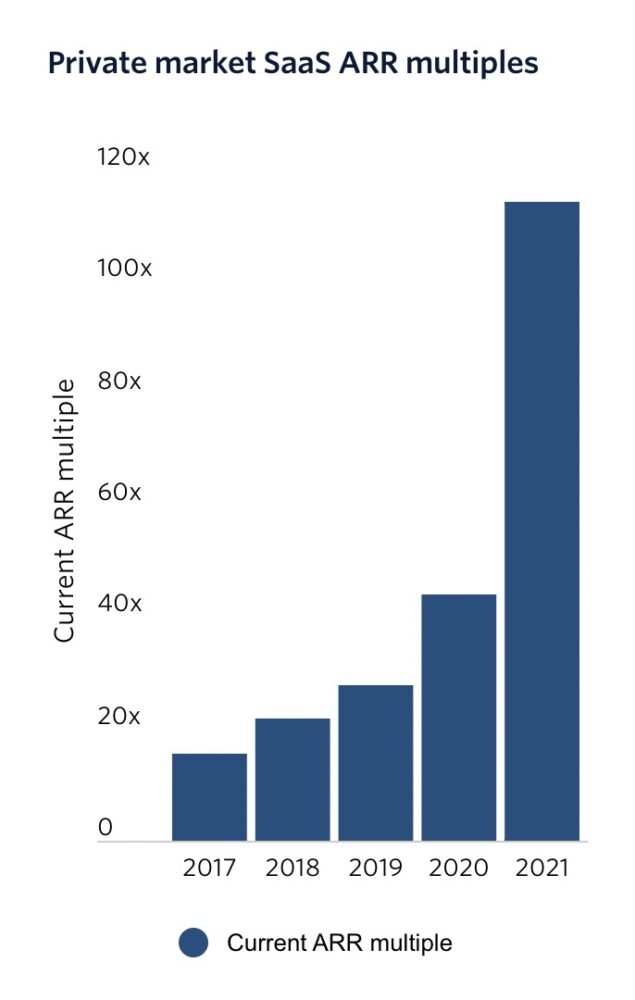

So there are a lot of rough and arm chair metrics for fundraising in SaaS in terms of valuations. For years, the standard was “about 10x”. Top tier SaaS companies would tend to raise at around 10x ARR, with ones with slightly lower growth often raising at 5x.

As SaaS picked up, 10x ARR remained a rough standard but for Series A, B and later rounds grew to about 15x for top performing SaaS companies. In 2018-2019, it grew then a bit, and for very top SaaS companies, 20x ARR wasn’t uncommon for Series A and later rounds.

And then things just went crazy. Per Pitchbook and IVP, top-tier growth rounds had a 114x ARR ask at the very peak in 2021!

Average asks and multiple for the very, very SaaS companies went up 700% in the Boom from late 2020-late 2021. Woah.

And then … came crashing back to earth. While the data ends here, here’s what I can tell you I am seeing in growth rounds today:

- Very few growth rounds are happening at all

- When the do happen, they are for capital efficient startups growing > 50% at scale

- And … the peak valuation is about 15x. For the best ones.

So the minor point is maybe we’re just back to 2016-2017 in SaaS venture capital for Series A and later rounds.

But the bigger point is especially for new founders and execs to just look at the chart above. We’re never “going back” to how things were in late 2020 and 2021. Never. Instead, it was an insane anomoly driven by temporarily very high public valuations.

If you’re wondering when things will go back to where they were, look at the chart above. You’ll see the answer is never.

Meritech, another late stage fund, just put together a great report summarizing just how many public SaaS leaders actually trade at 10x ARR or more. The answer, today? Only about 20%: So only the top 1/5 of public SaaS companies are even worth 10x ARR.

Things likely will be better 9-12 months from now. But not that much better on the multiple side. 10x ARR may still be best-of-breed for public SaaS companies, with 15x a stretch for the top later stage private ones.

A related post here:

Why Now is a Great Time to Raise Seed Funding. Even If It’s Awful for Series A-E Rounds.

The post Pitchbook & IVP: Top Tier SaaS Companies Usually Raise at 15x ARR. It Was 114x in 2021. appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow