So there’s a quiet SaaS success story you probably don’t know much about, but can learn a lot from.

It’s Docebo. It’s a leader in a pretty crowded space (Learning Management Systems) with dozens of top vendors. And yet …

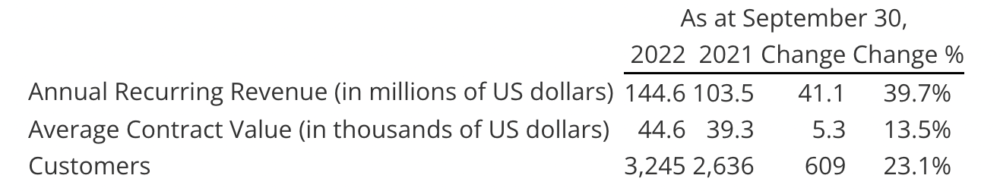

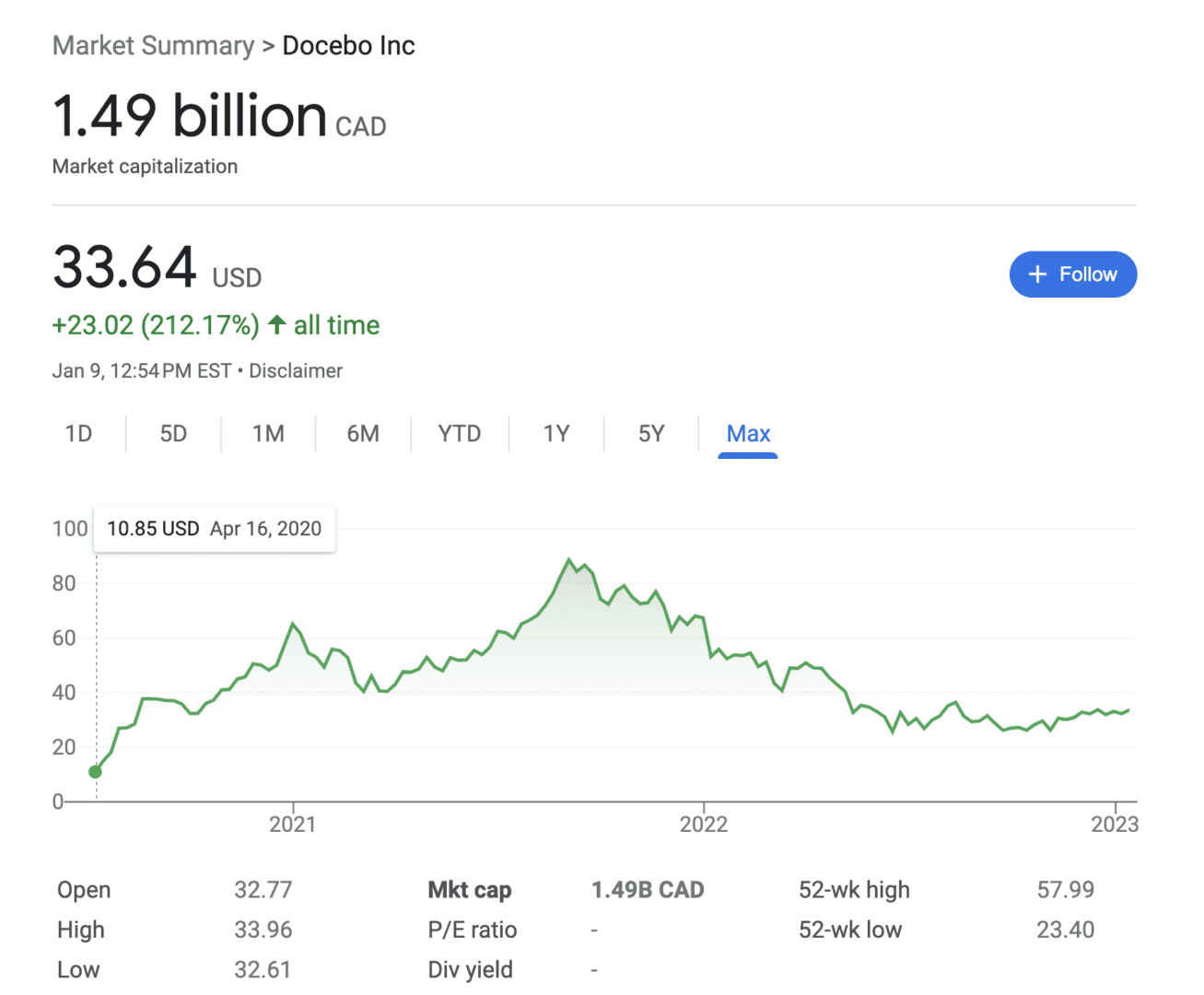

It’s worth $1.1 Billion today, doing $145,000,000 in ARR. It’s growing 40%+ on a constant currency basis. It’s cash-flow positive, and … it only burned $14,000,000 to get there.

That’s right. It burned just $14m to get to $145m in ARR and a $1.1 Billion Market Cap.

And while it’s stock price is down from its 2021 peaks, it’s still up 2x since its 2020 IPO. Profitable and capital-efficient is back in fashion:

(Still, I’d argue it should be worth much more with these metrics, especially given that it has $212m in cash on its balance sheet).

5 Interesting Learnings:

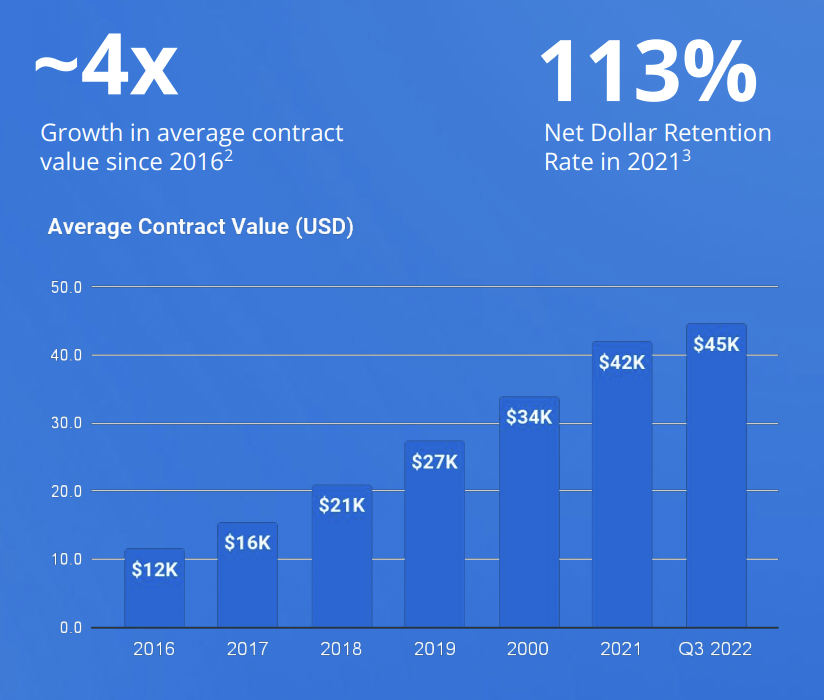

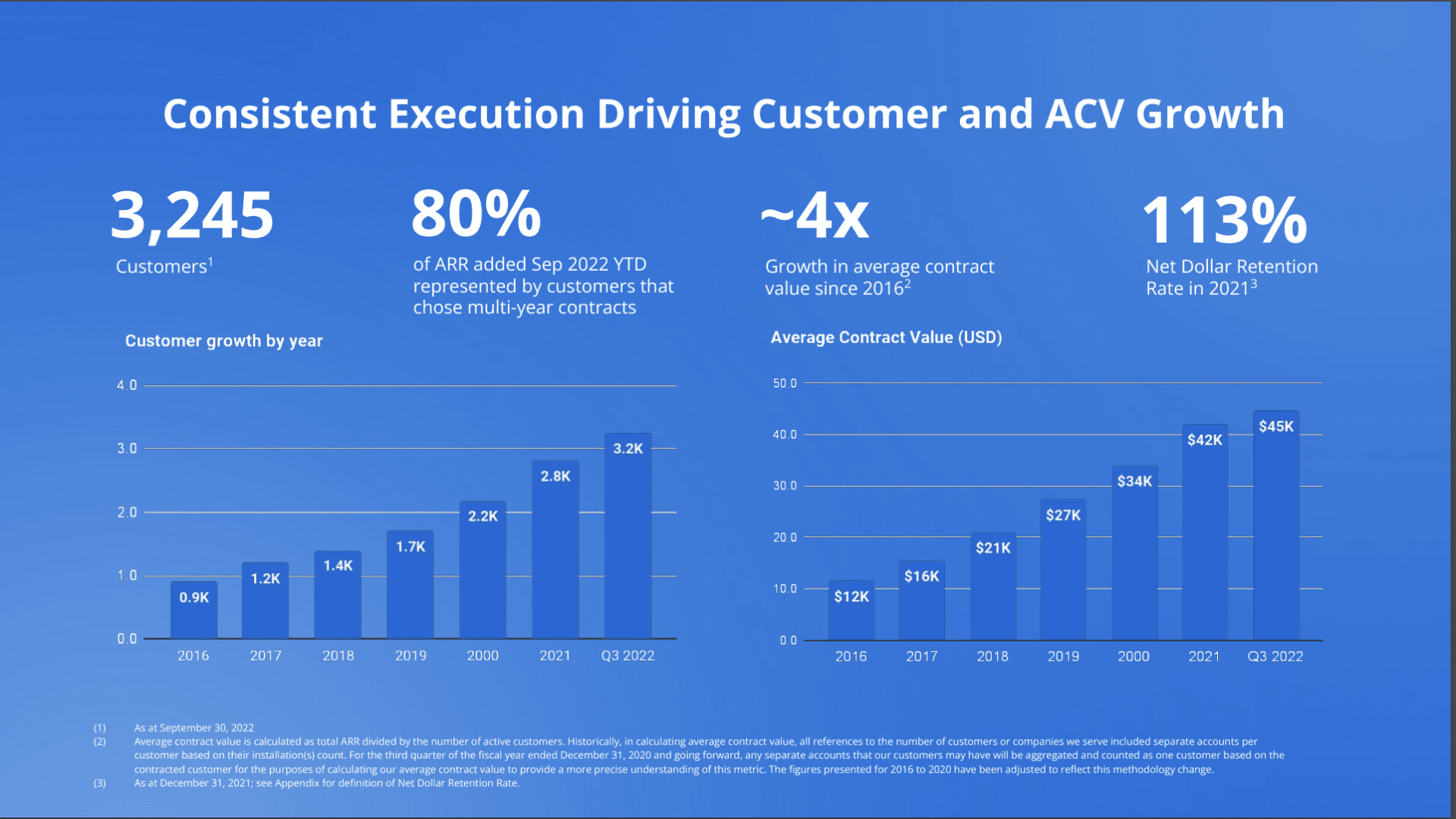

#1. 3,245 Customers, Up 23% — While ARR is up 40%. A good example of how driving deal sizes up (see the next point) and strong NRR lets you drive NRR up well about new logo growth.

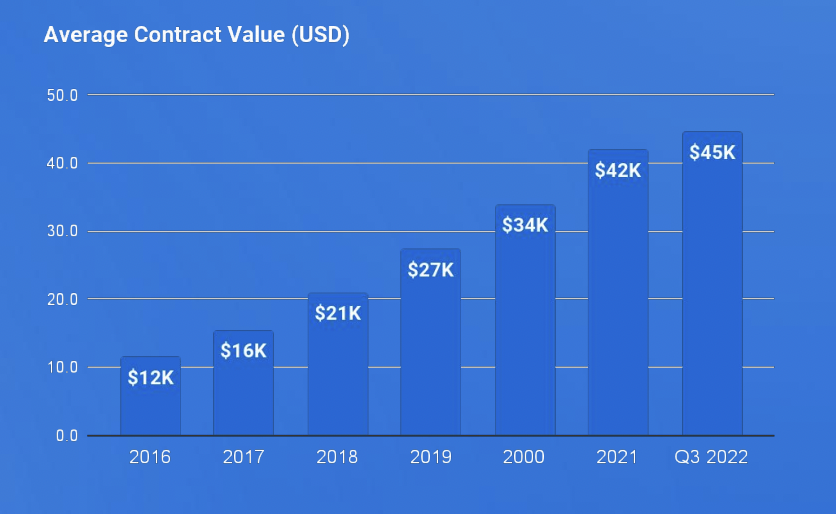

#2. $44,000 ACV, up from $39,000 a year ago — and up from $16k 5 years ago. Docebo’s pricing is on the “corporate” side of LMS. It doesn’t compete at the bottom of the market, and targets top logos with a reasonably priced product. But importantly, it’s raised its ACV 4x since 2016. Without that, the company would likely be a fraction of its current ARR.

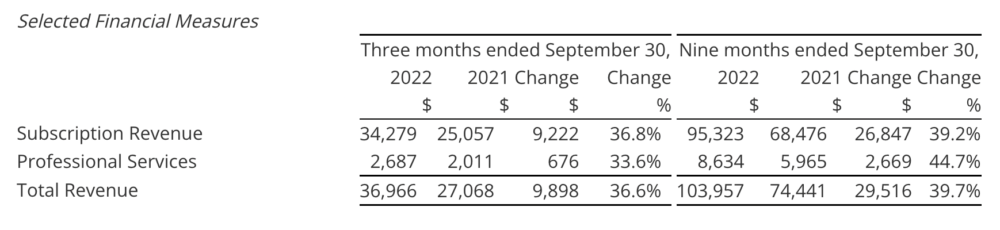

#3. 7% of Revenue from Professional Services — down from 12% in 2018. Docebo doesn’t do proserv for all customers, but it also doesn’t shy away from it for larger customers. Many do need help scaling up their learning systems. Just under 7% of their revenues come from services.

#4. Incredibly capital efficient growth — Docebo got to $144m+ ARR burning just $14m. Wow. Wow. The company was bootstrapped its first 7 years or so, and then mainly sold secondary shares.

#5. 113% NRR. Not enterprise-high NRR, but about what I’d expect from their ACV and category.

And a few other interesting learnings:

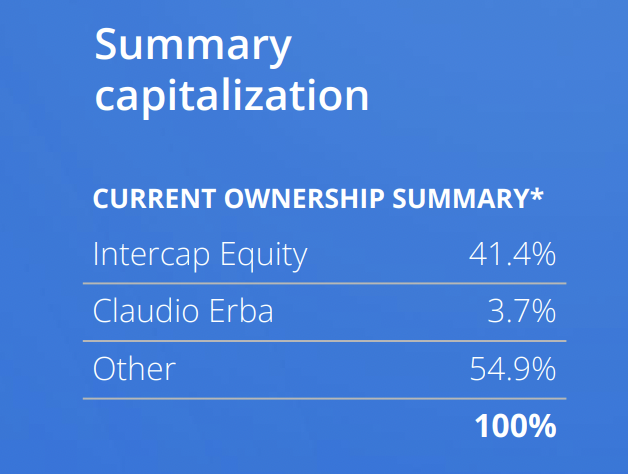

#6. Founder Has Been CEO since founding in 2005, ownership down to 3.7%. The founders sold many of their shares 7+ years in to private equity, so this isn’t all “dilution” per se, but still a learning.

#7. 80% of customers sign multi-year contracts. Always good to learn how others do this. The LMS category is a large time investment, so it makes sense to try to get customers to do longer deals.

Docebo — a quiet success story of going long in a crowded category. 15 years to IPO, and carefully and steadily going upmarket. And of doing it in a very capital-efficient way. The way more of us may be doing these days.

The post 5 Interesting Learnings from Docebo at $145,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow