So we focus more on the newer up-and-coming public SaaS companies in this 5 Interesting Learning series, from Datadog to Zoom to Snowflake to Monday and Shopify.

But Adobe’s a good one to examine right now. Why? They aren’t seeing any decline in their business at the end of 2022. None.

At almost $18B in ARR, it’s still growing an impressive 15% year-over-year on an FX-adjusted basis. And my old division of Adobe, Document Cloud, is growing 21% at $2.4 Billion in ARR!

Not too shabby. Especially now. Let’s dig in:

Woo-hoo!!

“Document Cloud revenue was $2.38 billion, representing 21 percent year-over-year growth or 24 percent adjusted year-over-year growth1.”

Go #adobesign Adobe Acrobat Sign!!

Adobe – Adobe Reports Record Q4 and Fiscal 2022 Revenue https://t.co/WVxmXvwnaA

— Jason

Be Kind

Lemkin (@jasonlk) December 16, 2022

Whatever Adobe is doing — it’s doing it right.

5 Interesting Learnings:

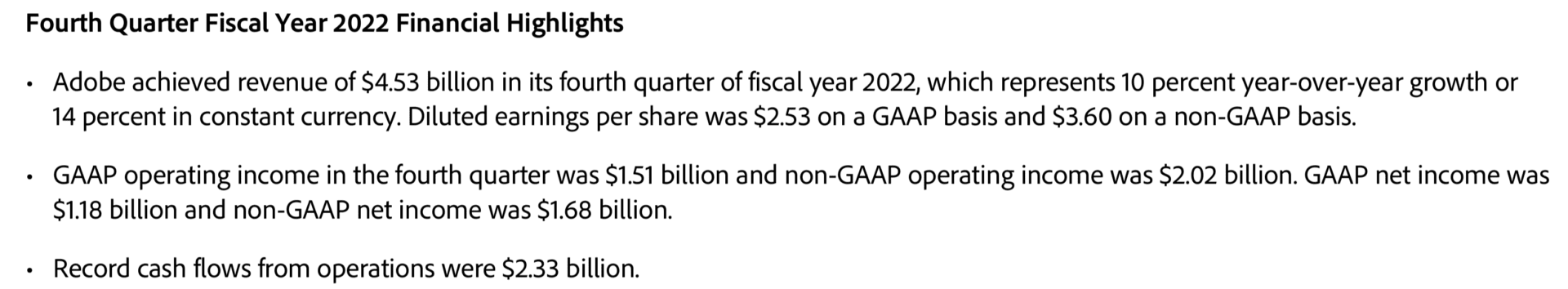

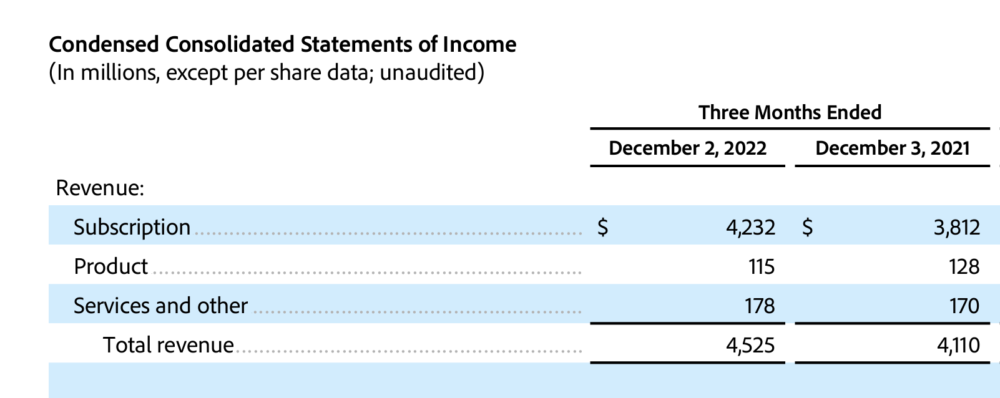

#1. Adobe is massively, massively profitable. Of its $17.6B in revenue in 2021, about $8B dropped to operating income and well over that in free cash flow. Half of every dollar Adobe takes in turns into free cash flow. Adobe brought in a record $7.84B in free cash flow in 2022. This is how software companies used to work.

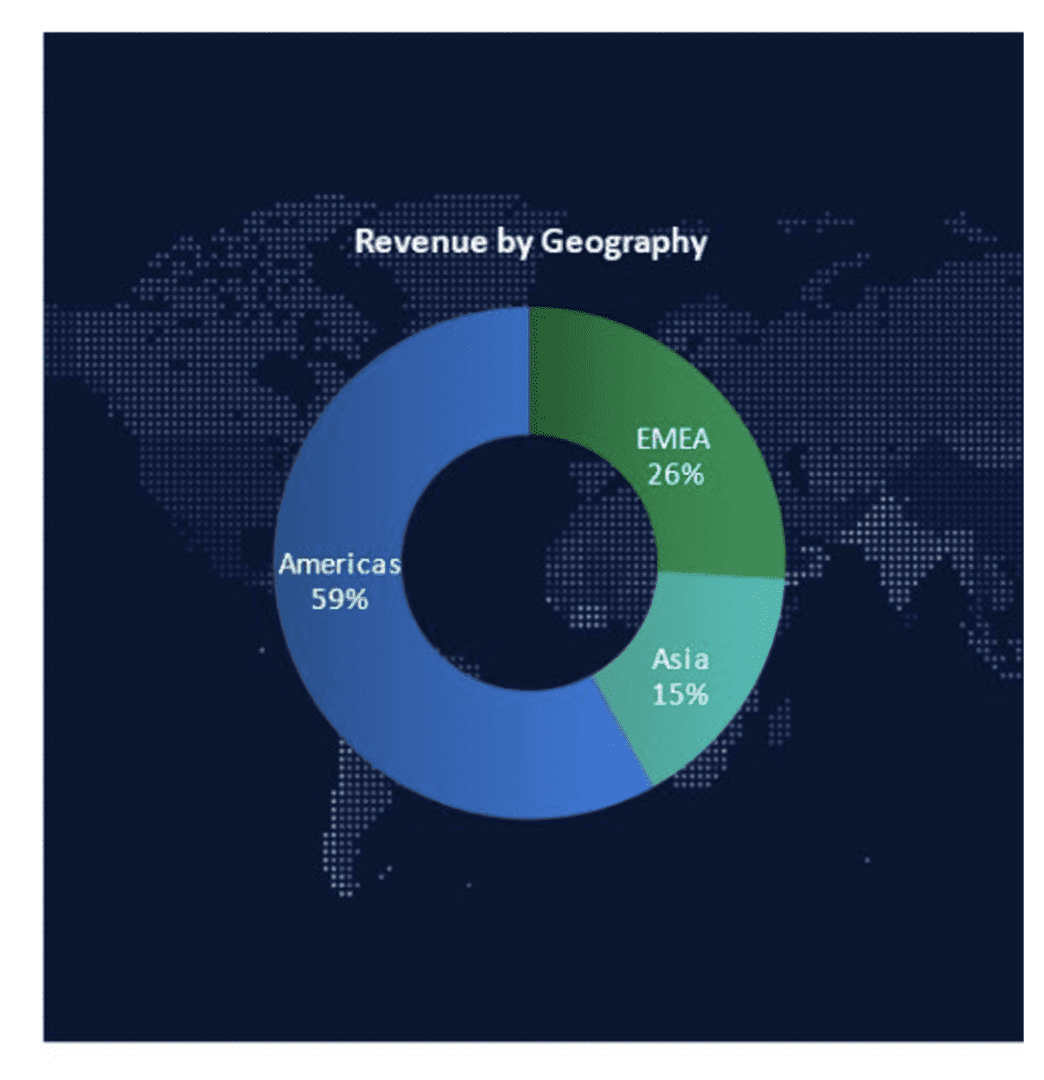

#2. 59% of revenue from Americas, 41% from Rest of World. A reminder to go global in software!

#3. No Downturn in 2022, and None Predicted for Now in 2023. Adobe was very bullish for 2023. For now at least, they are seeing no downturn in their core businesses — and no signs of one coming.

#4. One of its oldest products and divisions, Document Cloud, is growing the fastest. And Q4’22 was the strongest quarter ever for Digital Media. This is where I worked after Adobe acquired EchoSign. PDF and Acrobat were long seen as a dying business, being killed by the web. That couldn’t be further from the truth in the end. Decades later, going into 2023, it’s the fastest growing division at Adobe, growing 24% currency adjusted at $2.4B in ARR. Go team! And it proves just how long a life so many B2B products have — especially if you keep investing in them.

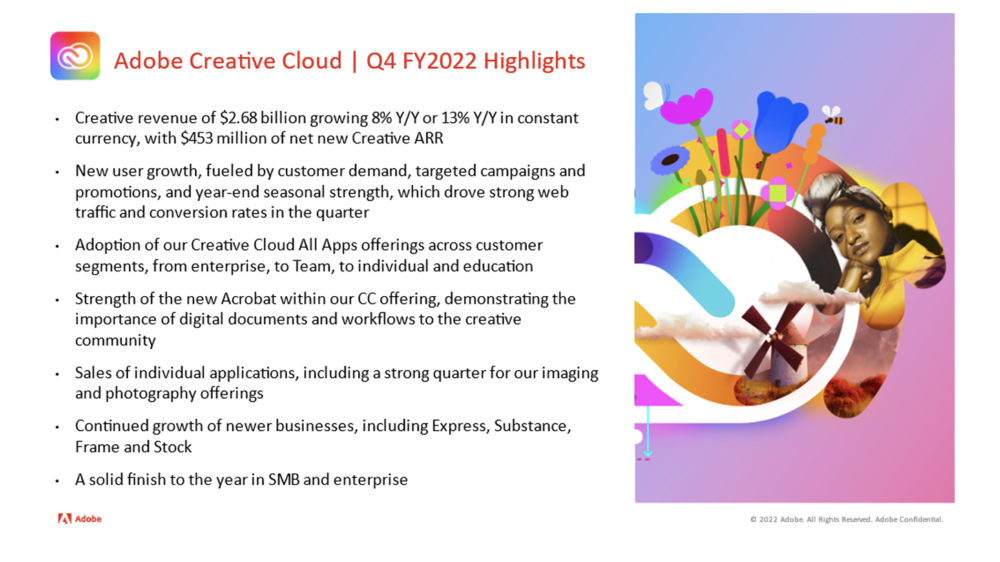

#5. Creative Cloud crossed $10B in ARR. While growing a smidge more slowly than the other 2 major business units at 13% in constant currency, that’s still pretty impressive at $10B, especially given how incredibly profitable Creative Cloud is.

And a few other interesting learnings:

#6. Still hoping to close Figma deal in 2023, but not planning on projecting any 2023 revenue from the deal. So Adobe is expecting it to take late into 2023.

#7. Adobe is almost 100% subscription revenue based now. I actually hadn’t looked at this in a while, but Adobe is essentially 100% recurring revenue, subscription-based revenue. The transformation is 100% complete.

#8. Only spends 18% of revenue on R&D (engineering), and just 30% on sales and marketing. These aren’t the lowest in the top public software companies, but spending less than half your revenue on product, sales and marketing all combined … makes you very profitable at scale.

#9. 22,381 employees, or about $800,000 in revenue per employee. OK that’s probably about 4x or more the average start-up. And this is from where profits flow.

Wow! Adobe leading us to the light. Times are still very good in software and SaaS. They just aren’t quite as crazy and nuts as 12 months ago for most of us.

Pain aside, maybe that’s OK.

The post 5 Interesting Learnings from Adobe at $18 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow