SCOOP: TikTok parent ByteDance's operating losses more than tripled last year to over $7 billion as it pushed for growth. Check out the company's full-year 2021 and Q1 2022 finances https://t.co/XneCChBjYm tip @Techmeme

— Sal Rodriguez

(@sal19) October 6, 2022

So advice from VCs is an odd thing. It’s almost always correct — but almost always biased. Biased by the stage of VC. Biased by the success of the VC. And biased by the current state of the markets. When the markets are strong, like 2021, VCs are all Go. Go. Go. And when they are tougher, like now, VCs preach capital efficiency. Because they have to. Growth capital has almost entirely dried up, and follow-on rounds are much, much harder. Founders in many cases have to make do with what they have. Versus when in 2021, it seemed like everyone could raise a new round every 6-9 months.

But it’s important to parse that advice. In the end, the public markets, i.e. when your IPO don’t really care what your losses were in the past. Nor your capital efficiency in the past. They only care about now, and the future. And they really only care if you are on a path to profitability.

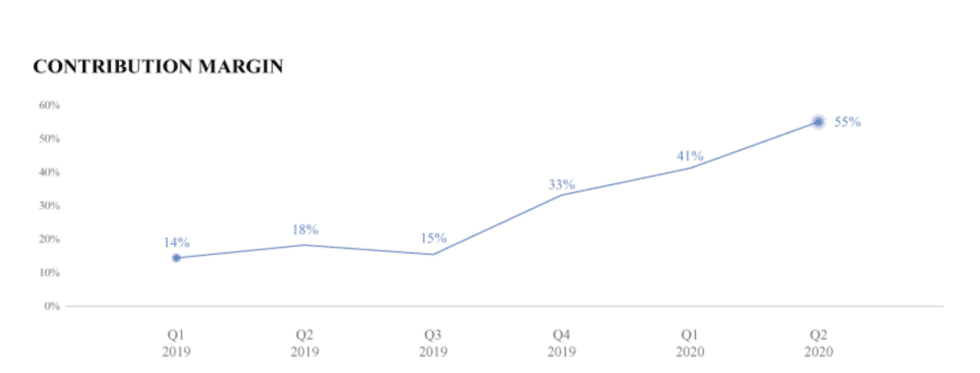

For example, Palantir was barely a software company in the 16 years before it IPO”d (more here). Its gross margins were well below 50% until just before the IPO. I.e., it just barely became a software company (i.e., 50%-60% gross marings or higher) in the year prior to IPO. For the 16 prior years, it really wasn’t a software company yet. And the public markets didn’t really care. They just cared that when it came time to IPO, Palantir had the margins and profile to be a software company (and thus benefit from software multiples):

Similarly, while it’s not SaaS, look at the crazy TikTok numbers above. Tik ok has grown faster than any other social network in the history of time. But as part of investing in that growth, it lost a stunning $7 Billion (!) last year.

But those crazy investments still make sense, when they produce crazy growth. At least, if the growth stage venture markets support it. If the valuations are high enough in Series B, C, D, etc. stages to support huge rounds.

At the moment, it’s tough. With public market valuations down more than 50%, it’s very hard to raise a unicorn round in SaaS, and thus very hard to raise massive amounts of capital to play to win.

But that doesn’t mean you don’t still have to grow at basically the same rate as before. That’s the key point. The public markets still expect you to ultimately grow 40% or more at $150m-$200m ARR (or more) when you IPO. And they don’t really care how you got there. And you don’t get a pass just because you were capital efficient.

No, you don’t get to slow growth just because capital efficiency is back in fashion. Maybe your existing investors will give you a pass for a quarter or two. Everyone has a challenging few quarters. But in the end, no one else will. Acquirors won’t. Later-stage investors won’t. And the IPO market won’t.

Yes, cut the burn

Yes, be more efficient

Yes, growth rounds are way tough nowBut

You can't cut your way to growth

Cutting can be a necessity.

But rarely is it a strategy.

— Jason

Be Kind

Lemkin (@jasonlk) October 7, 2022

Even when capital is scarce, you still have to grow at unicorn rates to become a unicorn. Fair or not. Cut back too much on growth, and you might never be able to get back. Too many founders are cutting now when capital is tougher to raise, and that’s OK in the short term. But it’s not a strategy. It’s not a victory. It’s not a win. It’s not more happy customers, and more closed deals.

You can’t cut your way to growth.

(cut image from here)

The post The Confusing and Confounding Advice on Capital Efficiency appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow