Starting a business is an exciting achievement, but you’ve got to keep your eye on the ball and stay innovative to keep things thriving. That’s where good business budget planning comes into play — it’s the bedrock of growing your business.

If you’re not monitoring your business finances and setting aside resources for growth, you might not just get stuck — you could see things start to slide downhill. Over time, this might mean your business brings in less revenue, making it tougher to cover expenses and keep things running smoothly.

The trick is managing your finances so you always have the funds ready to fuel that growth. In this blog, we’ll discuss the basics of budgeting for business growth and some financial policies you should consider.

Understanding Business Budgeting

As your business grows, financial management can get a bit more complex. It might be tempting to see newfound profitability as a chance to spend on both business and personal expenses. But be careful — this can lead to financial instability pretty quickly. Having extra funds can lead to overspending, sometimes even using money that isn’t really there.

When a business operates under the mindset of scarcity, it is less likely to overspend and more motivated to generate additional revenue to meet perceived needs.

This is where budgeting plays a crucial role. Creating a budget plan in business involves setting aside specific amounts of money for particular purposes. In a business context, it refers to creating a spending plan based on income and expenses.

A budget helps identify available capital, estimate expenditures, and forecast revenue. It also guides business planning and serves as a benchmark for setting and achieving financial goals.

Read more

Key Components of a Business Budget

Let’s start with the basics: what is budgeting in business?

Take a closer look at the key components of a business budget:

Income Forecasts

Income refers to all sources of revenue for the business, including sales, investments, and loans.

Income forecasts are projections of future revenue from sales and other income streams. You can calculate the average income from the past six months to gain a general sense of your expected revenue.

Remember that these figures may vary, especially if your business experiences seasonal peaks. During those periods, it’s crucial to analyze the average revenue specifically for those times.

While your sales may increase year over year — making precise predictions challenging — this approach provides a proper estimate of what to expect.

Expense Estimates

Expenses are all costs incurred in running the business, such as rent, utilities, payroll, and supplies.

Expense estimates refer to the anticipated costs associated with operations, marketing, payroll, and other expenditures. These are generally more predictable since they can be assessed based on your regular monthly bills, payroll, and material costs.

Take a look at your spending from the past six months, and you’ll get an average that helps you figure out future expenses. This way, you’ll better understand what to expect cost-wise.

If you run an online store, your ecommerce platform can give you some handy data. For instance, if you’re using Ecwid by Lightspeed, you can check out the Revenue report for insights on your store’s revenue and expenses.

Reviewing expenses in the Revenue report of an Ecwid store

When it comes to expenses, your Ecwid store can track:

- Total expenses: How much you spend to generate sales in your online store

- Taxes: Total amount of taxes charged on all orders in your store

- Shipping expenses: Total of all shipping rates specified for your shipping methods in your online store

- Handling fee: Money spent on fulfillment, including storage, prepping, and packaging

- Cost of products sold: The sum of product cost prices specified in your store settings.

You can also compare your expenses to those of a previous period. With this data, you can estimate your future expenses and keep them in mind when planning your business budget.

Learn more about different reports available for Ecwid stores and how to use these insights to grow your business.

Fixed Costs

These are expenses that remain constant regardless of changes in production or sales levels, such as rent or insurance payments. Fixed costs are typically easier to estimate since they are consistent month-to-month.

Variable Costs

These are expenses that fluctuate based on changes in production or sales levels. Variable costs may include raw materials, labor costs, advertising costs, and shipping expenses.

Variable costs can be harder to estimate since they can change based on external factors.

Set-Asides

You should set aside specific funds to handle key aspects of your business, like covering liabilities or building a growth fund.

Think of these set-asides as parts of your budget earmarked for certain things, making sure you have money ready when you need it for financial responsibilities or chances to expand.

Cash Flow

This is the movement of money into and out of the business. A positive cash flow indicates that more money is coming into the business than going out, which is a good sign for the health of your company. It is important to track and manage cash flow in order to ensure that necessary expenses can be covered and any financial goals can be met.

One tool often used to help with cash flow management is a cash flow statement, which tracks the inflow and outflow of cash over a specific period of time. This statement can help you identify patterns and areas where adjustments may need to be made in order to maintain positive cash flow.

Read more

Creating a Comprehensive Business Budget Plan

Now that you have a better understanding of the components of a business budget, it’s time to learn how to make a budget plan.

Assess the Current Financial Situation

Take a look at where you stand financially by estimating all your expenses. Make sure to set aside a percentage of your income to build a growth fund. This way, you can figure out exactly how much money your business needs to make to keep going strong.

Regularly reviewing your expenses helps identify areas where you can cut back or find more cost-effective solutions. For example, negotiate with suppliers for better prices or explore different vendors for cheaper options.

Review Financial Statements

Analyze your balance sheet, income statement, and cash flow statements to gain insights into your business’s current financial position.

Balance sheet is a snapshot of your company’s assets, liabilities, and equity at a specific point in time. It shows what you own (assets) and what you owe (liabilities), as well as the net worth of your business.

An income statement shows your business’s profitability over a certain period by comparing its revenues against expenses. This helps track changes in revenue streams and identify areas for improvement.

Cash flow statement tracks the movement of cash in and out of your business. It helps monitor how much cash is available for day-to-day operations, investments, and debt repayment.

These documents provide a snapshot of your assets, liabilities, revenue, and expenses, helping you identify trends and discover where you may be spending too freely.

Identify Revenue Streams

You can have a revenue stream from products, services, or investments. An income statement helps you see which streams are doing well and which might need a little boost.

The Revenue report for Ecwid stores comes in handy when you need to track your online store’s revenue. It even provides insights on average order value and average revenue per customer and visitor.

Checking average revenue per visitor in Ecwid’s reports

Figure out where all your revenue is coming from and put your energy into what really brings in the cash.

For example, if your business sells both products and services, you can use the income statement to see which one is generating more profit. This information can help you make informed decisions on where to allocate resources for further growth.

Since marketing is a big part of running a business, it’s important to analyze your marketing expenses as well. For instance, if a specific marketing strategy makes more money than it costs, think about investing more there.

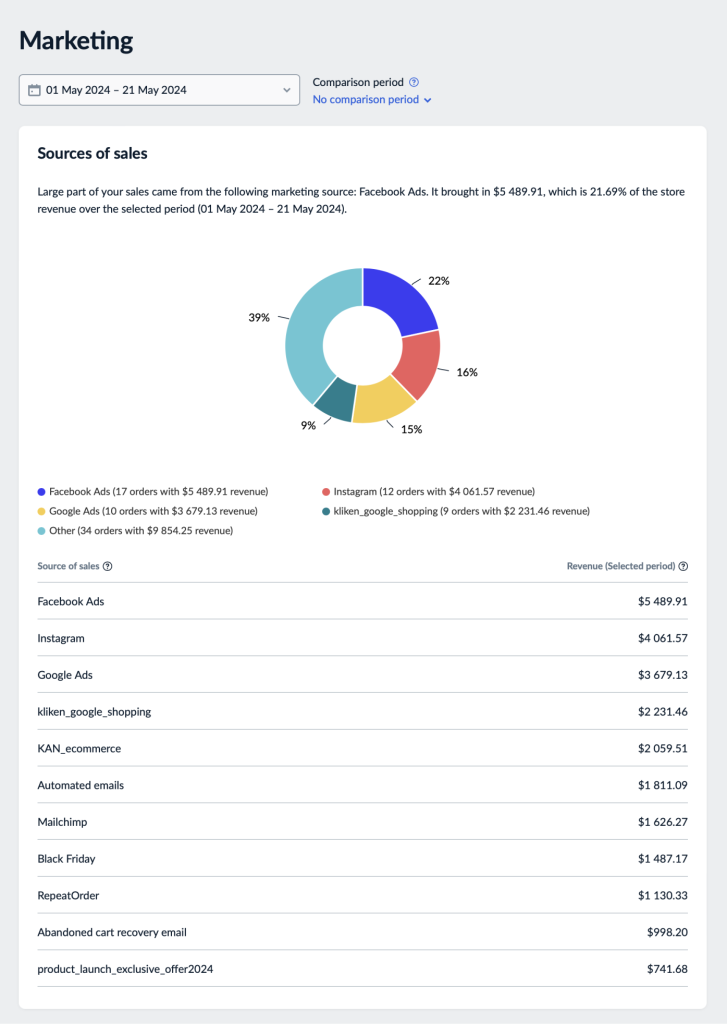

Ecwid makes it easy with built-in Marketing reports. You can easily check where your orders are coming from, whether it’s a Google ad, a Facebook post, or an email campaign.

Ecwid’s Marketing reports provide you with an easy-to-understand overview of your sales sources

Channeling your resources into the most profitable marketing channel will likely boost your business’s overall revenue. Discover how to use Marketing reports and leverage their data to make smart, data-driven decisions.

Categorize Your Expenditures

Start by taking a look at your essential operating costs — things like utility bills, rent, and other basic expenses that keep your business going.

Once you’ve got those sorted out, check out your production-related costs, such as materials and payroll, since they’re crucial too.

For every expense, ask yourself, "Do I really need this for monthly production?" Things like printers and laptops help with production, but they should be funded from set-asides instead of being seen as core operating expenses.

Maintaining Your Business Budget

Now, let’s talk more about set-asides. These are funds that you designate for specific purposes like unexpected expenses or future projects.

Liability Set-Aside

Set aside a percentage of your profits, like 5%, for covering any surprise liabilities that might pop up and cost your business unexpectedly.

Usually, this is handled through a business savings account, but without clear rules on using these funds, there’s a risk of spending them on other things like new equipment. This could leave your company open to financial trouble.

So, just setting aside some money isn’t enough. You need clear rules for what you can spend those savings on.

For example, you might decide that these funds can only be used for emergency repairs or legal fees. This way, you have a safety net in case something unexpected happens, but you also have guidelines to prevent it from being misused.

We all hope emergencies don’t happen, but it’s crucial to have some savings set aside for those unexpected moments. Sure, insurance helps with some things, but it doesn’t cover everything.

Consider how unprepared many companies were for COVID-19. Businesses lacking savings struggled greatly, with some forced to close. At the close of 2019, 43% of small businesses were in "very good" health. However, due to the impact of the pandemic, this figure dropped to 25% by the end of 2020.

US Small Business Index: overall health of business 2019-2024 (Source: Statista)

So, having a financial cushion means your business can handle surprises better and stay strong through tough times.

Business Growth Set-Aside

Set aside a percentage of your profits for business growth. This fund is all about fueling your business’s expansion, whether it’s hiring new employees, buying new equipment, or other crucial stuff. By putting these funds aside, you’re setting the stage to invest in your business’s future success and growth.

Marketing Fund

If you don’t market your business, people won’t know who you are, and that makes it tough to grow. The amount you should spend on marketing can change depending on the industry.

For example, in franchising, it’s normal to set aside 5-7% of revenue for marketing. We mention franchises because they’re businesses with a track record of success, offering a solid model for others to follow.

It really depends on what you’re aiming for. If you just want to keep your current revenue steady, putting 5% to 10% of sales into advertising might do the trick. But if you’re aiming for rapid growth, you might need to up that to 20% or more, depending on your industry and business type.

If you’re just starting out, it’s a good idea to set a fixed amount for your marketing spending since your revenue might be too low to use a percentage of sales as a guide.

Read more

A Safe Option

To keep your business growing and shielded from financial risks, figure out how much income you need to cover your set-asides. This will help you find your "break-even" point. Until those set-asides are fully funded, your business isn’t financially secure yet.

A smart business owner makes sure to set up reserves right away and keeps a budget that makes it look like there’s no extra cash lying around. This way, it helps avoid overspending and keeps the business strong and growing over time.

Additional Resources

If you want to make budgeting easier, consider using business budgeting software like Quickbooks, Xero, or Freshbooks. They help with tracking expenses, invoicing, and reporting.

By the way, Ecwid by Lightspeed integrates with all the above-mentioned software, making it easy to sync your store data and automate routine accounting tasks.

If you’re not ready to dive into accounting software, starting with a business budget template could be a great first step. It provides a structure for organizing financial data and setting financial goals.

You can find business budget plan samples and templates online — some are even free. They are frequently provided in standard formats and ready for use across various software. For example, this Excel business budget template for startup expenses.

Wrapping Up

By carefully planning your income, estimating expenses, and setting aside some funds, you prepare your business to handle both expected and unexpected challenges. These strategies aren’t just about keeping your business going; they’re about driving it toward greater success and stability.

Remember, it’s key to allocate every dollar wisely and make sure your financial decisions match your big-picture goals for growth and sustainability. With smart budgeting for a business and good financial habits, you can turn growth potential into real, lasting success.

Consider adding Ecwid to your budget to enhance your online store and grow your business.

The post Budgeting for Business Growth: Financial Strategies to Expand Your Business first appeared on Ecwid | E-Commerce Shopping Cart.

via https://www.aiupnow.com

Anastasia Prokofieva, Khareem Sudlow