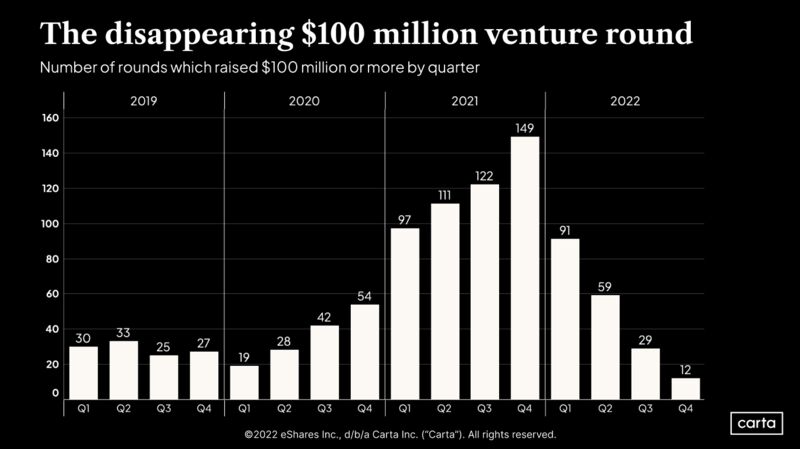

So we’ve looked at a lot of great sources of data on how much tougher the late stage venture markets are now, and yeah they all point the same way. It’s a lot, lot, lot harder than 12 months ago to raise a Series A or late round. And growth rounds are down 80%+ or more.

But this latest chart from Carta visualizes it in perhaps the most helpful way — around $100m rounds. Forget about valuations and letters, let’s talk about money. How much money is coming into startups.

And Q4’22 was … terrible. Not just worse than 2021, of course. Not even just down 80% year-over-year. But worse than any quarter in 2020, and worse than any quarter in 2019:

The only quarter that came close was the Covid Quarter of Q1’20, but even there, there were 19 $100m+ rounds.

Q4’22 was even worse.

Times are still pretty good in SaaS in many ways. The markets remain strong in many cases, if shaky.

But $100m+ rounds?

They’re at recent all-time lows. You have to go back years to find a slower time for $100m+ rounds.

I don’t think public multiples will stay this low forever. I do think they’ll come back 20%-30% higher, at least, later in 2023. And when they do, it will be easier to raise growth rounds. But for now, $100m+ deals are basically frozen.

A related post here:

Cooley: Series D Deals Dropped 78% in Just Q3 Alone. Late Stage Has Fallen Off a Cliff.

The post Carta: $100m+ Rounds Fell To Multi-Year Lows Last Quarter. Really, Really, Low. appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow