As a founder, you may wonder what venture capitalists are looking for these days. In a lineup of all Enterprise B2B SaaS companies with similar features, investors can only choose one or two per year. So what drives that decision? Let’s find out with Akriti Dokania, Partner at Ridge Ventures, from last week’s Workshop Wednesday, held every Wednesday at 10 a.m. PST.

Akriti has spent six years doing VC with thousands of teams. She’s also sat on boards with 15 or 16 companies, figuring out what does and doesn’t work for her as an investor.

A Founder’s Story

Nine years ago, Akriti was the founder of a B2B company that sold accounting software to small to medium-sized businesses in India. They were building a Quickbooks type product but there was no crazy exit. It was a team of four great co-founders, plus a few more, and they pitched 10-12 VCs. Only three came back. Why?

Each investor has its own criteria, likes, and dislikes. Just like dating, founders and VCs are meeting each other for the first time and seeing if they like each other or not. Akriti shares more context on what Ridge Ventures is and what VCs are typically looking for.

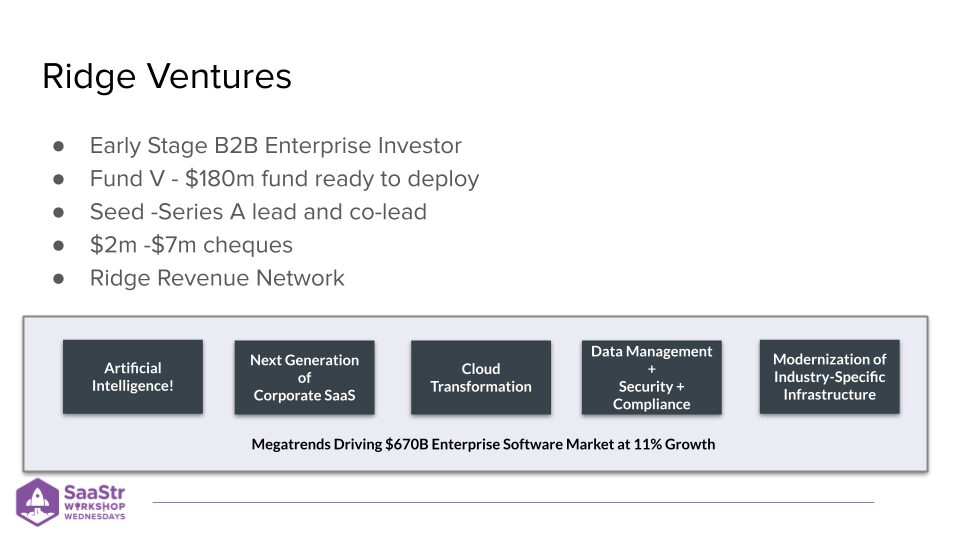

Ridge Ventures’ fund is $180M, and they’re deploying aggressively across the Enterprise stack — from data intelligence to management to next-gen SaaS.

What are they looking for in the Founders they invest in?

For Akriti, she’s looking for something very specific:

- A strong team with complementary skill sets

- A big market

With those two things, you have an opportunity to build a company that might last.

You can break down the VC mindset into three green and three red flags. Of course, each investor may be looking for different things. Every investor in a coffee chat is trying to pick up on the skills of the person sitting in front of them and to see if they’re excited.

Founder Green Flags

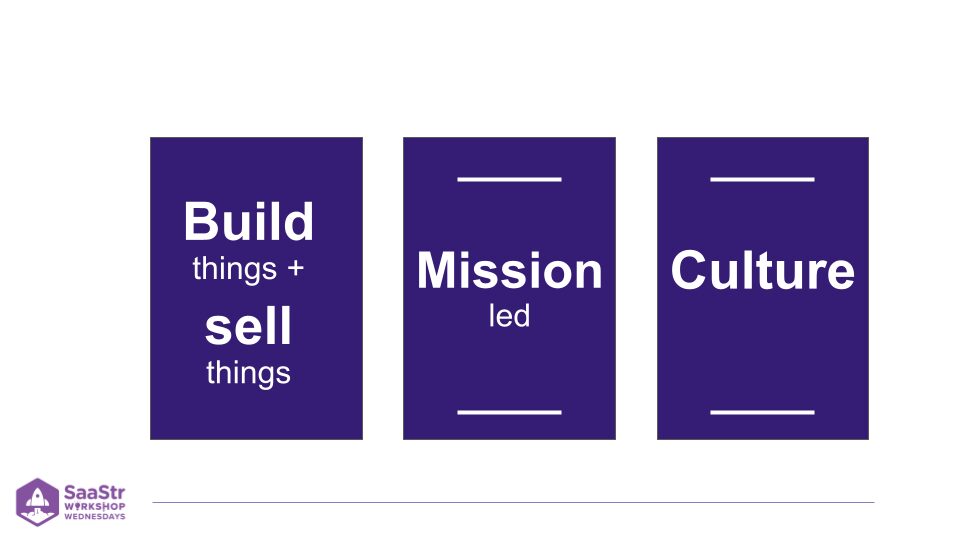

Three practical green flags in a meeting are:

-

- Build things or sell things. Not every founder will be technical or product savvy, and not every founder will be a salesperson. But are there complementary skill sets between the people on the team, some who can build and others who can sell?

- Mission-led and not necessarily impact-oriented. These founders are passionate about what they’re doing, and that passion gets other people excited. It also drives the business during hard times, acting as a North Star for why you’re building the company in the first place.

- Culture, culture, culture. As a founder, you need to know what culture you’re bringing to the table, and it’s up to you and your team to define that. Your culture is why people will leave a lucrative job at Google to work with you.

Founder Red Flags

VCs are looking out for green flags, but they’re also watching for any signs that you might not be the right partner for them. Most of the time, if you get a rejection email from an investor, no one will say it’s you. But think about the things you might be projecting in your ecosystem that might put off an investor.

-

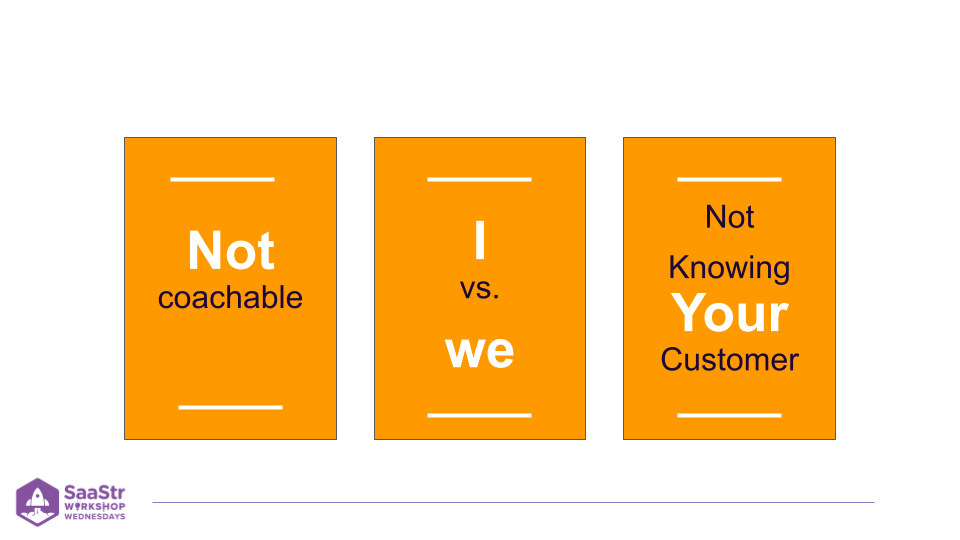

- You’re not coachable. A classic example for Akriti was walking into a pitch meeting with two founders, and one of those founders kept interrupting the other one consistently. To be coachable means to be aware of your surroundings and what people are communicating.

- I vs. we. Building a company takes 5-7 years. It’s a team game, a marathon. To have great outcomes, you need to be a “we” person, not an “I” person. If investors hear the words “I built” or “I created,” it may be a red flag for them.

- You don’t know your customer. It’s understandable to be excited about the technology you built, but if you don’t see the problems you’re solving and you can’t answer “So what?” after building your product, then you have a problem. Ask yourself, “For what? For who? And so what?” as you go after building new tech.

Key Takeaways

- VC is a service business. Like dating, you want to make a good impression on VCs, and VCs want to make a good impression on founders. It’s all about keeping the excitement levels going up.

- Ask yourself the important questions. So what? Who will use it? Who likes it? Who will pay for it? Why are people leaving their jobs to come here? What are we doing right and wrong?

- Be mission-led. Why are you spending eight years on something and giving up those years that could be spent elsewhere?

- Build a culture so people are attracted to what you’re doing.

- Know your customer.

The post What Venture Capitalists Look For in Leaders: Tips from a Founder-Turned VC with Ridge Ventures appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow