It’s no secret that 2022 has brought market shifts that even the previous two years lacked. While previously, investors were a bit more open and hyper-focused on growth, now SaaS VCs are more interested in proving efficiency alongside growth. As always, investors still have high-growth expectations, which have not changed. But in 2022, there is a new focus on efficiency. In fact, 82% of investors in a recent survey said that efficiency is more critical this year.

During this year’s SaaStr Annual event, Christophe Janz, Partner at Point Nine Capital, shares the secret to attracting investors in the new landscape.

What Makes Companies Go From Boom to Bust?

It’s a cautionary tale that could send chills down every founder’s spine: A company with explosive growth suddenly fails. How does this happen, and how can it be avoided?

Regarding companies facing a sudden loss of momentum, Janz explains, “If you find yourself in a worse situation, it’s probably because two things happened. One, your growth rate went down, and number two, you kept spending cash according to your original plan.”

If your growth slows but you don’t adjust your original spending plan, this leads to a higher burn rate, a loss in ARR, a shorter runway, and less investor interest.

This doesn’t always have such severe consequences, but, as Janz goes on to say, “In a red-hot VC market like the one we had until last year, you can probably get away with [slow growth and high spend], but in a much tougher market like the one we entered this year, this is a formula for disaster.”

One way to help prevent this situation is to be mindful of projection versus current reality. When you look at your plans versus actuals, look at your Net New ARR, not just your regular ARR, to get the most insight.

Measuring Efficiency in SaaS

To keep tabs on your efficiency, be mindful of these helpful metrics:

-

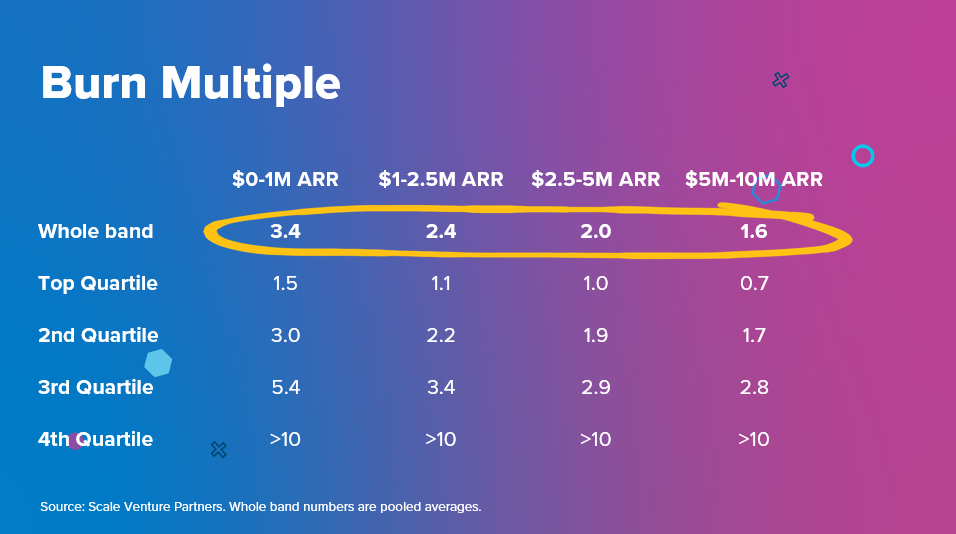

- Burn Multiple

Burn Multiple = Net Burn / Net New ARR

Your burn multiple reveals how much capital you need to raise for every dollar of Net New ARR. It measures capital efficiency holistically. If you are below $25M in ARR, a burn multiple of 1 – 1.5 is considered good; lower than one is excellent. Often, your burn multiple will be higher in the earlier stages of your business or during build-up periods.

- Burn Multiple

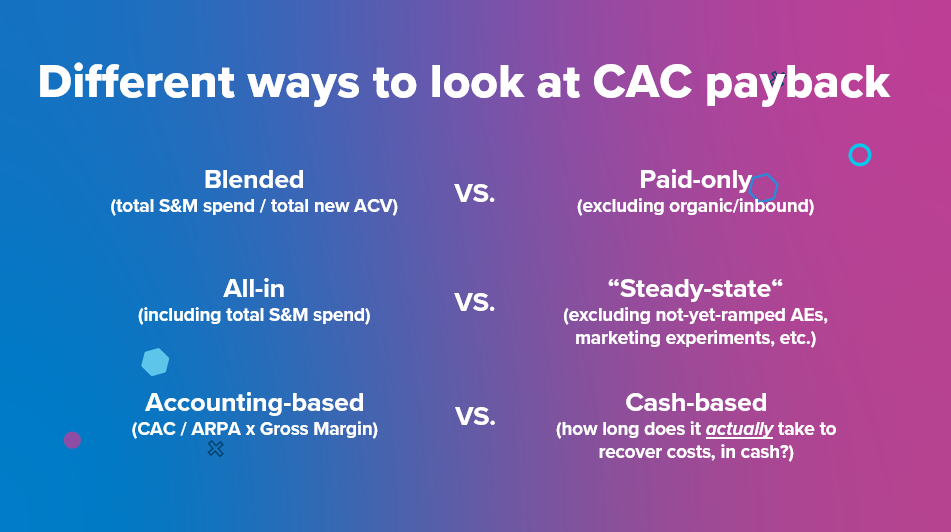

- CAC Payback PeriodCAC Payback Period = CAC/ARPA x Gross Margin

This metric reveals how long it takes to earn back your sales and marketing spending, which is highly relevant when factoring into efficiency. If you sell to enterprises and your NDR exceeds 100%, 15- 18 months is considered normal. But if you target SMBs with a higher churn, aim for 12 months or less.

- CAC Payback PeriodCAC Payback Period = CAC/ARPA x Gross Margin

Key Takeaways

- You can have an ambitious “upside case,” but your runway planning should be based on more modest growth.

- Keep a close eye on Net New ARR, be fast to adapt, and have a burn budget.

- If you have enough cash, it’s ok to have a high burn multiple for a few quarters. But watch your “steady-state” CACs, and make sure you are investable by the time you need to raise again.

The post Growth vs. Efficiency: How to Weatherproof Your SaaS Startup for Tougher Times with Point Nine Founder and Partner Christoph Janz (Pod 599 + Video) appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow