So no question many folks, especially selling sales and marketing tools, are having a pretty tough time of it. Leaders we admire and look up to from Zoominfo to Zoom to Box have had tough years on the stock market, no doubt.

But not everyone. Not by far. Overall, the BVP Nasdaq Emerging Cloud Index is up 22.97% this year.

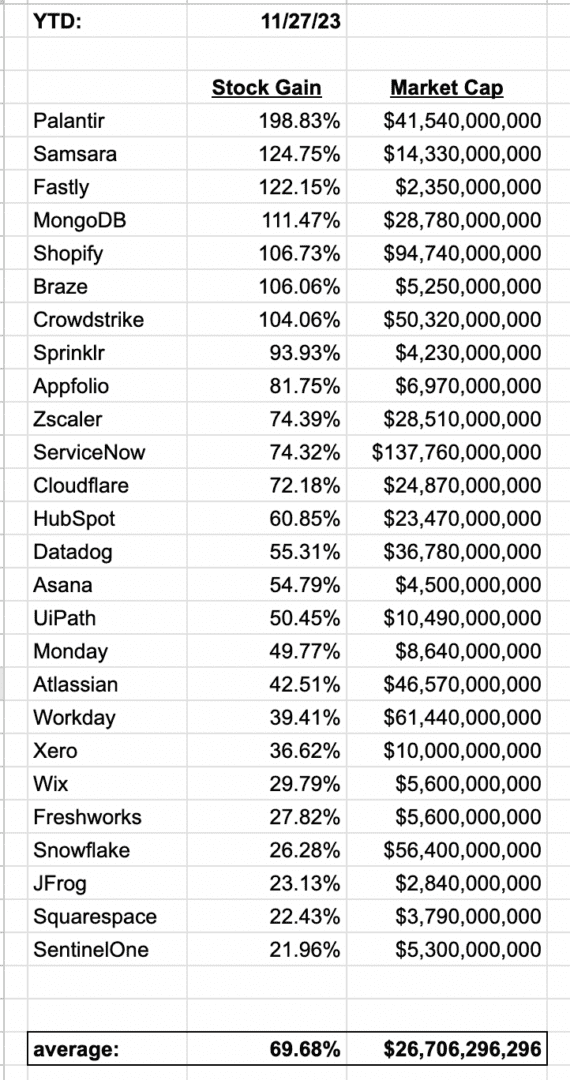

I went further and put together a quick list of 25+ SaaS and Cloud leaders to see how their share prices are doing. On average, their share prices are up a stunning 68.50% and they are worth on average $26 Billion!

Now it’s not all smiles, daisies and glory. The ARR multiples in many cases here aren’t all that high. And the growth for many of these leaders has come way down this year, even if in most cases, they’ve gotten far more efficient. And importantly, many are still way off their 2021 highs. The big stock price swings in 2023 in many cases are still under their 2021 peak.

But still a reminder, quietly, this isn’t too bad a year or a time for many SaaS and Cloud leaders. Not all. But many.

The post Times Are Tough for Some. But — A Ton of Leading SaaS and Cloud Companies Are Up 69% on Average This Year appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow