So this year has been rough on SaaS and Cloud stocks, with multiples down 75% from a year ago and the markets overall down 50% or more.

But the impact hasn’t been even. Leaders like ZoomInfo and Paycom that combine strong growth with strong profits have seen their stock prices stay relatively high, often at 15x ARR still. And those without both have suffered the most. Wix is one. Despite crossing $1.4B ARR, it’s trading now at $4.7 Billion. A big number, but not a big multiple. It’s barely trading at 3x revenue.

Wix is in a bit of a tough spot, with growth slowing to 11% on a constant currency basis, but with a struggle to get to cash-flow positive after $1B ARR.

So while 3x ARR is way low by historical standards, it’s a bit of a sign of the times. Today, you really have to do it all. And in some ways, its even harder when you sell to SMBs like Wix does. Because getting that NRR up, and getting them to buy even more from you, is often harder.

5 Interesting Learnings:

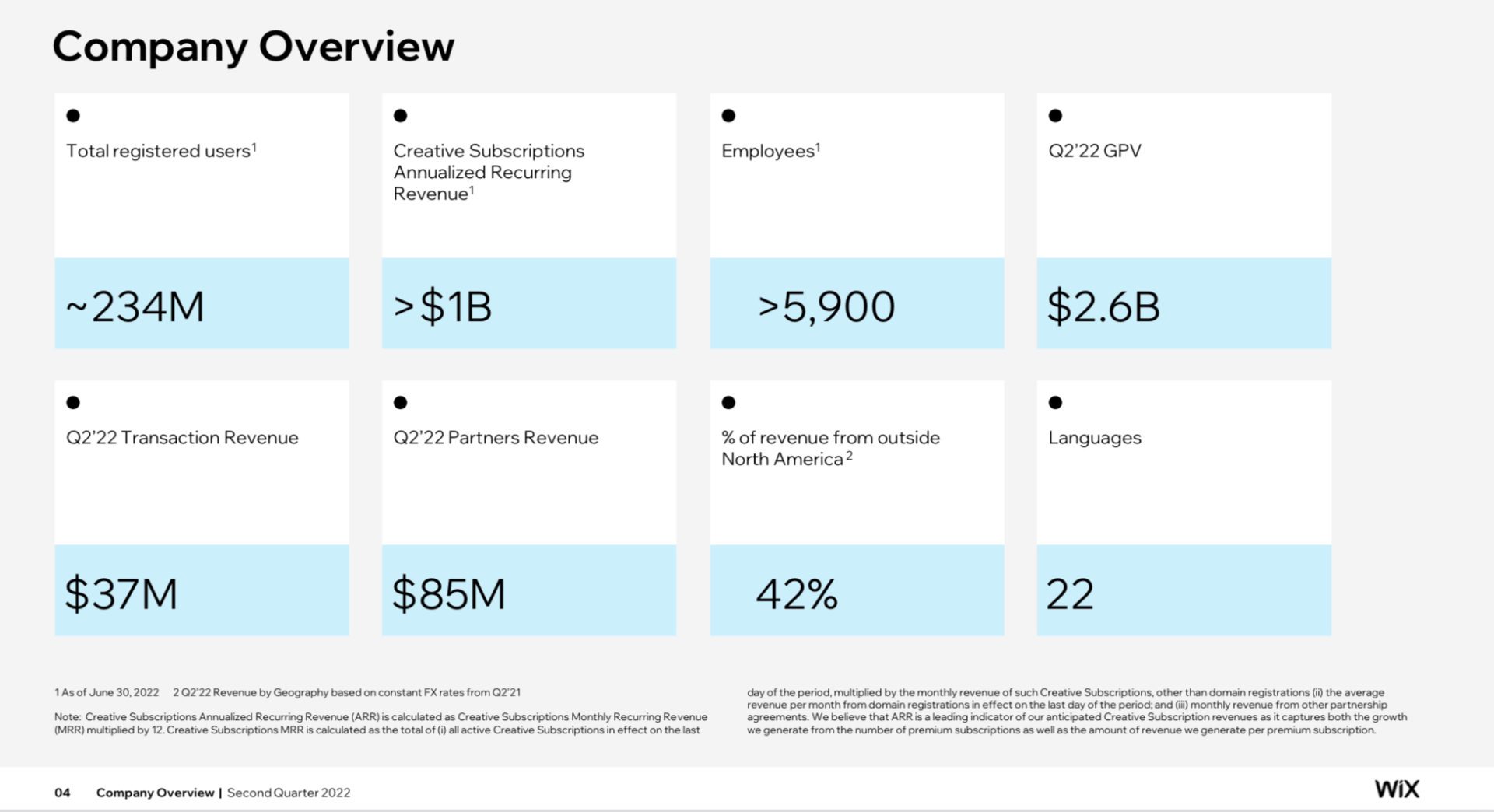

#1. 234 Million Total Users to Generate $1.4B in ARR. That’s Freemium at scale. We had a classic SaaStr post sharing how it can take 50 million free users to make freemium really work, and Wix’s math ties to it. They needed 200 Million+ Users to cross $1B in ARR. That’s a lot of human beings.

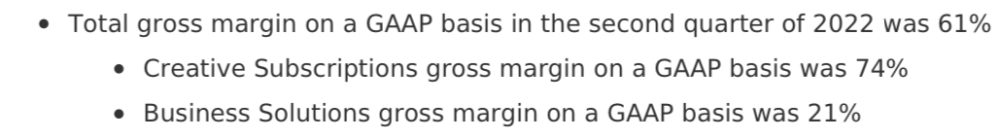

#2. Payments and e-commerce drag blended gross margins down to 60%. Wix along with Squarespace and also WordPress / Automatic have pushed deeply into e-commerce and as part of that, payments. It makes sense, as ecomm adds a ton of value to a standard website. But payments can be low gross margin, and they are for Wix. “Business Solutions” including payments has gross margins of only 21%. Pure software (“Creative Subscriptions”) has more traditional software gross margins of 61%. Wix gains revenue and stickiness by pushing into payments and commerce, but it comes at a cost in margins. Embedded fintech often has a price.

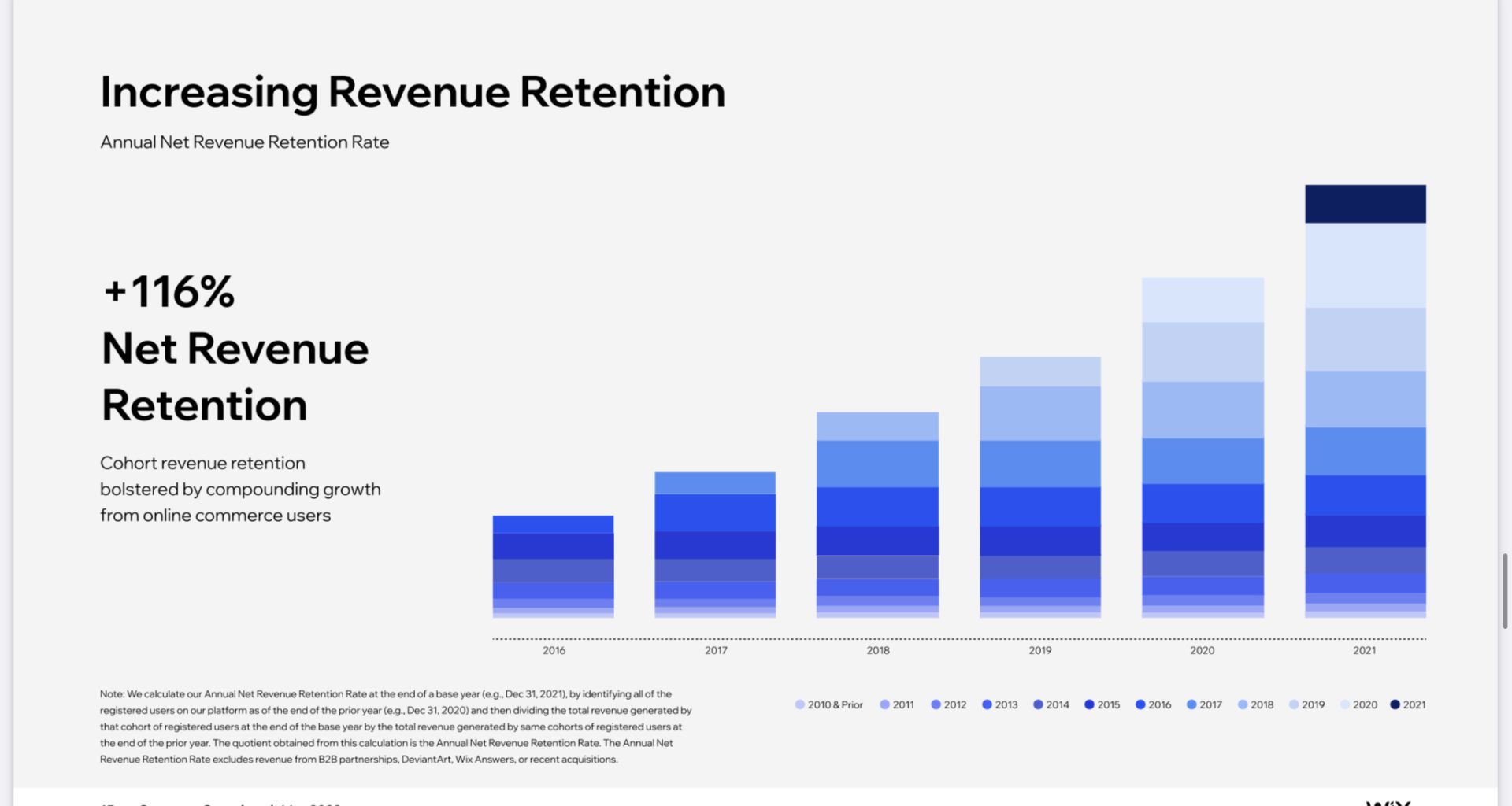

#3. 116% NRR. While I can’t quite get the math to tie with revenue growth, I’m sure it’s right, and 116% NRR from SMBs is impressive. Add e-commerce, payments and more has pushed it up. But again, at a cost of gross margins.

#4. Cutting costs by $150m — a lot — to get profitable. 25% of the savings are coming from customer support. I hope that doesn’t impact service, but I worry. But user acquisition marketing isn’t being touched. They still have to grow. Cut that, and you cut your future.

#5. Wix, like Shopify, had a bit of rough ride as e-commerce reset to pre-Covid growth rates. A lumpy past 12-18 months. While Wix’s growth is relatively modest now, it’s been as much lumpy as anything else the past few quarters. Q2’22 was down in growth from Q3, but flat with Q1. Things are getting a bit harder at Wix clearly, but the sky is not falling.

And a few more:

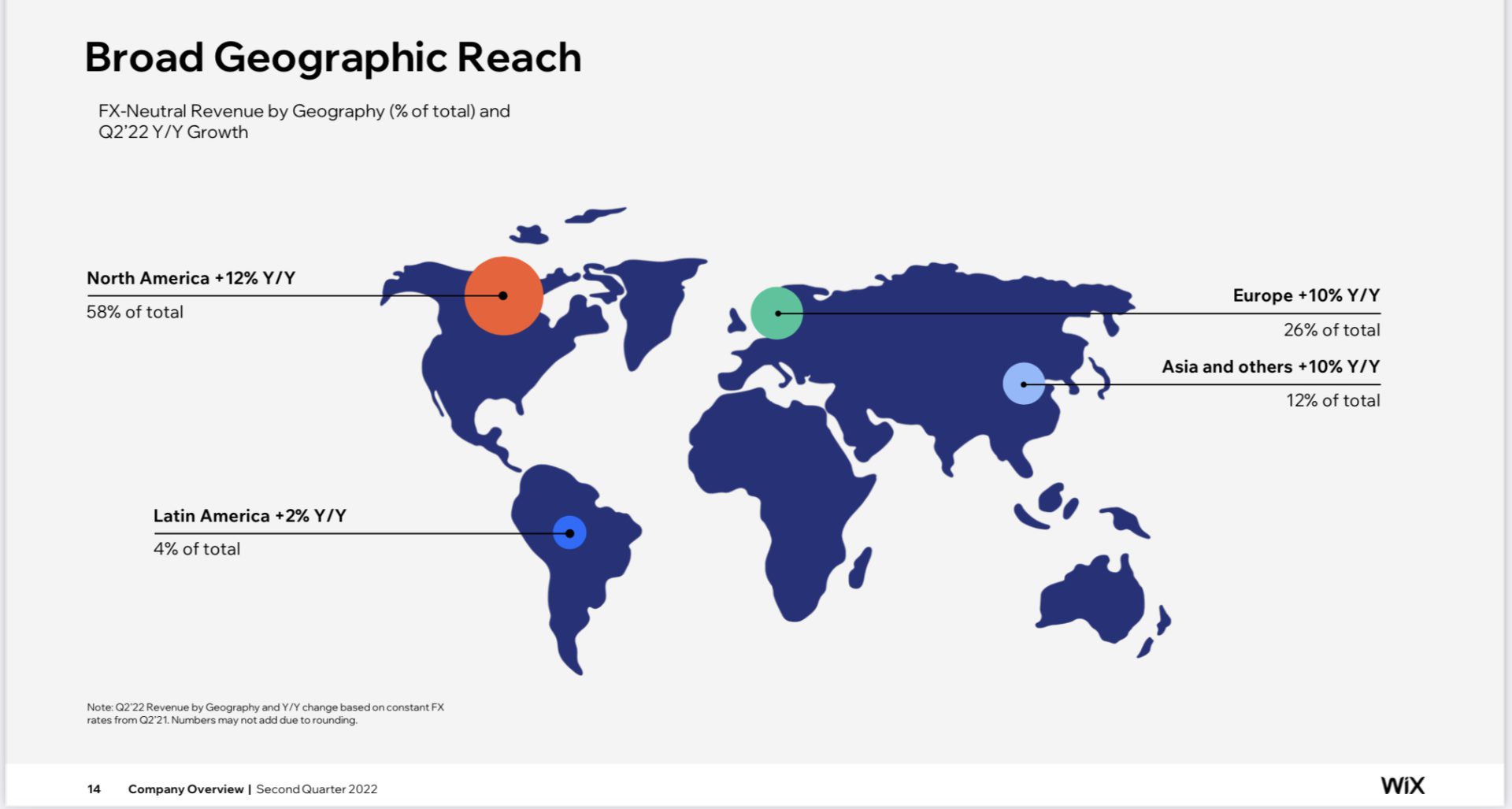

#6. 42% of Revenue Outside the U.S. This has been true of Wix for many years, but always a good reminder to go as global as you can. Interesting to note though that North America is the fastest growth segment.

#7. About $230,000 in revenue per employee. That’s OK but not all that efficient. Despite being freemium, Wix’s business model isn’t hyper efficient. The space is very competitive, and marketing costs are material. $230k per employee is relatively low, below the minimum of $250k the public markets like to see, but not dramatically so.

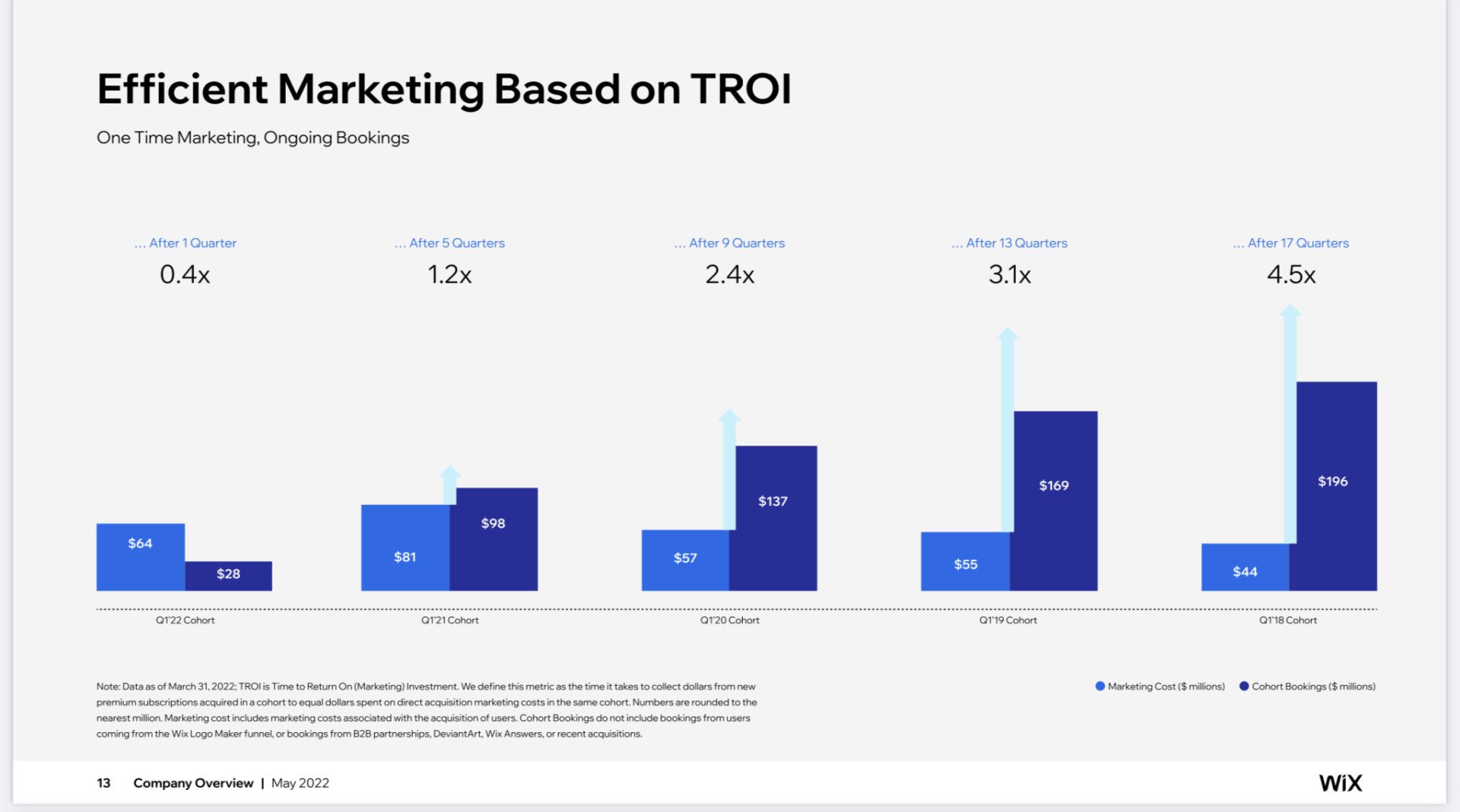

#8. It takes Wix 5 quarters to get profitable on a new customer. While that’s OK with 110%+ NRR, it also burns significant cash at scale.

Wix has steadily grown into one of the very top leaders in websites and e-commerce. It’s amazing they’ve cruised past $1B in ARR. But it’s also a sign of how much tougher the public markets have gotten in 2022. You gotta have the full package now of growth and profitability. Not easy. Nothing is in SaaS, really.

The post 5 Interesting Learnings from Wix at $1.4 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow