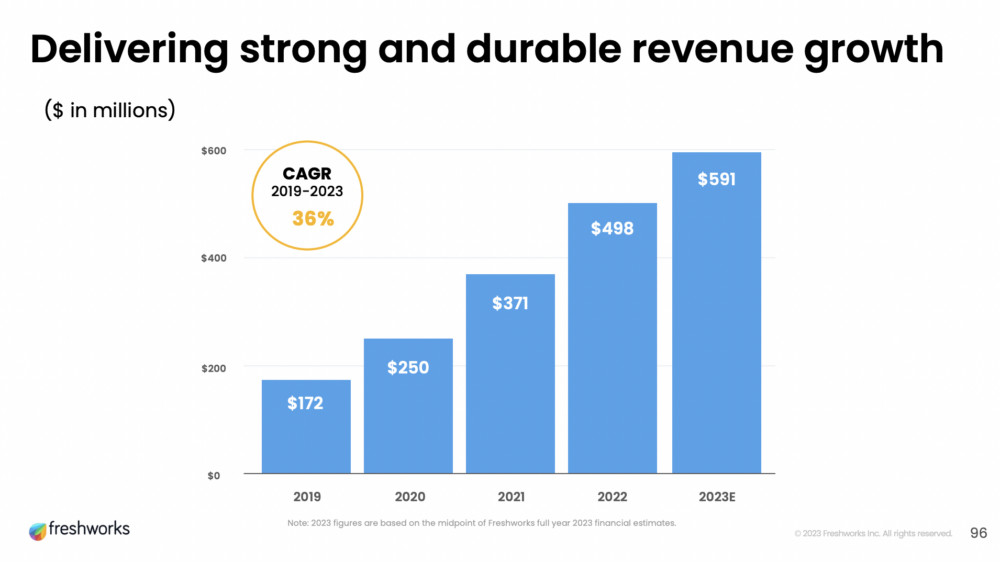

So we last checked in with Freshworks at $400m in ARR. Fast forward to today, and last quarter they crossed an incredible $560,000,000 in ARR growing 20% on a constant currency basis. That should put them at about $600m ARR today!

5 Interesting Learnings:

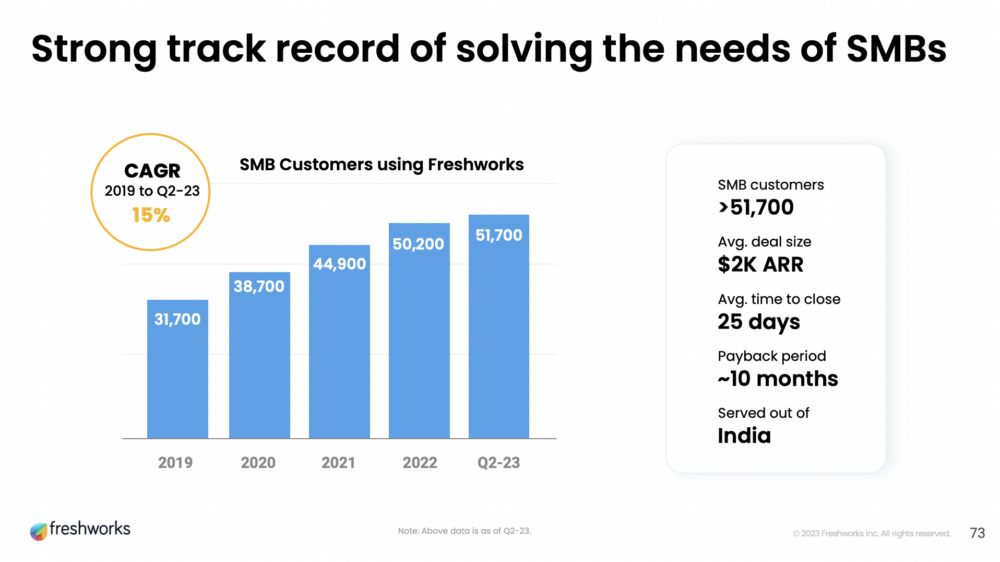

#1. Bigger Customers Keep Growing, But SMBs Have Slowed

A common theme across tech today. Freshworks has 51,700 customers at around $2k ARR, with a quick close of just 25 days. But in contrast to their bigger customers, the macro environment has led to slowing growth in this segment in 2023.

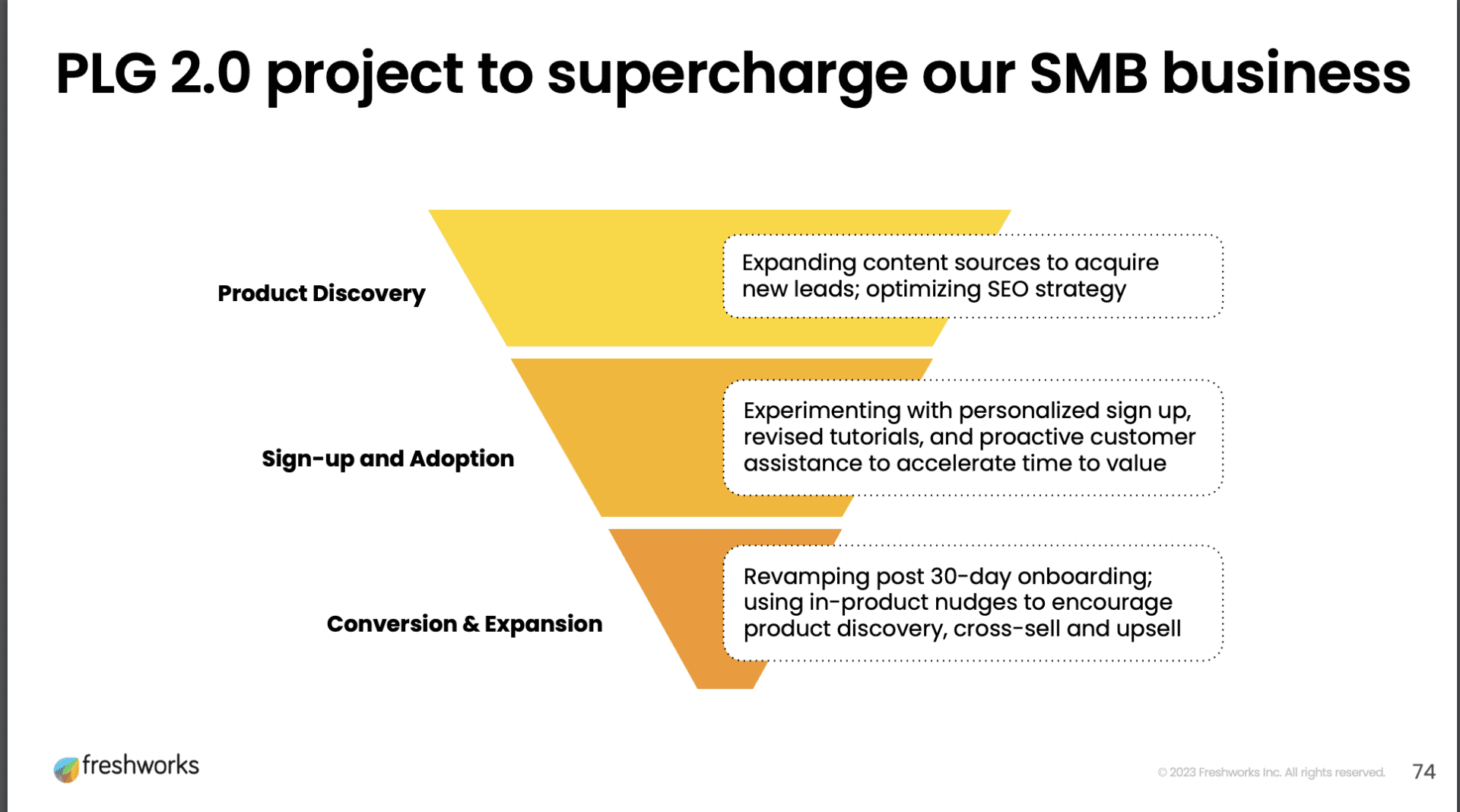

#2. Levelling Up PLG to Accelerate SMB Customers, Including More Attention to Onboarding

I love seeing this, it can seem hard to invest heavily in small customers, but if you don’t especially invest in onboarding, that’s a big shame. Because there are few things worse than closing a customer that never actually uses your product. So much wasted energy getting them there.

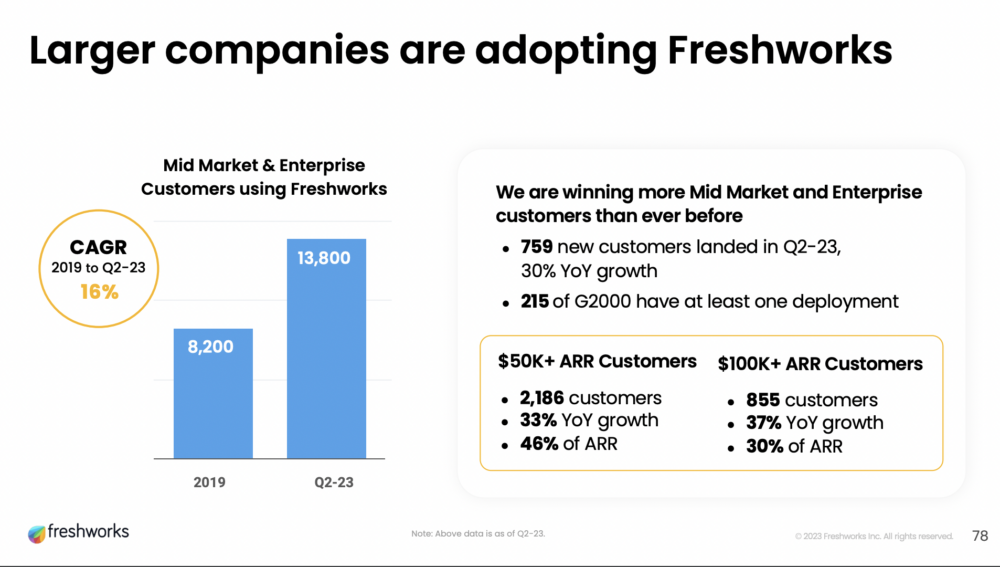

#3. The Big Growth Today is In $50k+ and $100k+ Customers. Soon, They Will Be The Majority of Revenue.

Not a surprise per se, other somewhat similar players are seeing the same thing. But good to learn from. $50k customers are growing 33% (vs 20% overall) and $100k+ customers are growing 37%. Soon, the majority of Freshworks’ revenue will be $50k+ customers. A big change from their roots with smaller SMBs.

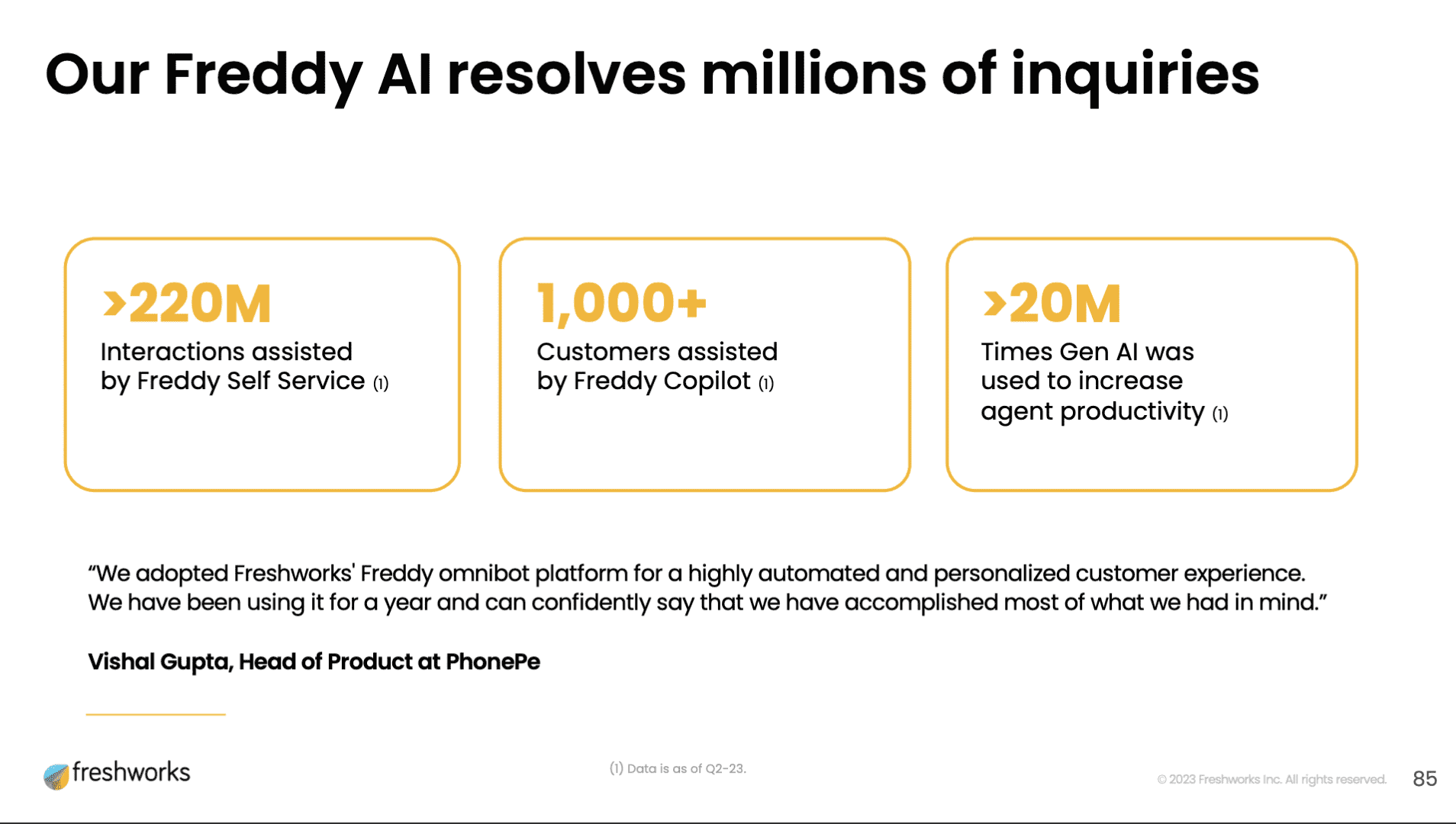

#4. Automation / AI is Already a Big Deal. Over 220,000,000 Transactions Automated in Whole or Part.

The contact and support spaces have rapidly adopted as much of AI as they can. Automating tickets and support is a huge industry theme, and Freshworks has already automated 220,000,000 interactions, in whole or part.

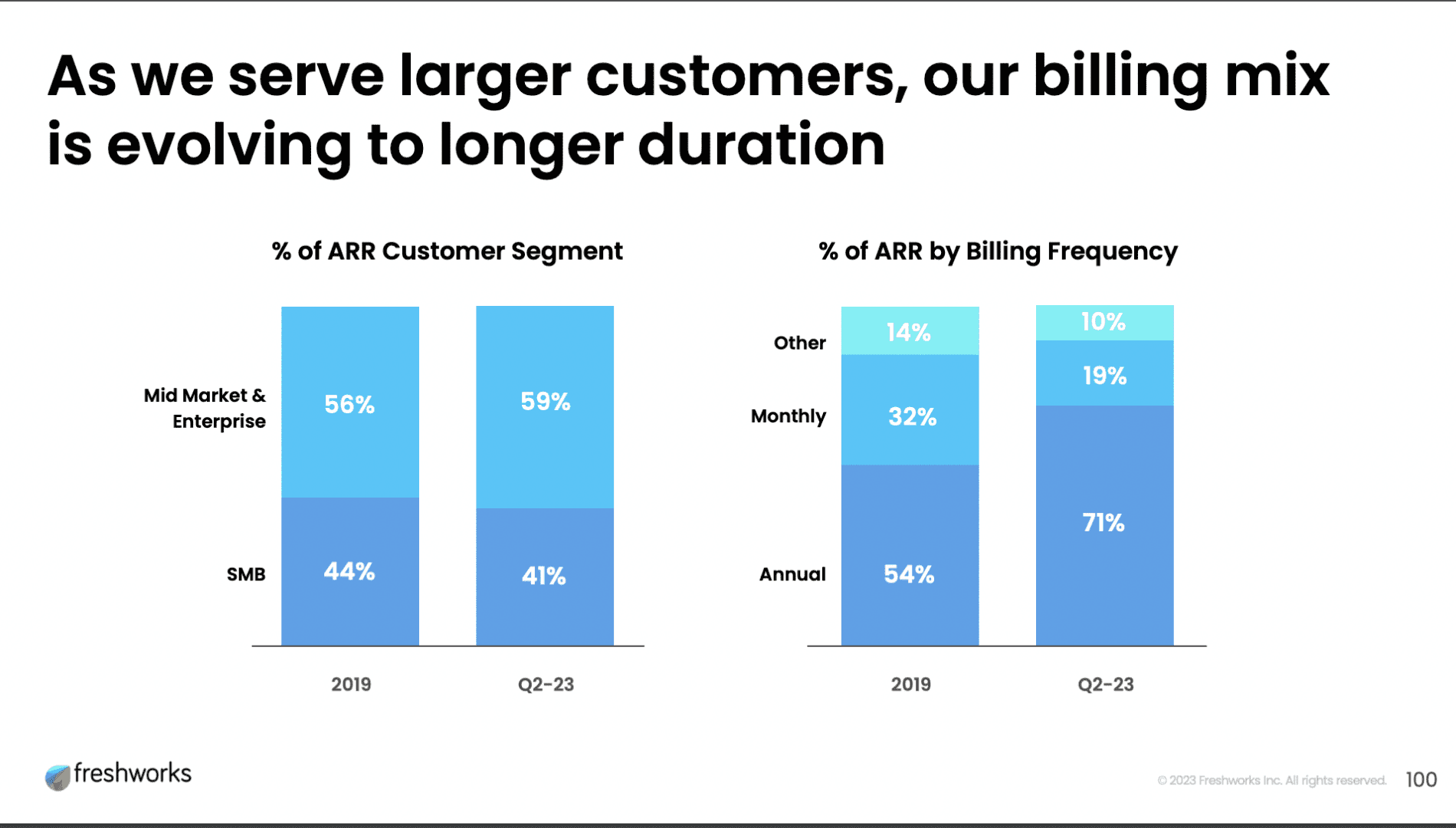

#5. Moved to 71% Annual Contracts (From 54% in 2019) As Have Gone More Enterprise

This is what I’d expect, but very helpful to see this data presented this way, as they’ve move to half of their revenue from $50k+ deals, vs the $2k for smaller customers:

And a few bonus learnings:

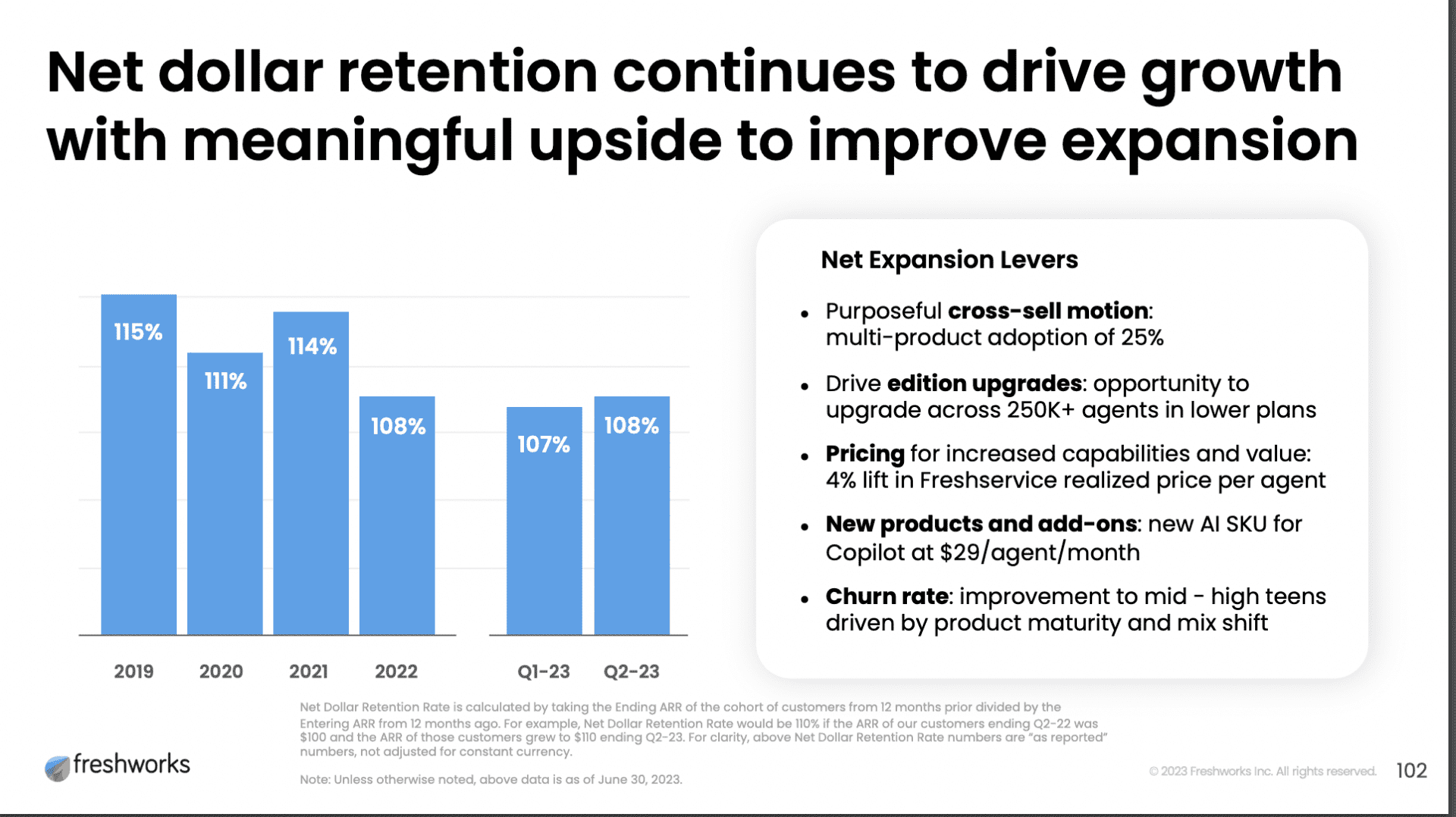

#6. NRR Stable / Up a Smidge at 108%, But Boosted By Price Increases

Like Monday and many other leaders that sell to SMBs, they’ve seen some decline in NRR. It remains relatively strong at 108%, however. But a 3% price boost likely materially helped.

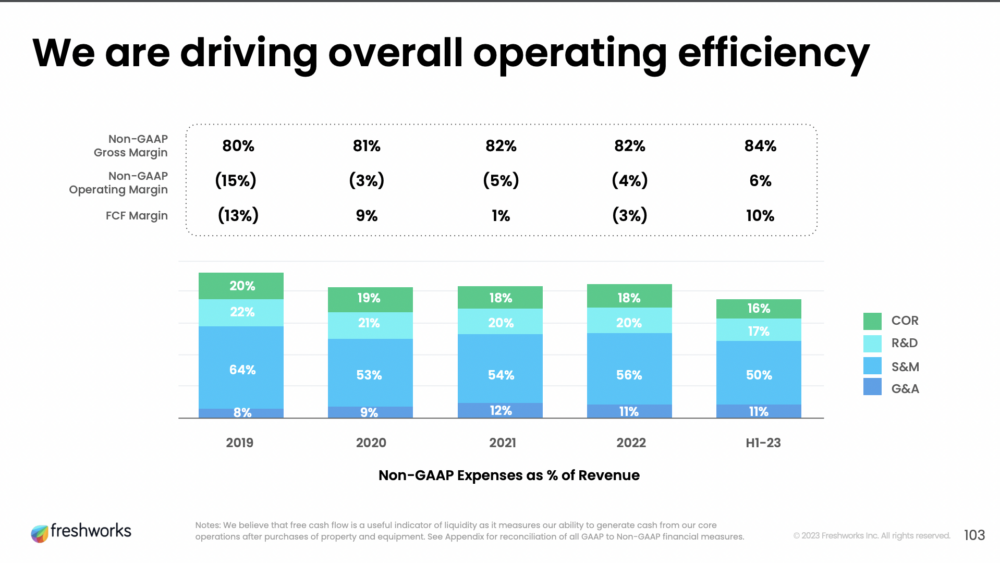

#7. Like Almost Every Other SaaS Leader, Freshworks Has Gotten Much, Much More Efficient. Free Cash Flow Has Swung From -3% to +10% in One Year.

Like just about every other Cloud leader, Freshworks has gotten much, much more efficient the past 12-18 months. In 2022, they had negative free cash flow of -3%. Just a year later, they are at +10%. That’s radically more efficient.

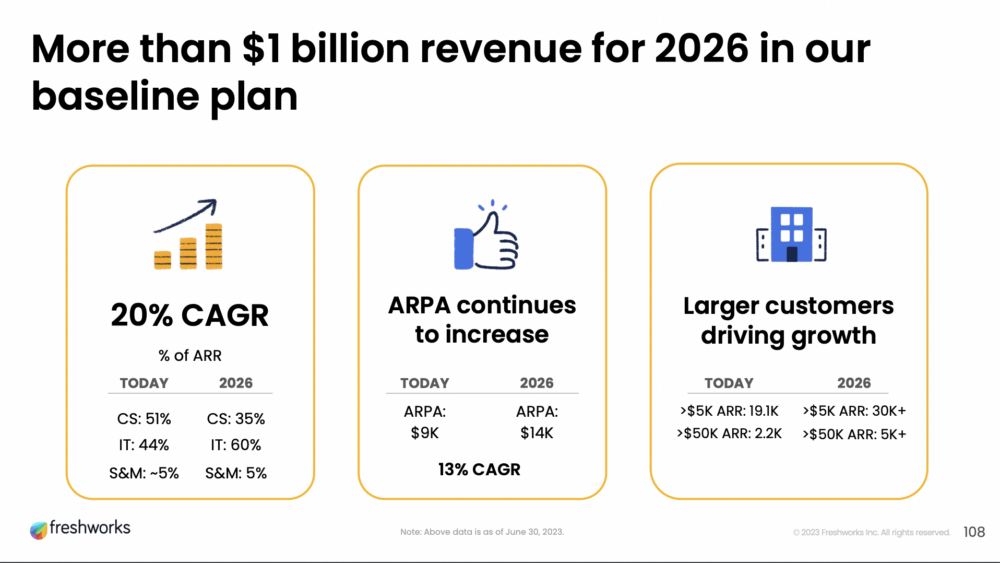

#8. Predicting $1 Billion in ARR in 2026

The power of > 100% NRR. You can pretty reliably predict revenue over the coming years. Freshworks clearly sees $1B in ARR bu 2026. That’s just math, really. And a ton of really hard work 🙂

Wow what a run! See you at $1 Billion in ARR, Freshworks!

The post 5 Interesting Learnings From Freshworks at ~$600,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow