Is it the end of an era for customer success in SaaS?

We just wrote up how some of the biggest changes of SaaS are now coming, specifically in Customer Success and Sales. Back in 2015, when didn’t have the data or NRR or GRR of 115 public SaaS companies. The number one insight back then was to put a person on it.

Now, in 2024, we’re in the age of efficiencies, and we’re rethinking whether we should put more people on it or tolerate more churn and issues because we want to be cash flow positive. SaaStr CEO Jason Lemkin also wrote how Customer Success has now morphed into part of the sales team and that the 2024 trends in CS include everyone wanting to eliminate humans from support to replace that headcount with AI and bots.

The world has changed. We still want to drive retention and growth and make money. Yet, we don’t know what the new world is, but it won’t be the same.

So to go a bit further in on this topic, we thought we’d also bring in SaaStr Fan Fave and expert on Customer Success, Gainsight CEO Nick Mehta, together with Jason to share their predictions for the future of customer success in 2024. Let’s dive in.

Customer Success Is Vulnerable to Cuts

Jason shared that he didn’t realize how vulnerable customer success was to cuts until 2023. With the number of layoffs, customer success was the highest. Being in SaaS for a long time, he thought customer success would be the last thing you want to cut.

Back in the day, they would hide in NRR during tougher times, in those existing customers. Now begs the question, why would you fire the protectors?

People want to drive customer success across the company and customer base. No one would disagree that retention and expansion are important. But there is debate happening about how to achieve that. There’s a lot of nuance.

If there were one or two metrics or data points that Nick learned at Gainsight by sitting in on board meetings, what were they? Eventually, you can build a model to show you can create sustainable value in a company that’s not just based on a revenue multiple. Cash flow sounds obvious, but if you do it right, SaaS companies generate a ton of cash over time.

Some other key learnings included:

- The power of the SaaS model. If you’re in an early-stage model, you don’t see the other side of that spectrum.

- The ways to drive Enterprise value, one of them being M&A.

Now, it’s time to dive into the top five predictions for the future of customer success in 2024.

Prediction #1: GRR and NRR Make a Mild Comeback

GRR (Gross Revenue Retention) and NRR (Net Revenue Retention) have been hard for many companies over the last year or so. Gross retention dropped because those who were early stage and “nice to have” got cut. Even if you were sticky, people were cutting licenses and asking for a discount in the age of efficient growth.

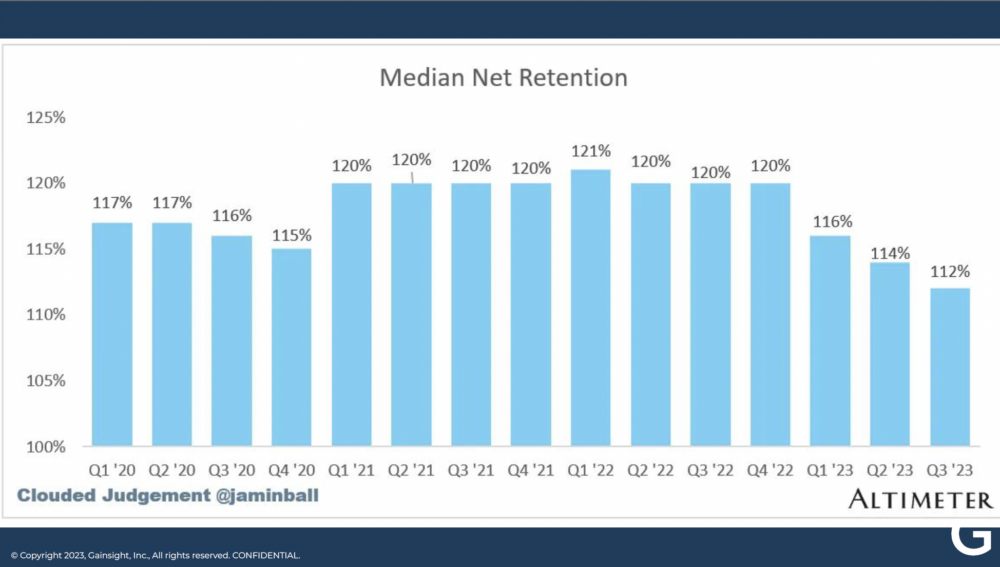

This chart on median net retention by Jamin Ball at Altimeter really tells the story of the bubble. (PS – watch his recent deep dive on this and a bunch more SaaS metrics for 2024 in the Workshop he did with us.) NRR went up a lot, then started dropping. People weren’t adding as many seats or pre-buying at higher tiers for predicted growth. Free growth is there but not nearly as high.

Jason pointed out that it’s still 112%. So even if you had a hard 2023, there’s magic in this chart. If you make your customers somewhat successful, you’re going to get 112% revenue retention each year. “This chart says never stop investing in customer success for real. Never stop,” he said.

Even if this is stressful for folks, as leaders and founders, you need to pause and look at this, dial it in, build better software, and make customers happy. You can’t kill a company with 112%. In the bubble, people gorged on software and entitlements. And now, people don’t buy ahead anymore because they’re processing through that overhang. That will eventually go away because that excess capacity will be gone. It probably won’t go back to 2021 levels, but it will be some kind of growth.

There’s Only So Much Energy That Can Go Into Cuts

You can do it for a year and cut people, but it takes so much energy to do that. This isn’t a five-minute decision. The time and energy people put into cutting marketing budgets is profound, but it won’t help them hit their commits. You don’t get points for cutting costs at the end of the day.

“You can’t cut your way to prosperity,” Nick adds.

When you’re growing, you don’t have time to see how much people are using your product, so it can’t last unless we’re in a global meltdown, and we’re not. At the end of the day, software companies are valued on growth. Yes, efficiency matters, but you have to grow.

Prediction #2: Vendor Consolidation Continues

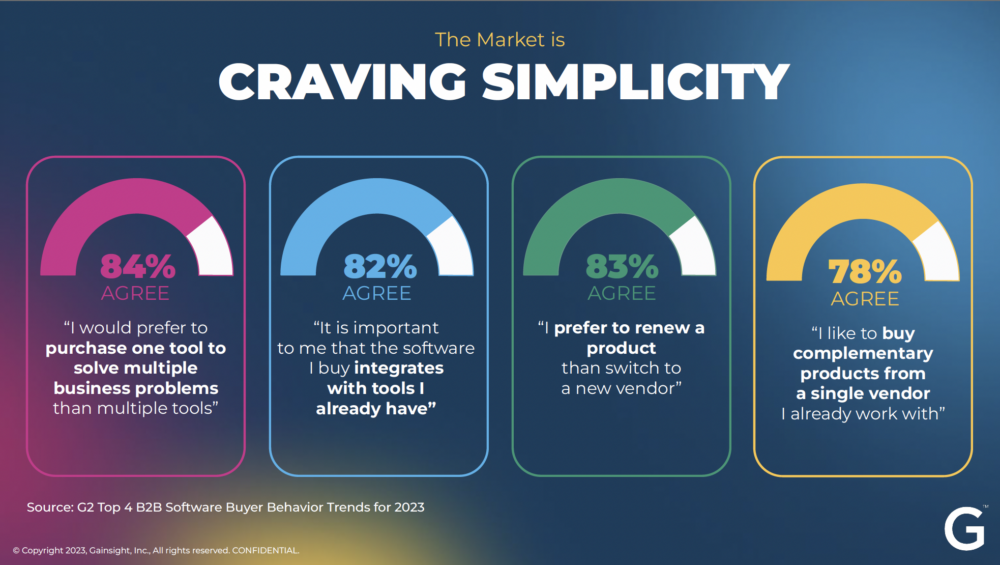

In 2023, there was a lot of focus on fewer vendors. Some buyers wanted fewer tools, or they preferred to consolidate spend with existing vendors. So the next prediction Nick and Jason had for 2024 was that vendor consolidation will only continue to funnel more business towards multi-product solutions vs. one-off SaaS tools.

We’ve learned, roughly speaking, that to get past $200M in revenue, you have to have a solid second product in addition to your core offering. There are exceptions like Canva that bleed into the consumer markets, and then there is the other extreme, like DataDog, where users buy on average of eight different product lines.

Over the last couple of years, we’ve gone through multiple waves of app layoffs, something we’ve never seen in our history.

“You need to be 10X better in general,” Jason commented on this prediction. “And yes, we went through weird app layoffs and we forced people to consolidate but I think everyone’s confusing forcing people to simplify and consolidate, with multi-product. I think they’re different things and we’ve gotten good at multi-product as so many folks are above a billion in ARR, but that’s not the same as consolidation. It’s like a cousin, but it’s not the same effect. It’s not always budget-driven.”

Prediction #3: CSM Hiring Doesn’t Bounce All The Way Back

Things are bouncing back, in 2024, not all the way back, so efficiency still matters. The hiring won’t bounce back the same way, and people won’t grow their team at the same rate the company is growing. Nobody is going ahead, but we’re (hopefully) past the low point in SaaS.

There’s a question of whether we’ll go back to our old ways if things get easier. Monday.com was one of 80% of public SaaS companies that went from negative to positive margins in just a year. They paused hiring for a year (rather than cut) and got profitable.

But if things got better, would they stay this disciplined? Monday said they will hire less than they grow forever now. They won’t go back.

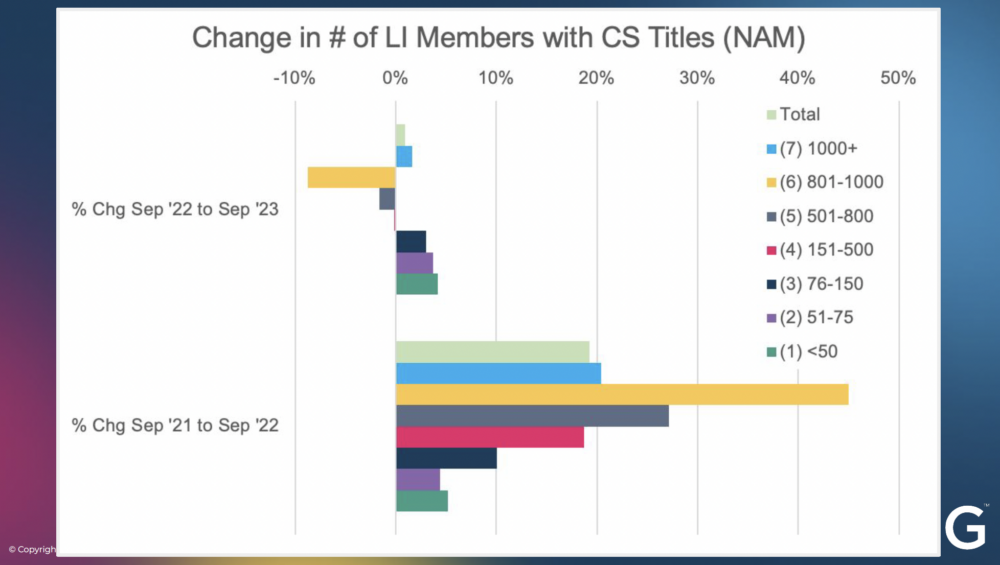

As you scale, you hire less people and spend less money. You get more efficient. The supporting data that Nick brought from Gainsight is super interesting. Sales grew a little less. People did invest a lot in CSM, and in 2021 and 2022, the CSM population grew roughly 20%. From 2022 to 2023, it grew 0%.

They stayed flat, which means people were grinding it out. SaaS growth didn’t drop to zero. Just fewer customers got coverage or CSMs got a bigger book of business to manage.

Nick explained: “If you look at 2021 to 2022, the bubble peaks. The CSM population in the world grew roughly 20%. If you look at 2022 to 2033, the downturn, it grew basically 0%. And so what does that mean? So of course some people are hiring and some people are laying off. But the net was 0 – flat. My guess is in 2024 teams are going, 5-10% percent only. In other words, people are going to want to get leverage, and hiring and people are not going to be the same as the revenue anymore.”

Jason agreed with Nick on this prediction but also added one asterisk and exception. For the SaaS/ tech companies that are experiencing a growth phase right now, like it’s 2021 – those companies will likely be spending and hiring this year, like it’s 2021.

“I think this is going to confuse people in 2024,” Jason added. “Deel announced this week that they’re hiring a thousand people this year, and I will bet you those are good paying jobs and I will bet you there’s some flexibility on attainment and CS coverage is higher than it might be in a more mature company. They’re hiring a thousand people and the vibe at a Deel is going to be a lot different than at a SaaS company that has decided to grow 12 percent this year profitably and it will confuse everyone in the industry.”

Prediction #4: Customer Success Scales through Clients and GTM Team

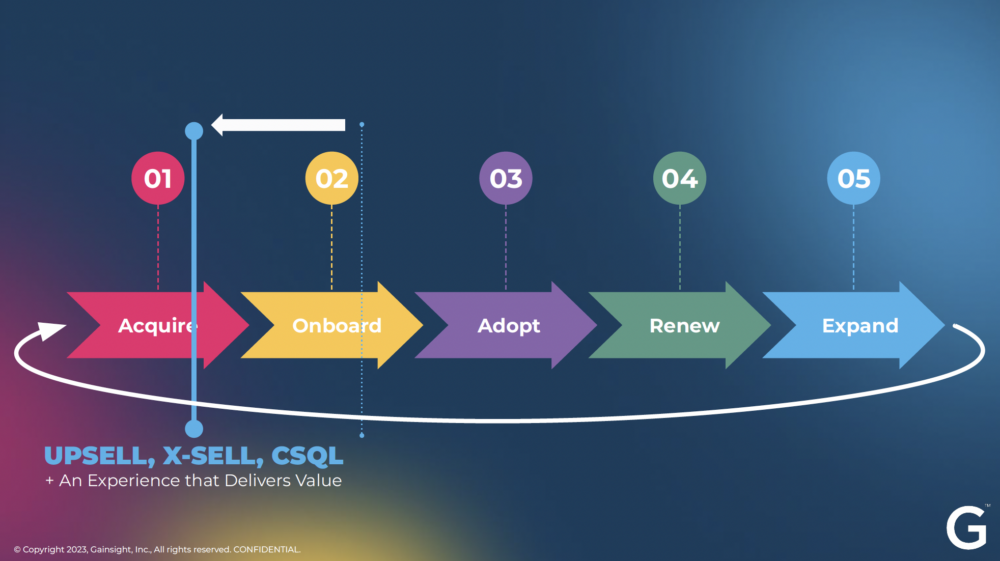

The next prediction for 2024 is that we’re seeing (and will start to see more frequently) customer success scale in different ways beyond just hiring CSMs. Automation and pushing more to the client in the form of self-service and also internal GTM teams will expand the role of CS more into Sales.

Of course, this can go too far sometimes if you push the customer and sales team, and customers don’t get value, they’ll churn. In some software categories, you can make the product great and have great self-service, but you still need change management and human beings. When you roll out Workday, it takes time. Human Capital Management is a hard problem since sales by nature, doesn’t care about deployment and implementation.

So, whether it’s CSM or professional services, there is still a need for humans. A word of caution. If your product requires change management, don’t just abandon that. If you cut back your customer success or post-sales budget and don’t implement world-class change management or measure it across the company, it’ll be worse than cutting the function.

It would also be a shame to cut implementation, deployment, and onboarding as part of this process.

Prediction #5: AI Goes Mainstream in Customer Success

In every category, we think about LLMs and AI, and many of us are building it into our products. The post-sales world is ripe for opportunity.

One way AI goes mainstream in customer success is by automating support. But in Customer Success Management, there’s a way to make them way more productive and happier.

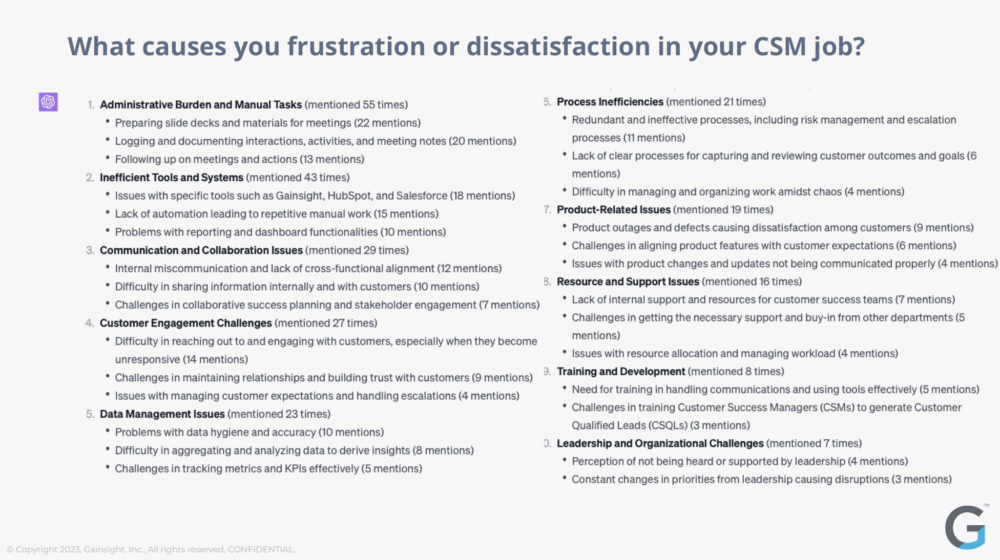

Gainsight did a survey where they asked people what they liked about CSM and what they didn’t like. People liked building relationships and being strategic. They didn’t enjoy manual work, updating data, and internal collaboration. The opportunity to use GenAI to eliminate data entry and improve internal communications is real now. So, if you’re not thinking about it in post-sales, you should be.

Many early-stage startups are incorporating into their products from the very beginning.

The truth is we aren’t going to hire all these people in customer success, so the entire category needs more customer success software. But we have to remake the whole category from scratch. We have to do it for real, and AI alone won’t accomplish this.

Key Takeaway

We’ve had account managers in every type of business since the beginning of business. People have always managed accounts. In other industries, we usually get better support than SaaS.

In the beginning of SaaS, customer success people were smart, quirky people who cared about customers and loved software. If you hired them and threw them at top customers, magic happened.

That doesn’t work anymore.

We lack that true champion of the customer. As an industry, we have to evolve and change, and as a category, humans aren’t going away, but we can’t do it the same way we have been.

The post 5 Predictions about the Future of Customer Success in 2024 with Gainsight CEO Nick Mehta and SaaStr CEO Jason Lemkin appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow