A reminder it’s never too late to go upmarket!

#5. 5,395 employees, so about $250,00 in revenue per employee. This isn’t actually that high, but OK if a lot aren’t expensive engineers and sales folks. It’s right about where most SaaS companies look to hit or exceed, but then again, overall Paycom is so wildly profitable it’s all quite efficient overall, even if revenue per employee is just average.

And a few other interesting learnings:

#6. More and more demos is key to growth. They stepped up marketing including webinars and more to drive more demos for sales. It worked. Sales closed more

#7. The company is 51% women and 33% “ethnic minorities.” Paycom does it. So — you can too.

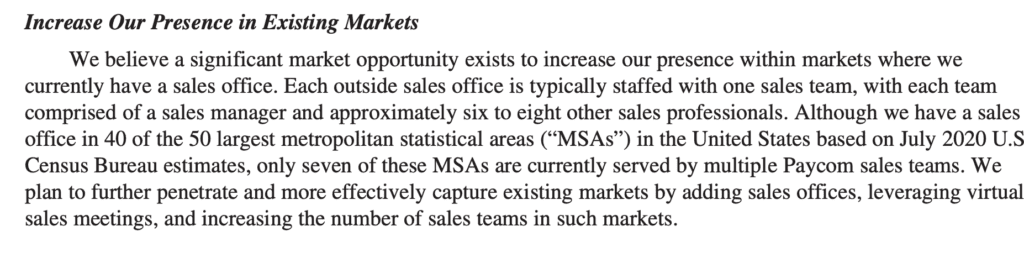

#8. A sales-driven model, that is still very profitable, with 40 local sales offices. See, also, ZoomInfo. Procore has sales offices in 40 of the largest cities of the U.S. They go visit their customers, even as they push going more-and-more self-serve on the software side. It takes them 24 months to make a new office profitable. You’ll probably find the same.

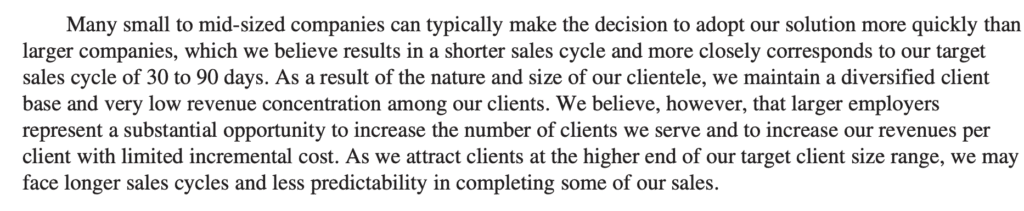

#9. 30-90 day sales cycle. Pretty normal for the “M” side of SMB, but fairly fast for the deal size. Payroll is nice in that the organic deal size is high.

#10. 9% customer count leads to 30% annual growth. Paycom grows its customers over time, both by buying multiple products and as they add employees. 9% customer growth is material but not huge, so the key is growing ACV over time, even with SME customers.

Wow, what a gem. Paycom isn’t an overnight success story. But they never stopped pushing over 14 years, and now are a huge winner in the HR and payroll space. One that’s accelerating after $1B ARR and … very profitably.

Unlike most in the Cloud and SaaS, they’ve been rewarded for it.

The post 5 Interesting Learnings from Paycom at $1.2 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow