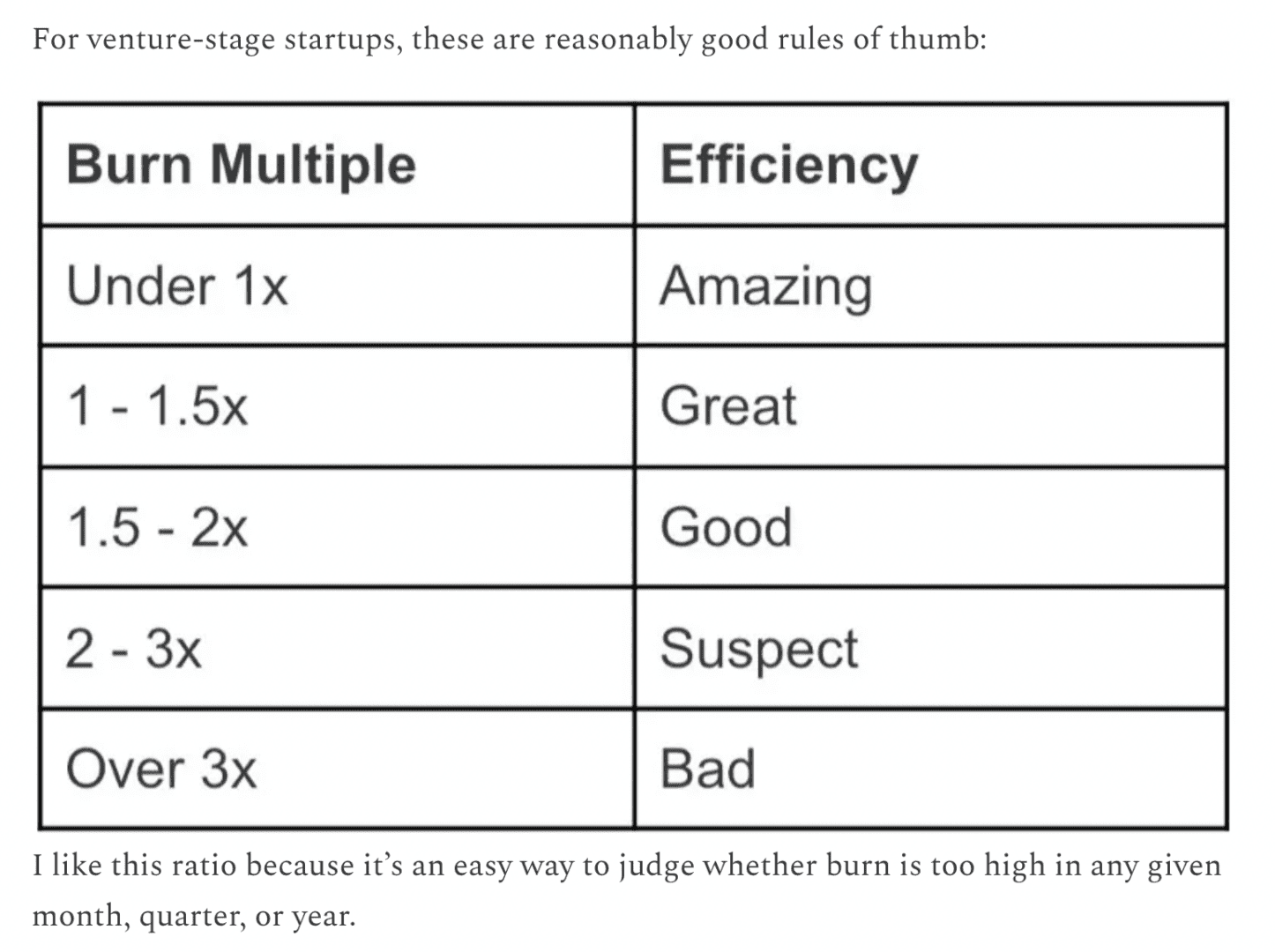

David Sacks classic post on Burn Rate Multiple is A+ and a key metric for every venture-backed startup. It simplifies a lot of complexity into one metric.

That if you’re venture-backed, yes, you do have money to spend (and burn). But the best burn less each month than they bring in in new bookings and revenue (a Burn Multiple of 1x or less).

And especially these days, having a Burn Multiple of 1x or less will certainly make you more attractive to VCs — if the growth is also there. If.

However, I’ve seen this metric now misused by many venture-backed startups as a magical health meter for a “good enough” burn rate. Why? Well, at a practical level, it assumes the next round is coming.

Many VC-backed founders miss a simple, basic point:

- You can still run out of money even at 1x

- You can still run out of money with a “good” Burn Multiple

A Burn Multiple of 1x or less is relatively efficient, but it’s still a burn.

If you aren’t 95%+ sure you can raise another round, Zero Cash Date is even more important.

The post A Low Burn Multiple is Great. But — It Doesn’t Mean You Won’t Run Out of Money. appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow