Founded in 2019, Laika (an enterprise-ready compliance platform) closed a $50MM Series C by the summer of 2022. Looking back on its explosive growth, however, the company realized just how badly it needed the valuable services of a Chief Financial Officer (CFO).

Eva Pittas (Co-founder and COO at Laika) and Dicken Chaplin (CFO at Laika) discuss the value a well-versed CFO brings to their business as well as a few key lessons they’ve learned along the way.

Hiring a CFO

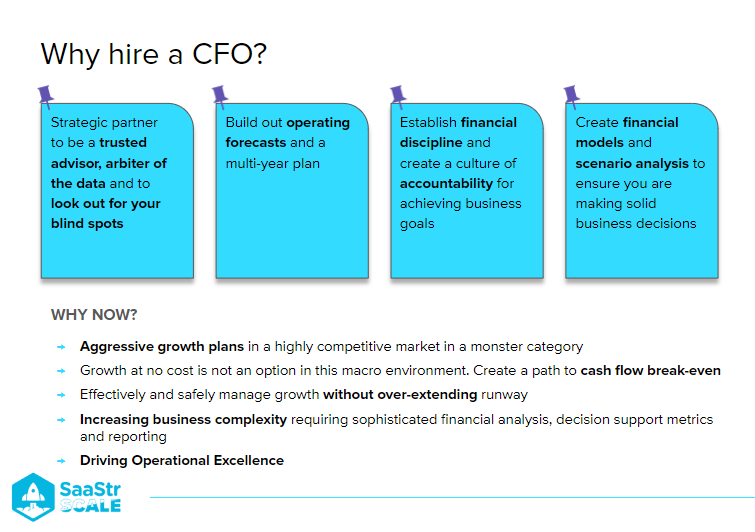

First: Why hire a CFO, anyway?

A CFO is a strategic partner serving as a trusted advisor, arbiter of financial data, and guardian against fiscal blind spots. CFOs can build operating forecasts and multi-year plans, create financial models and scenario analyses, establish financial discipline, and create a culture of accountability. In Laika’s case, they decided to hire a CFO when they decided that looking only one quarter into the future was no longer sufficient.

A CFO can help you safely manage your growth during times of increasing business complexity without overextending your runway. They can also help secure the data, reporting, process, and discipline a business need to evaluate progress so it can develop the accountability necessary to drive operational excellence.

The path to success is not linear

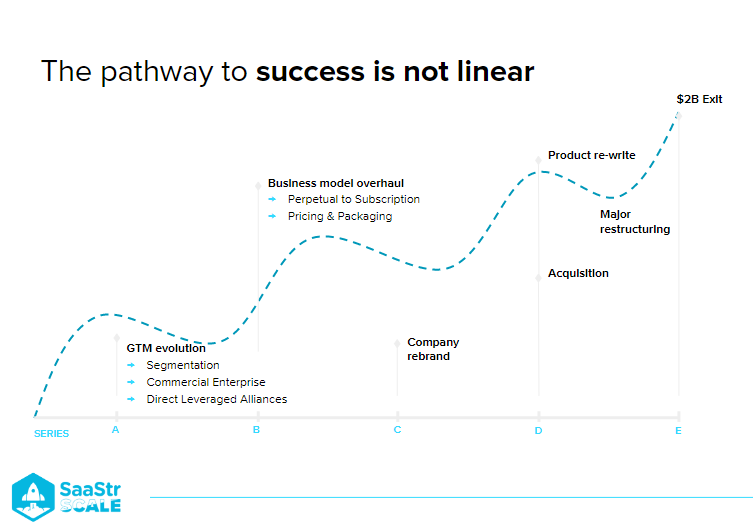

Success rarely resembles a straight line, smoothly ascending from humble beginnings to sky-high success. Instead, the pathway to success resembles a series of consecutive S-curves—the undulations of growth and contraction that occur in every business. One constant challenge, however, is figuring out if you are at the bottom of that curve (after a contraction but bouncing back) or the top (a period of growth heading into a downturn).

“Playing offense with a limited balance sheet is something that the venture space lives with daily. It makes us inspect our decisions at a much more granular level, and we have a high bar—especially in today’s macro environment—for burning cash.”

– Dicken Chaplin, CFO at Laika

During Chaplin’s previous tenure at the software company Turbonomic, he encountered this problem as the company—starting at the low end of the market—realized their unit economics did not comport with the market segment they hoped to acquire. They then overhauled their pricing and packaging to grow alongside their infrastructure and customers.

Looking back vs. looking forward

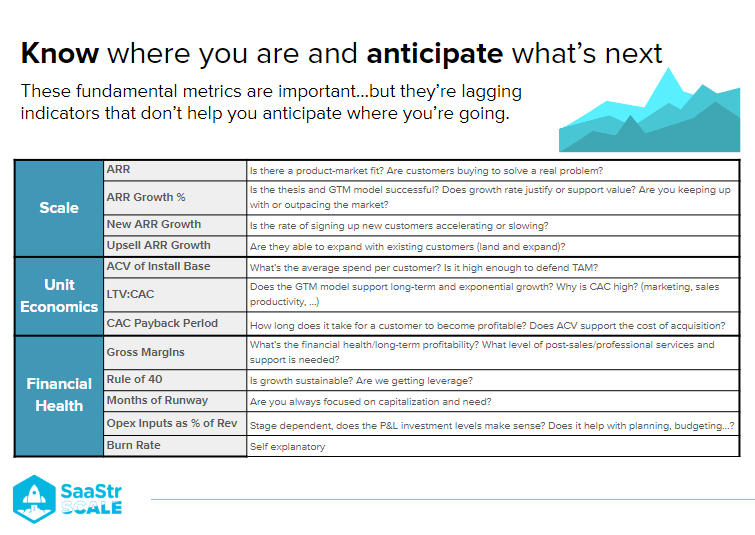

Fundamental metrics (like ARR, CAC Payback, or Burn Rate) will never stop being important; they’re industry standards for a reason. But they can also be lagging indicators that don’t necessarily help predict where your future lies. If companies only look at these core metrics before settling on their action items, they may be halfway through the next quarter before they realize that they should have been course-correcting the entire time.

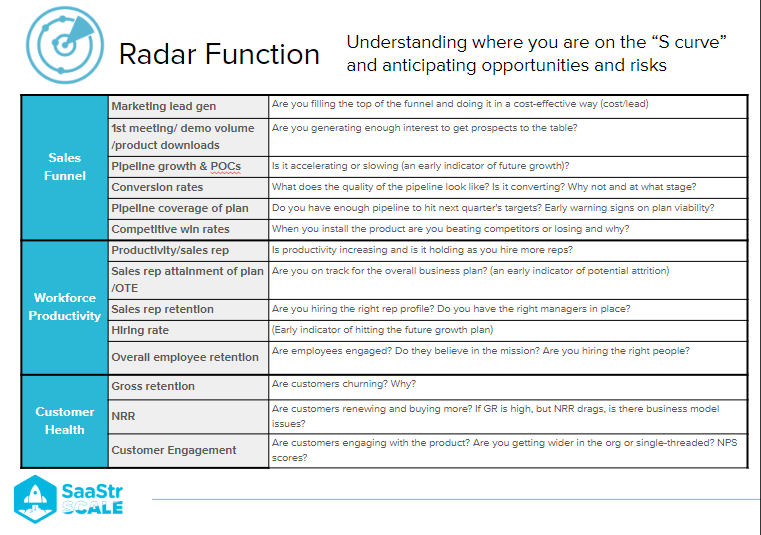

This is why Chaplin stresses ‘radar functions’—metrics and questions that allow you to better understand the challenges you face today and in the near future.

These metrics will vary by company, but can include elements such as the following:

Sales Funnel

- Marketing Lead Gen. Are you filling the top of the funnel cost-effectively?

- Pipeline Coverage. Do you have enough pipeline to hit next quarter’s target?

Workplace Productivity

- Productivity Per Sales Rep. Is productivity increasing, and is it holding as you hire more reps?

- Employee Retention. Are employees engaged, and do they believe in the mission?

Customer Health

- Gross Retention. Are customers churning? And if so, why?

- NRR. Are customers renewing and buying more? And if NRR drags while GR remains high, what changes might you make to your business model?

Failing fast in action

As leaders in your company, you are responsible to your investors to take bold bets. At the same time, it’s also your job to understand if these bold bets have paid off—and, if not, what to do next. Chaplin offers these key pieces of advice:

- Build a detailed operating model, and identify your leading indicators. List your assumptions: even if they aren’t right, it’s critical to measure against them.

- Define what success looks like monthly and quarterly, and constantly measure against that plan. Don’t wait to see how you did in the first half of the year and whether you see the ‘green shoots’ (that is, signs of economic vitality during a downturn).

- Be decisive. Experiments can be great, of course—but they can also bleed your balance sheet if you’re not quick to shut them down when you see that they’ve gone awry.

Live and die by the forecast

Developing a robust forecast is imperative for your future success. But as simple as that may sound, it’s often overlooked in the early stages of a business.

“Once you pick a methodology, you’ll see how accurate it is. And maybe you’ll have to change it. But even early on, while the stakes are lower, it will show you why it’s so valuable to build from the beginning.” – Dicken Chaplin, CFO at Laika

Once you’ve developed this forecast, however, you have to hold your sales accountable to it—while also building the statistical ability to triangulate that forecast with metrics and data. Your data set may be small at first, but you can work to refine your forecast methodology. Over time, you’ll be able to accurately anticipate your sales numbers weeks in advance, if not quarters.

Finally, always look two to three quarters ahead. If you take the time to develop a sturdy and reliable forecast, those calculations will serve as the bedrock for your decisions going forward.

Key takeaways

SaaS companies are known for their bold bets in an evolving marketplace, but these risks rest on a bedrock of metrics and data. This is why companies can live and die by their forecast, which demands a robust operating model. And this model, in order to function, requires a strong operations and analytics team that can guide you through the ebbs and flows of your growth.

The post Managing a Thin Balance Sheet: 4 Lessons Learned From Laika’s $2 Billion Acquisition with Laika Co-Founder & COO Eva Pittas and CFO Dicken Chaplin (Video) appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow