What are the three most under-discussed metrics on social media, with VCs, and especially with founders? SaaStr founder and CEO Jason Lemkin shares his top three SaaS metrics that matter in 2024:

- Net new customer count

- Growth vs. efficiency

- The bar to IPO

Net New Customer Count is Your North Star

One of the most important metrics in SaaS today is net new customer count. For those of who have seen growth slow over the last year or two, be laser-focused on this. Very few founders use net new customer count as their #1 KPI because they’re solely focused revenue growth.

In your first couple of years, you might now have any customer growth, but for anyone at scale, from $4M ARR to $5B, new customer growth is anemic. The top leaders in SaaS and Cloud still have triple-digit NRR, so you’ll still grow even if you bring in no new customers.

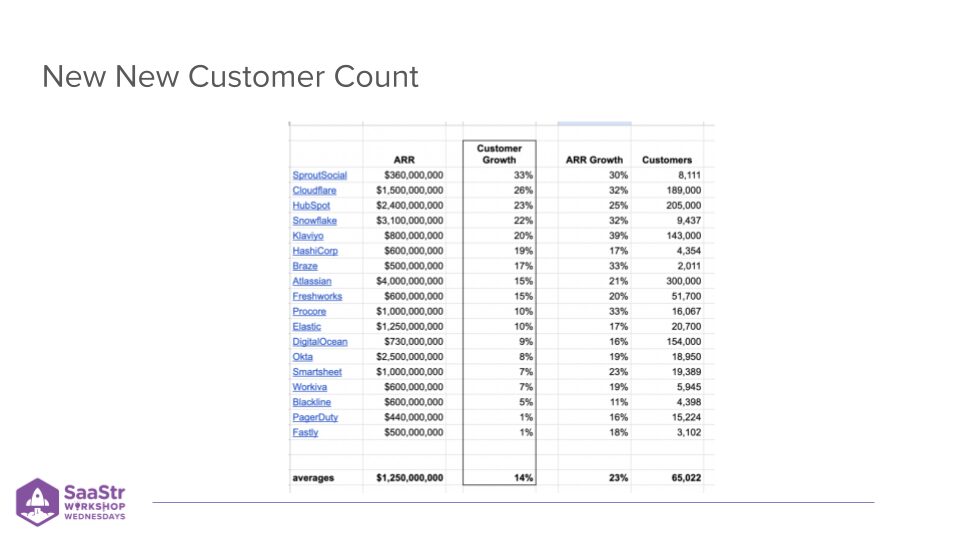

The worst offenders are at the bottom of this table, although these are great companies. Fastly, an Enterprise CDN at $500M in revenue is only growing its customers 1%. When times are challenging, or growth is ok but not great, founders hide from this and say, “Oh, we grew 48% this last year.” That’s great, but your future is uncertain if your net new customers don’t grow at least half of that top-line revenue growth. You’re hiding in NRR.

You may have to tweak the ratio based on how Enterprise or SMB you are, but roughly speaking, if your new customer growth is not growing half of your top line, you are shrinking in relevance and market share, and your future is at risk. Your future is growing your customer count, and it is an indicator of the core health of your company.

Growth Is Still 2x More Important Than Efficiency

The single biggest mistake founders make today is believing we’re in an era of profitability. We are not. Profitability is not your key to success. What has changed is efficiency. You have to be more efficient.

You can’t go public not growing. Too many startups aren’t growing, or they’re growing 10-15-20%. It turns out that if you don’t close customers, pay your sales teams as much, or cut down marketing, you get more efficient, but that’s now what building a business is about.

What has changed is that you now have to do both: growth and be profitable. But profitability isn’t enough. In 2021, all that mattered was growth. In 2024, profitability matters, but growth is twice as important. Let that be your guiding light and principle.

The goal of 2024 is to grow almost as fast as we did in 2021, but without burning all the cash. It’s hard, and you don’t get a pass on growth because you’re profitable or cash flow positive.

Hubspot vs. Veeva vs. Dropbox Case Study

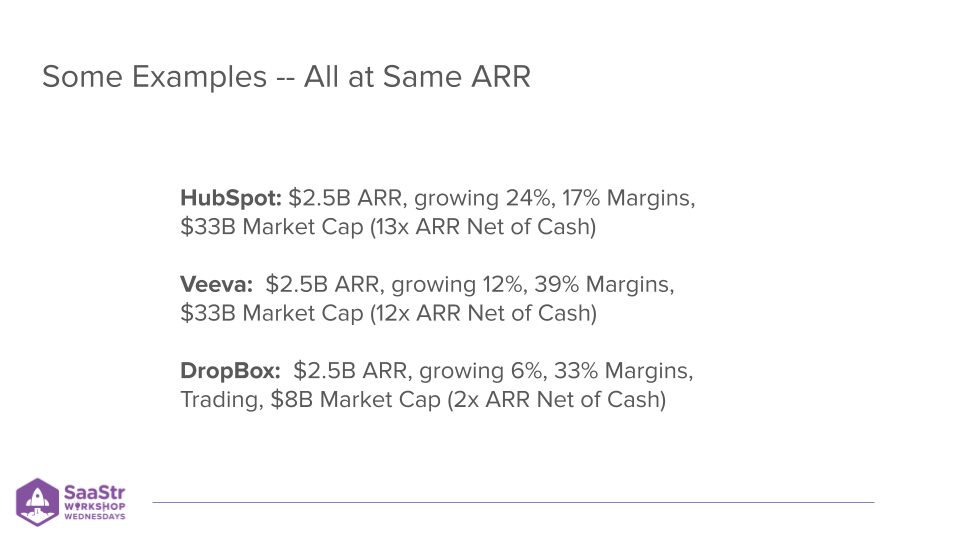

SaaStr publishes a series called 5 Interesting Learnings every Wednesday, where we look at all the complicated metrics from leading public companies and break them down into 5ish things that matter for founders. The latest ones were about Hubspot, Veeva, and Dropbox.

They’re all at $2.5B ARR today, but what they’re worth and how they’re doing is very different.

Hubspot and Veeva are both worth $33B. They’re the LeBron James of SaaS. Hubspot is growing twice as fast at 24% with a 17% profit margin. That combo is 41, so 13x ARR after you take out cash, which is pretty good.

For Veeva, they’re barely in the growth stages. It’s 12% at $2.5B, although they’re guiding to 15% next year, which tells Wall Street they will accelerate. They have almost 40% margins and are sitting on $4B cash. They only raised $8M in capital before IPO and haven’t spent anything. So, you have 12 plus 38, which is 51, meaning Veeva is wildly efficient.

Hubspot and Veeva trade at roughly the same; both are profitable and have high margins. But Veeva’s margins are insane, which can make up for good but not great growth. Hubspot has very good growth and still has to be profitable.

Now, look at Dropbox, also at $2.5B ARR, growing 6%. They’re not a growth company anymore. If you back out of all of its cash, it’s only trading at 2x ARR, a sixth of the valuation of Hubspot and Veeva. Dropbox is an example where a tiny bit of growth, and some cash is not good enough.

Getting profitable is not the mantra. It’s necessary but not sufficient. You have to grow and be profitable, and that combination is under-discussed.

What It Takes to Go Public Today

What does it take to go public today? Most of us won’t IPO, but it’s good to know where to skate the puck to. If you’re a little on that path, someone might buy you for $10M, $50M, $100M, $500M, a billion. What does it look like, and what do you have to build to?

When Jason started in SaaS, the bar was around $100M in revenue, growing maybe 50%. That’s what Hubspot and Box looked like when they IPO’d a decade ago. The bar has gone up for a variety of reasons.

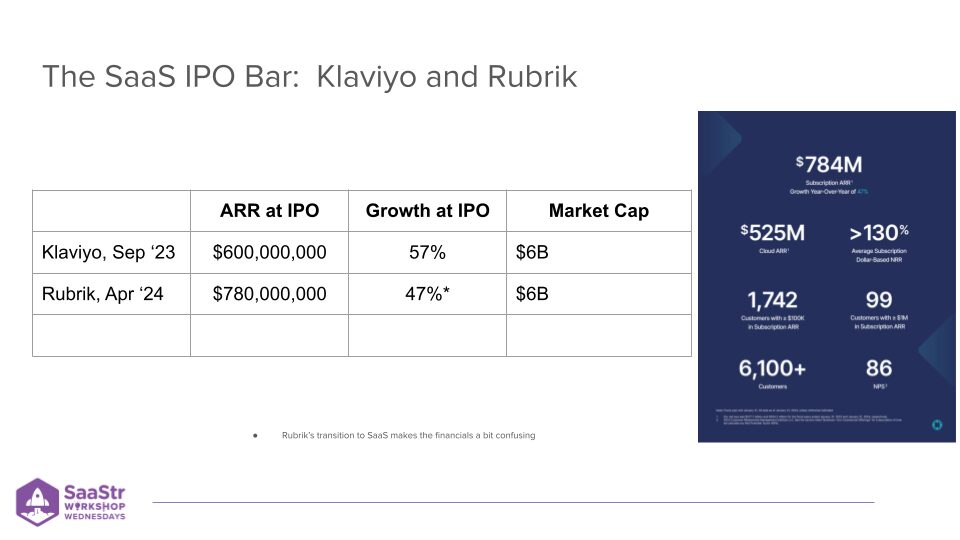

No one truly knows what the bar is today, but there have been two IPOs since 2022 to look at: Klaviyo and Rubrik soon.

Klaviyo IPO’d late last year. They own marketing for e-commerce, and almost 70% of everyone on Shopify uses Klaviyo. You can read more about them here. They IPO’d at $600M in ARR, growing 57% and profitable. It’s only worth $6B.

Rubrik is next. ARR is confusing for them; you can read 5 interesting learnings here. They went from on-prem to a SaaS model and may flatter their metrics a little by confusing them. But put that aside for this discussion, and let’s simplify it.

They’ll go public at $780M in revenue, growing at 47%. They might trade at $6B to $7B. This is the bar. Most venture-funded startups have no hope of growing more than 50% at $600M or more.

Today that might mean quadrupling or quintupling this year, and that’s just to trade at 10x revenue. If you’ve raised any capital at 10x revenue or more, you’re kind of living in a bubble. You should stay there as long as you can.

So, what is the bar, and how do we get to it?

As founders, you have to understand that as hard as what you’re doing is, you may have to do even better to IPO. The window is open, but the bar is pretty tough.

Key Takeaways

- Track your net new customers after churn. This should be your North Star metric. Invest in your long-tail; don’t give up on champions and smaller customers.

- Profitability isn’t everything, and growth matters twice as much. You have to do both, and it’s harder.

- Quietly be aware of the bar to IPO.

The post The Three SaaS Metrics That Matter in 2024 with SaaStr Founder and CEO Jason Lemkin appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow