Securing funding has become more challenging for SaaS companies over the past few years as VC firms have grown more cautious about their investments. As a result, startups trying to determine how to approach fundraising efforts may want to consider strategic partnerships with existing company funds.

In this edition of SaaStr Workshop Wednesdays, Brandon Greer, Head of HubSpot Ventures, shares tips on fundraising and working with strategic VCs.

SaaStr Workshop Wednesdays are LIVE every Wednesday. Sign up for free.

Strategic Funds: An Introduction

Greer began his VC career at OpenView VentureCapital, where he invested in brands like Loopio, Calendly, and Applitools. At HubSpot, he managed the strategic fund, a $100M CRM platform fund specifically focused on accelerating activity in the HubSpot ecosystem. This ecosystem has grown from about 150 partners when Greer first started to around 1500 today. While at HubSpot, Greer has witnessed many successful investments like Jasper, ClickUp, ContentFly, Maze, and more.

How it Works:

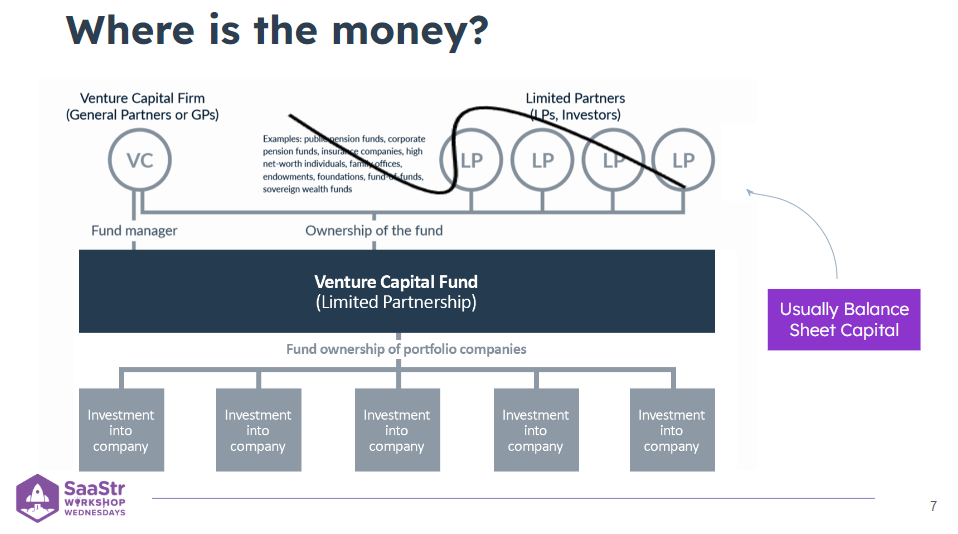

So how do strategic funds work? Greer explains, “The classic example of a venture fund, you’ve got this base of LPs. With corporate, that’s usually not the case. There are a few that sort of spit out in which the mothership company is the LP in our case. It truly is the allocation of our balance sheet.”

HubSpot is not alone –– there are 4,000+ strategic arms worldwide that operate this way and growing, including BP, Bosch, Salesforce, Microsoft Ventures, Citi Ventures, etc. These range from large corporate heavy hitters to private companies.

Strategic Funds Quick Facts: The “Who” and “Why”

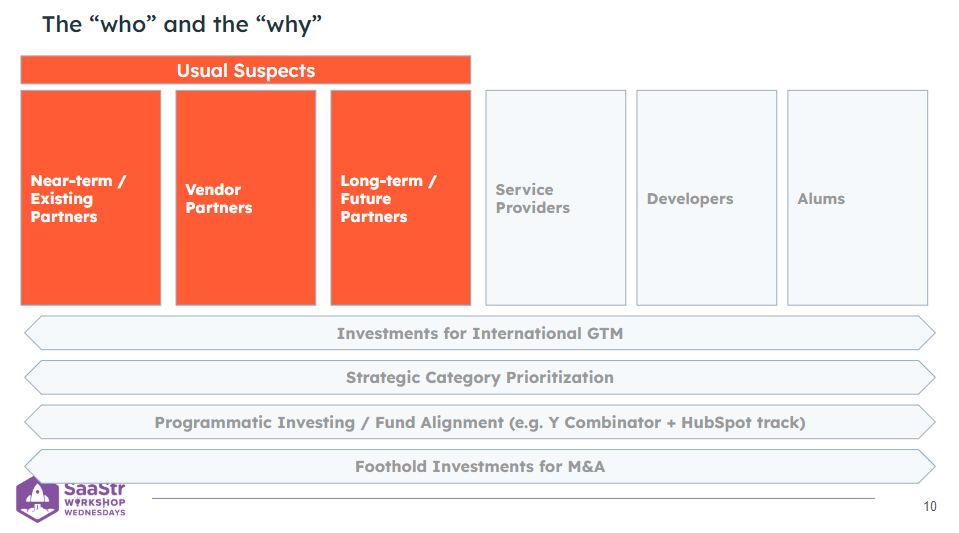

Candidates for Investment: The Usual Suspects:

- Near-Term/Existing Partners

- Vendor Partners

- Long-Term/Future Partners

Lesser Known Partner Types:

- Service Providers

- Developers

- Alums

The “Why” For Investment:

- Investments for International GTM

- Strategic Category Prioritization

- Programmatic Investing/Fund Alignment (e.g., Y Combinator + HubSpot track): This can be great for the brand overall

- Foothold Investments for M&A

What’s In It For Corporates?

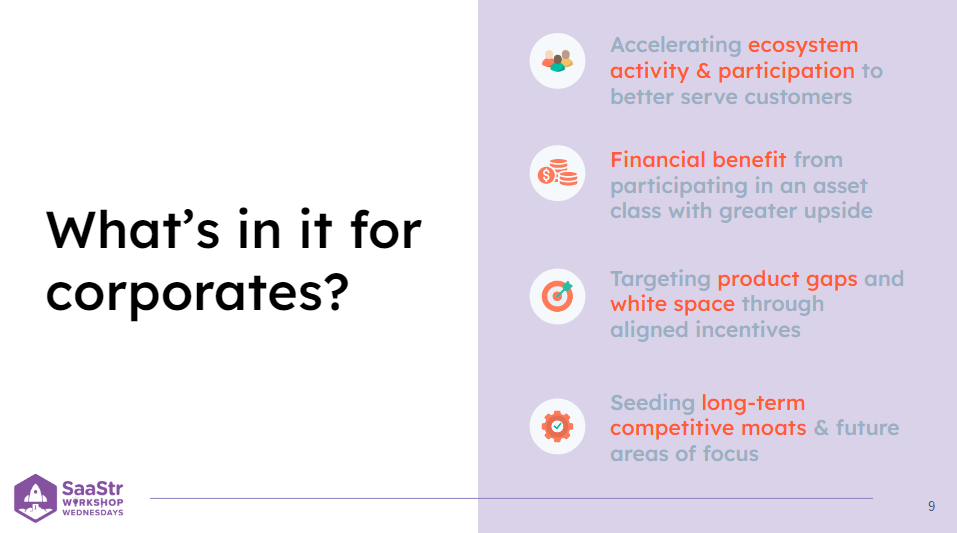

For a company to invest strategically has several significant tactical advantages:

-

- Accelerating ecosystem activity and participation to better serve customers. Greer emphasizes, “The reason we care about ecosystem activity is that ecosystem is kind of a precursor to stickiness.” The stickier and more convenient your product is to use along with the ecosystem, the more likely you will be to set up long-term retention.

- Financial benefit from participating in an asset class with greater upside. Obviously, every investment is purposed to yield a financial return. However, the reason for these strategic investments is not primarily for the direct financial award, or at least not by itself. Instead, these partnerships contribute strategically to the business as a whole.

- Targeting product gaps and white space through aligned incentives. Greer says, “Of course, HubSpot can’t do it all, and so we’ve got gaps, and some of those gaps are easily filled with strategic partners who build and don’t want our money…but there are some situations where the investments just allows us to align incentives, it allows us to kind of break a few rules on the back end where we can sort of expose an API or do something that allows the company to go a lot faster, do a little bit of co-marketing…[there are] a lot of ways we can get distribution of those businesses and also solve for a pain point that our customers are experiencing that we’re not building for.”

- Seeding long-term competitive moats and future areas of focus. To stay agile in the ever-changing tech landscape, companies may consider these strategic investments to keep up with the current market. “I think from a long-term competitive perspective, [a strategic investment] allows us to keep our finger on the pulse,” Greer says

What’s In It For Startups and Why Now?

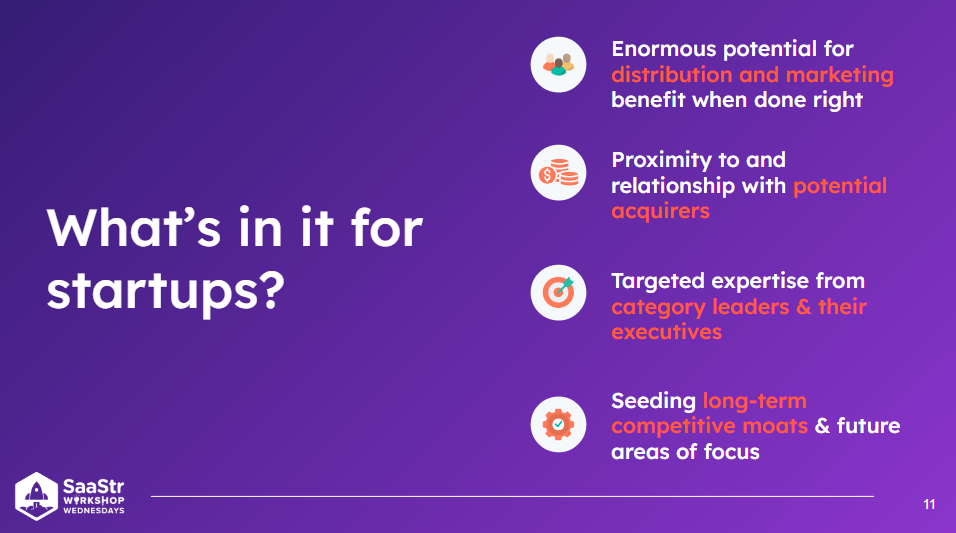

For startups looking for funding, a strategic fund could benefit you in the following ways:

- Enormous potential for distribution and brand awareness when it’s done right. This is not necessarily a given. However, the right partner could help propel you toward new customer segments and expand your market potential.

- Proximity to and relationship with potential acquirers. Again, this benefit does not guarantee an acquisition; however, this relationship can place you in orbit with potential acquirers and open up doors.

- Targeted expertise from category leaders and their executives. At the beginning of your company’s life, it can be enormously helpful to have access to experienced leaders in the industry.

- Seeding long-term competitive moats and future areas of focus. The relationships you build and the opportunity to align yourself with other companies in an ecosystem can help edge out your competition and open up more options for the future of your product.

So why is 2023 a good time to consider a strategic fund? Firstly, when capital is generally hard to come by, it’s an opportunity to get a company like HubSpot on your cap table. But you won’t be up against the ownership thresholds and targets of a large institutional fund. In other words, it’s an easy way to make noise without giving up a ton of your company.

Key Takeaways: Winning With Strategic Investors

- Start Strong to Make the Relationship Work in the Long Run

- Have a plan (integration vision), and bring your wishlist

- Don’t rush into a first close

- Prioritize legal terms and keep multiple strategies on equal footing

https://youtube.com/live/VOn7uWe72fk

Every Wednesday at 10 a.m. PST, SaaStr will hold live, interactive workshops on Zoom where experts in the community share their insights. Sign up HERE!

The post Fundraising and Working with Strategic VCs with Head of HubSpot Ventures, Brandon Greer (Video) appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow